Those categories are summarized in the table below.

|

Description |

Automated spend analysis |

Helps companies cleanse, normalize, and classify historical spend data from multiple data sources like ERP, procurement, and purchase (PCard) systems. |

Buy-side contract life-cycle management |

Supports all contract processes, including drafting, approval, amendment, renewal, and enforcement, treating contracts as information, rather than text or images. |

Accounts payable electronic invoice presentment and processing |

Automate the submission and processing of suppliers’ invoices and streamline the supporting manual processes such as discrepancy resolution. |

eProcurement |

Helps non-purchasing employees create requisitions for goods and services and support management review and approval; approved requisitions are then turned into POs. |

eSourcing |

Support buyers’ online publication of RFXs and bidders’ submission of responses as part of a reverse auction or a more traditional vendor selection process. Also helps buyers evaluate complex multiline bids (bid optimization). |

Services procurement |

Designed to help companies create

requisitions, field competitive bids, and fill positions for contingent labor and

project-based/statement-of-work consulting services. |

Supplier network |

Hubs that streamline eCommerce between buyers and suppliers for whom traditional EDI is inappropriate. |

Supplier performance

management |

Helps companies automate the continuous collection and normalization of performance data for analysis. |

Supplier portals |

A section of a company’s web site that it uses to exchange information with its suppliers. |

Adapted from Forrester research report |

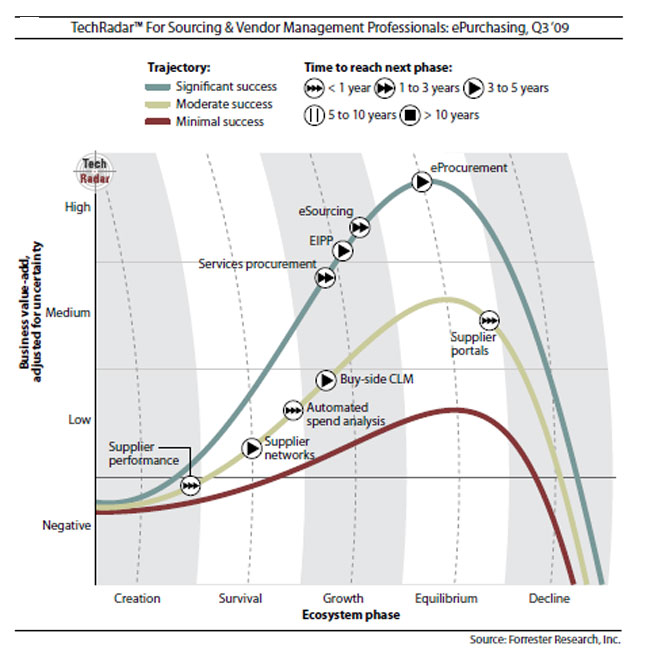

Connaughton and Jones then use Forrester’s “TechRadar” methodology to plot the current trajectory and relative value in each of these nine software categories. With this approach, as used in the figure below, Forrester creates three generic application lifecycle curves (high/strong – blue; medium – tan; and low/weak – red). A given type of software application is then positioned on one of the three overall lifecycle trajectories, classified as to where it is currently on that lifecycle (i.e., position on the X-axis), and given an estimated time frame by which it will move to the next phase (number of arrows).

So, for example, “eProcurement” as a category is on the strong trajectory, indicating it has delivered a lot of relative value and will have a long life as a software category. It currently is near the peak of its value and effectiveness.

Conversely, while no category was deemed to be on the ”low” trajectory, supplier portals are perceived to have only delivered medium value, and are much closer to entering a decline stage. In fact, Connaughton and Jones write that “The business value of single-buyer Web sites is declining as community alternatives become more prominent.”

Other categories, such as supplier performance management, are in much earlier stages of maturity.

“Enterprises can realize a wide range of benefits when rolling out ePurchasing — ranging from cost savings via automation to setting the foundation for a next generation strategic sourcing operation,” they add. “Chief procurement officers (CPOs) should look particularly closely at the key benefits they could get from the emerging categories.”

Do you like Forrester ePurchasing software categorization? How about the ratings on the TechRadar curves? Do you see supplier portals as perhaps getting a bit old in the tooth in terms of value and adoption? Let us know your thoughts at the Feedback button below. |