From SCDigest's On-Target e-Magazine

- Jan. 24, 2012 -

Global Supply Chain News: Ocean Shipping Capacity to Keep Building Despite Existing Glut, Weak Demand

Industry Will See a 9% Increase in TEU Capacity in 2013, Exceeding Record Levels of 2008

SCDigest Editorial Staff

In a way, you have to feel sorry for the ocean container shipping industry, which must order new ships several years in advance at the cost of many millions of dollars, unsure about what competitors are also doing, while relying on projections of what is always tough to forecast and highly unpredictable demand.

That said, in general the carriers keep the ships coming, despite a weak global trade market and continued overcapacity in the industry, as market share continues to trump profits.

SCDigest Says: |

|

Indeed, in early 2012, Maersk Lines CEO Soren Skou said that the carrier "will defend our market share position at any cost."

|

|

What Do You Say?

|

|

|

|

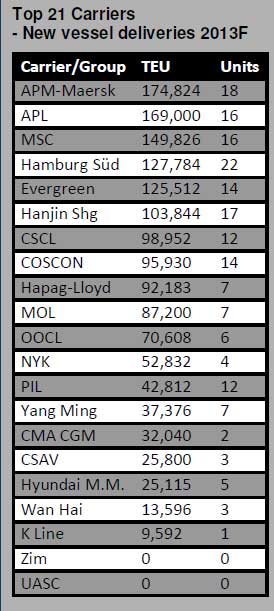

According to the analysts at Alphaliner, carriers will bring on-line a record level of new capacity in 2013. The container fleets of the 21 largest carriers Alphaliner follows are expected to grow by 9.0% in 2013 (net of potential scrapping). That represents some 1.75 million TEU worth of new vessel capacity to be delivered this year, after adjusting for some slippage of expected 2012 deliveries into 2013.

If accurate, those new ships would exceed the 1.57 million TEU that was delivered in 2008, making 2013 the highest level of added capacity ever recorded.

That as overcapacity continues to govern the container market, especially in the Asia to Europe routes that have been devastated by the debt crisis there and slowing economies, and to a lesser extent in Asia to US lanes.

The World Bank estimates that global trade grew by just 3.5% in 2012, far below rates in recent years, and just 1.2% above global GDP growth, again far less than the general patterns over the past 20 years. However, it does expect a rebound in 2013 to 6% growth in trade - assuming the Euro financial crisis continues to stabilize.

Alphaliner sees even bleaker numbers specific to container volumes. It says Far East to Europe headhaul cargo volumes shrank by 5.0% in 2012, while the Far East to US volumes declined by 0.4%, based on preliminary 2012 cargo volume estimates. It adds that these two key trades lanes are expected to grow by only 1.0% and 1.6%, respectively, in 2013 even from the low base in 2012.

Although volumes are more robust within Asia and Asia to Latin America, it is clear that a 9% increase in total global capacity will far exceed total demand for container movements, even though carriers of course are likely to reduce capacity through idling or scrapping older, smaller ships, as many of the new larger ships are delivered from yards.

The industry can also perhaps take some solace, despite a generally tough year, in some improvement in Q4, with spot freight rates as measured by the Shanghai Containerized Freight Index now up about a 26% year over year, while bunker fuel costs are 8% lower, helping to bolster shaky bottom lines.

But there is clearly lot more capacity than freight at the moment, as the carriers continue to resort to "slow steaming" to in effect reduce the available supply, and shippers seem largely OK with it.

Driving much of the industry's woes is the never ending battle for market share, which most ocean carriers seem to believe is worth it at almost any price. Indeed, in early 2012, Maersk Lines CEO Soren Skou said that the carrier "will defend our market share position at any cost."

That environment may be bad for the shareholders of the ocean lines, but great news for shippers, which are paying very low rates even with the recent increases.

The expected deliveries for 2013 are in fact fairly well balanced among carriers relative to their size, as shown in the chart below, though APL and Hamburg Sud might be among those called out for increasing capacity at greater levels than their current positions in the market.

Source: Alphaliner

(Global Supply Chain Article Continued Below)

|