Above and Below the Line

According to Nelson, companies need to consider tax efficiency in their supply chains from two perspectives:

- Above the Line: includes duties and tariffs, duty drawback, VATs, local, state, and property taxes and fees that are incurred before a company calculates its profit before income taxes

- Below the Line: Corporate income taxes, which may be both national and local in nature.

Depending on what products a company buys and sells and the nature of its global footprint and supply chain flows, one or the other of these two types of taxes can be more important, or they can be equally important.

For a global company with many operating units, the issue of tax efficiency can be quite complex – and doubly so since the tax experts are usually somewhere in the finance department. Often, there has not been close collaboration between those tax experts and supply chain managers, simply because they were in different functional areas and just didn’t speak the same “language;” supply chain network designers didn’t understand tax implications, and tax experts didn’t really understand supply chain design.

To understand the complexity inherent in this issue, consider an equipment manufacturer that sources hundreds of components from around the globe before assembling the final product. What countries those components are sourced from, whether they are produced by company-owned factories or from contract manufacturers, whether the company buys the parts for contract manufacturers or doesn’t, internal “transfer pricing,” and more all have a significant impact on taxes and, thus, net profits.

“The lowest cost supply chain is often not the one that delivers the highest profit to the corporation,” Nelson says.

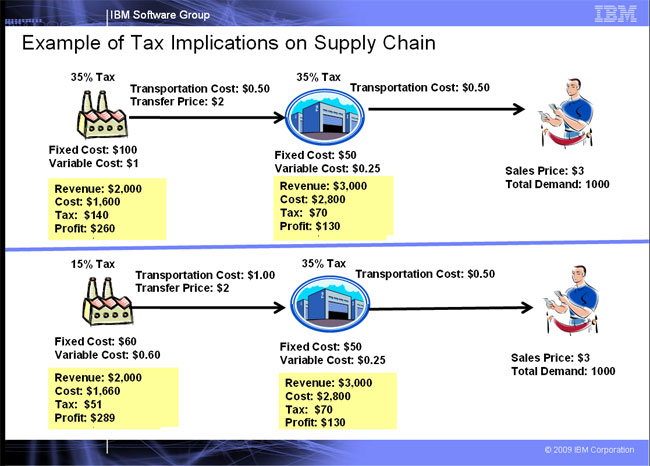

The good news is that providers or supply chain network design software are providing increasingly robust support for tax efficiency in their analysis of the optimal network designs. By modeling tax implications of various scenarios, the most profitable after-tax supply chain, not just the lowest cost one, can be identified. (See simple example below.)

Nelson says the subject of transfer pricing – the price at which a company “sells” products made in one location to another part of the business – is especially tricky. That transfer price will determine the “profit” in that location and, thus, tax liability. Given the wide range of corporate tax rates, this can make a big difference in the net profit of a company.

“There are both legal and ethical issues around transfer pricing,” Nelson said. “It’s usually important to bring in some real experts in this area.”

Do you agree most supply chains could be more tax efficient? How is this best accomplished? How big is the opportunity? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest |