As many of you know, supply chain flexibility has been a recurring theme this year, with a couple of 2010 columns trying to ponder what it is and if it can be measured, among other issues.

So it was timely (and not in-coincidental) that the Fall session of the Georgia Tech Supply Chain Executive Forum (SCEF), under the capable leadership of Dr. John Langley, focused on just this topic, and with interesting results.

Gilmore Says:

|

|

"Several said the biggest barrier was that flexibility had a cost - and right now companies don't want to pay it."

What do you say? |

|

Send us

your Feedback here |

|

I (along with our friend Gene Tyndall) assist Dr. Langley with getting an agenda and speaker list together for the two annual meetings, and I am limited in what we can report back based on the semi-private nature of the meeting. However, I can highlight overall themes and anonymous quotations.

To support this Fall meeting, we conducted a survey of SCEF members, and received about 40 responses, primarily from supply chain executives (VPs and some directors-level). The results are worth sharing.

We first asked members to provide their definition of supply chain flexibility, and we received a wide range of responses.

“I don't know exactly how to define it, however, I do know how it behaves on a daily basis," said one executive, adding that "the supply chain must react quickly to inefficiencies coming from all directions: suppliers, customers, partners, and internal to itself.”

Another said that SCM flex was: “The ability to respond to fluctuations in demand or capacity with minimal impact on cost or service.”

That notion - being able to adapt without hurting cost or service - was a consistent theme. Another along those lines: "The ability to support significant and rapid changes in demand, supply, mix, etc., without customer service failures. Ideally flexibility is designed into all aspects of supply chain - manufacturing, warehouse facilities, transportation, etc."

All told, it certainly again supported my earlier contention that for something this seemingly important, the supply chain profession right now lacks any clear or generally accepted definition of flexibility. It was also interesting to note that the definitions tended to be either focused on short term flexibility (what I've called micro flexibility - response to disruption and exceptions right now or over a few days) or longer term, more strategic agility (what I have called macro flexibility - how fast can the supply chain adjust to meet changing business requirements and strategies) but not both aspects.

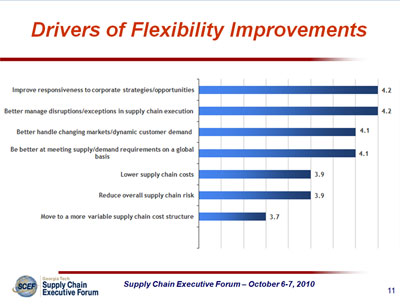

We also asked respondents to rank a series of "drivers" of the business needs for flexibility. As you may be able to see in the graphic below or easily on the full size image, both the strategic and real-time aspects of flexibility rose to the top, with "improve responsiveness to corporate strategies/opportunities" and "better manage disruptions/exceptions in supply chain execution" topping the list with average scores of 4.2 on a scale of 1-5.

In total, all of our selections scored high in importance, though I would have thought "moving to a more variable cost structure" might have been a bit higher.

View Full Size Image

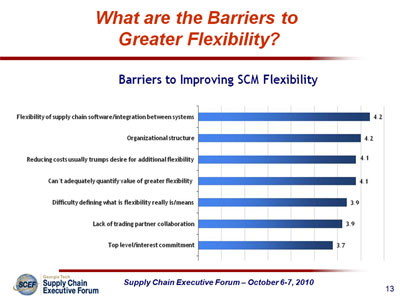

Perhaps the most interesting part of this survey discussion at the meeting was actually around the barriers to greater supply chain flexibility. Again, as shown in the chart below, we asked the members to rank various obstacles to flex. Here, I was a little surprised, as "flexibility of supply chain software/integration of systems" was rated the top barrier.

View Full Size Image

In the discussion, a supply chain executive from one of the world's largest technology companies supported this view, noting that his company had built so many custom systems over the years to do this or that that whenever a change was needed, it took months because all these systems had to be touched. His/their plan was to dramatically reduce those systems, and in a sense be constrained by what the core systems could do, but be able to then make changes rapidly as needed within those contraints.

I am not so sure on this one, as today's supply chain software is incredibly more configurable and flexible than it was in the past, and my sense is the integration issues have also dropped dramatically. But then, how you view that depends on what you have right now. If you have dozens of custom, "legacy" type applications that are stitched together like a ball of yard, than surely that is a large barrier to fast reaction.

I will also note that IT/systems issues would primarily seem to me to be barriers to strategic flexibility more so than short term disruptions/issues. For example, if a company now needs to be able to do this new thing in its supply chain, or change product flows, or whatever, and the IT system may need to be modified to support those changes. But then again, a company like Procter & Gamble now can react more quickly to short term changes in demand based on new "demand sensing" technology it has deployed, so perhaps tech issues are key to both the macro and the micro.

There was a lot more to this barrier discussion. Several said the biggest barrier was that flexibility had a cost - and right now companies don't want to pay it. One attendee noted that "You talking about making an investment in flexibility now that may not ever be needed or may only come in to play two years down the road. Is that investment going to play in this environment? No way. Companies want immediate returns."

Organizational structure was cited as the number 2 barrier, and there was some great discussion around this issue too. One attendee noted that "the challenge is that improved flexibility that might help the whole supply chain often comes at a cost to someone else's P&L or some supply chain function."

We can all say that is old thinking or a bad metric system or whatever, but it was clear from these executives at many great companies that these types of issues were still very real barriers to enhanced supply chain and flexibility.

There is so much more but I am out of space. Will consider doing more on the outtakes from this great meeting - one of the best SCEF's ever - very soon.

But I will close with this, from the same IT industry exec who made the comments supply chain systems issues.

Despite those IT barriers he has, he noted in an excellent presentation that at the end of the day the most important attribute of all was "Leadership Flex" - how committed company and supply chain leaders are to building a culture of business agility, and constantly driving and (making the necessary investments) to ensure rapid reaction to this ever changing business and supply chain environment.

In the end, he said, like most things flexibility all comes down to the people.

Amen to that. At last, we have some clarity.

Are people and culture in the end the real keys to supply chain flexibility? How big a barrier - or in your case perhaps an enabler -are IT and systems integration? What are the real drivers of the need for greater flexibility? Let us know your thoughts at the Feedback button below.

Web Page/Printable Version of Column

|