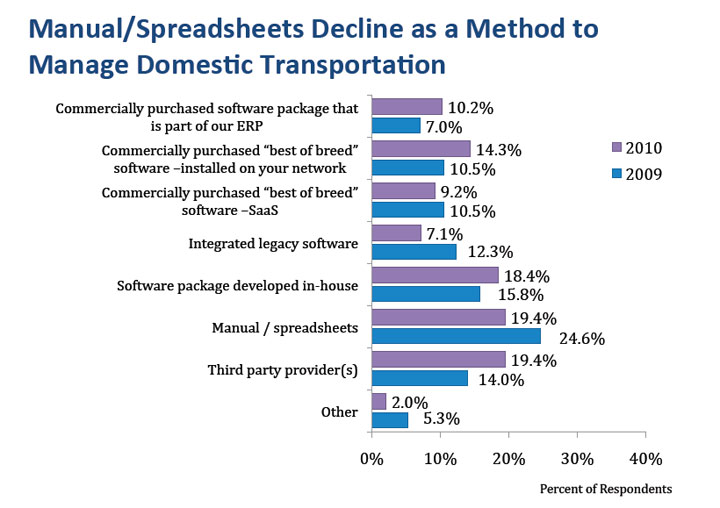

Under this section, it was interesting as always to see the technologies being used to manage transportation (i.e., TMS) across the survey population. The results show very fragmented approaches across ERP, best-of-breed, and even manual systems, as shown in the graphic below. We question though whether the "SaaS" or on-demand category really dipped as a percent in 2010 - our sense is that category in fact went up strongly over the past year.

Source: Trends and Issues in Logistics and Transportation 2010

Truth #3 - Most firms are focused on operations, which is just the tip of the transportation cost pyramid; more strategic and tactical approaches are often left out of the picture: The report found the following five tactics were the ones being most commonly implemented to reduce transportation costs or effectiveness:

- Improved shipment consolidation

- Sharing capacity forecasts with carriers

- Improved carrier performance tracking

- Improved route planning

- EDI integration

Interestingly, among the transportation strategies that did not have much current support included greater use of 3PLs to manage transportation and beginning to use more "green" carriers, though in the latter case that may simply be the result of such moves not having a big impact on cost or service.

Truth # 4 - Effective inventory management is the supply chain's Mount Kilimanjaro. Trying to scale its height has a low success rate: Consistent with other data, the survey showed tremendous decreases in inventory levels for 2010 - the question is whether such reductions are permanent, or will inventory levels revert to the norm for subsequent years and economic recovery?

Inventory metrics improved substantially in 2010 over 2009 (though respondents were likely reporting on 2009 numbers), with average inventory turns among the largest firms going from 11.5 in 2009 to 15.1 in this year's report. In medium size firms, the improvement was small, going from 16.1 to 17.4 turns per year in 2010, and among small firms turns actually decreased year over year, moving from 11.7 to just 11.2 over the past year.

Another key inventory metric, Days Inventory Outstanding (DIO), showed similar levels of change, though the smaller firms actually showed some small improvement there, which doesn't really jive with the inventory turn numbers.

The report says a still relative lack of systems integration within firms is still a major barrier to improved inventory performance.

Truth # 5 - Firms have embraced the concept of differentiated service: The survey showed that not only do a company's "best" customers received better service in terms of quality, damage, and backorders, but that service overall has improved substantially in 2010 over 2009 numbers. The assumption is that in a period in which volumes were dropping over 2008 levels, companies were able to increase service across the board.

The report notes that many firms have difficulty defining who their "best customers" really are, and that the industry has a ways to go to get differentiated service models correct. In fact, a survey from MIT a few years ago in fact found few firms were really using differentiated service models.

A copy of the CSCMP presentation can be found on Dr. Manrodt's personal web site: Trends and Issues in Logistics and Transportation. At press time, we did not yet have a link for the full written report.

Any reaction to this year's Trends report? Any issues with the five "undeniable truths?" Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest |