| |

|

| |

|

|

Supply

Chain by the Numbers |

| |

|

| |

- Feb. 6, 2020 -

|

| |

|

| |

|

| |

|

| |

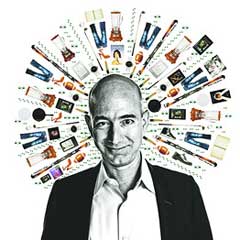

Amazon Revenue and Profits Jump in Q4; US Manufacturing Back to Expansion in January; MIT Says Recession Likely in Next 6 Months; Coronavirus Taking Toll on Supply Chains |

| |

|

| |

| |

| |

| |

$12.9

Billion |

|

That's what Amazon spent on shipping worldwide in Q4, according to the on-line giant's earnings report released last week. That giant number, which does not include fulfillment center costs, was up 43% over 2018, compared with revenue growth in the quarter of 21%. The company said in its last earnings report in October that it would spend $1.5 billion during the holiday shopping season to expand one-day and same-day delivery. So shipping costs continue to soar, but seems to be working, as evidenced by the revenue growth. For the full year, revenue rose to an incredible $280.5 billion – that's getting not too far from Walmart's top line. Amazon also had decent profits in the quarter, at $3.3 billion, up about 10% from 2018 and representing 3.8% of revenue. But Amazon's AWS web services unit generated $2.1 billion in operating income in the quarter, almost the same as the $2.2 billion in operating income in North America for the rest of Amazon's business, while international had negative operating income of -$642 million in Q4.

|

|

|

| |

| |

|

|

|

That was the level of the US Purchasing Managers Index (PMI) for January, in data released Monday by the Institute for Supply Management. That puts it above – though just barely – the 50 mark that separates US manufacturing expansion from contraction. And it was welcome news after a streak of five consecutive months below that 50 mark, including the lowest monthly score since 2009 in December. Meanwhile, the overall economy grew for the 129th consecutive month, ISM says. The New Orders Index registered 52, an increase of 4.4 percentage points from the seasonally adjusted December reading of 47.6, in good news for future manufacturing activity. "Business has picked up considerably. Many of our suppliers are working at or above full capacity. Tariffs are still a concern and are believed to be a factor in short supply and higher prices of electronic parts. Our profit margin has been somewhat negatively affected by high tariffs, particularly on electronic parts from China," said one survey respondent. |

| |

| |

|

| |

| |

20% |

|

That is the decline in container ship calls at or through major Chinese ports since Jan. 20, according to the analysts at Alphaliner. That drop of course stemming from the growing coronavirus outbreak in the country. What's more, the Wball Street Journal reports that freight brokers in China said bookings for container ships, tankers and dry bulk vessels are falling rapidly and that the slowdown could extend until March– as if anyone really knows how long this crises will last. Leading container carriers continue to operate at China's main coastal seaports, but the world's top 10 operators have canceled at least two dozen sailings to China in recent weeks, many more than they typically drop during the traditionally slow first quarter. And the impacts on the broader supply chain are developing. Hyundai this week said it will begin suspending production at all seven of its plants in South Korea because of a lack of parts made by suppliers in China. Apple and Foxconn Technology, the largest manufacturer of Apple devices, said production will resume after a 10-day delay on Feb. 10. "This is a much bigger impact than the Trump tariffs," Dan Panzica, a former executive with Foxconn, told the Journal. "Then you could move things. Now, you can't." |

| |

| |

| |

| |

| |

|

|

|

| |

|

|

| |

|

![]() |

|

|

| |

|

Feedback |

|

|

|

![]()

|

No Feedback on this article yet.

|

|

![]() |

|

|

|

![]() |

|

![]() |

|

|

| |