From SCDigest's On-Target e-Magazine

- Oct. 23, 2012 -

Global Logistics News: MIT Research Puts Some Real Data Behind Ocean Shipping Variability

Lots of Complaints, but Little Data to Date; Delays Come at Ports, not Over the Water, Caplice and Kalkanci Say at CSCMP

SCDigest Editorial Staff

There is a lot of variability in global ocean shipping times, right?

Well, that's certainly what a high percentage of the corporate sponsors of MIT's Center for Transportation and Logistics were telling director Chris Caplice and others at MIT, Caplice recently said during a presentation at the CSCMP conference in Atlanta.

SCDigest Says: |

|

At the Port of LA, the performance varies dramatically, with the best performer on average processing containers two and a half times faster than the worse, and everyone else in between.

|

|

What Do You Say?

|

|

|

|

As Caplice note, however, the problem is that "the evidence was all anecdotal" - almost none of the shippers and importers had hard data to support their complaints about inconsistent delivery times.

So, Caplice and colleague Basak Kalkanci decided to see if they could actually quantify what was going on, and the two were able to get data from a handful of shippers, freight forwarders and others. With that data, they were to perform some analysis to begin the journey of better quantifying what is really happening in the container shipper market.

Caplice started off by noting that one issue right upfront is that there is far from a universal definition of how "reliability" in the ocean shipping sector is defined.

He said that some companies focus primarily on whether the carrier did what it was supposed to do, or what he called "credibility" (e.g., didn't bump containers, made all the stops they were supposed to, etc.).

The other perspective is what he called "schedule consistency," which relates to such issues as whether the containers arrive on schedule, or (from another angle) how much variance there is for a carrier around their average or median performance (i.e., how tight is the bell curve?).

A related challenge to understanding what performance really is, both Caplice and some audience members noted, is the fact that while syndicated date from researchers such as Drewry Shipping Consultants provides accurate data on ship departure date and arrivals versus published schedules, that data is only port-to-port, and does not tell you the full lead times from container arrival at the origin port or availability at the destination. The focus of the MIT research and analysis was at the specific container level, not the ship level.

And that is quite important because, as Kalkanci detailed, it is at the outbound and inbound port operations where in fact most of the delay and variation is occurring. More on that below.

Caplice also noted that there are too often disconnects between the procurement staff negotiating the contracts with carriers and the operations team that must execute them. Too often those contracts are "simply thrown over the wall" to operations, he said, and there may be factors that make it very difficult for carriers to meet the service levels in the contract - but by then it is too late.

Another issue is that the penalties and bonuses for failing to meet or exceeding service schedules are rarely applied, Kalkanci said, which again brings into relief the disconnect between the contracting processes, where these incentives are negotiated, and the actual execution of those contracts.

"Token penalties don't motivate carriers to make real changes to the operations," Kalkanci added.

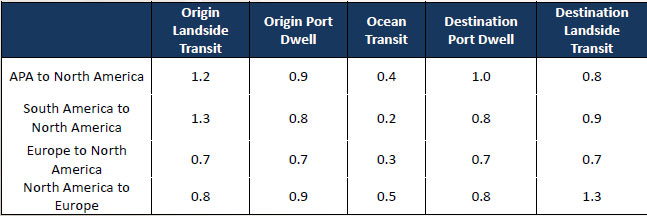

She then showed data illustrating that port-to-port delivery times were pretty consistent, whereas dwell times in origin and destination ports were much more variable. That can seen in the chart below, which illustrates a common measure of variability, the coefficient of variation, for different elements of the total ocean journey. As can be seen, the measure is markedly lower for the on-ocean part of the full trip than for port operations versus pre and post-ocean shipping steps. (The coefficient of variation is calculated by dividing the standard deviation of a data set by its average.)

Ocean Shippping Variance by Step in Total Move, by Coefficient of Variation

Source: Caplice and Kalkanci, MIT

The idea port-to-port reliability is a good measure of an ocean carrier's overall performance is a myth, Kalkanci said.

(Global Supply Chain Article Continued Below)

|