Often, but not always, the seller creates a purchase order for the replenishment for the buying company to approve.

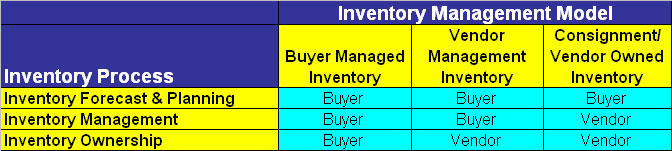

In this model, the buyer takes control/ownership of the inventory upon receipt from the vendor.

VMI not only largely removes the administrative burden and cost from the manufacturer for planning component/material orders, it also, in theory, might reduce total supply chain cost by allowing the supplier to better optimize planning and replenishment processes through improved visibility and control of the total order planning and execution steps.

However, execution issues have often led VMI programs to be less than successful.

Pros of the VMI model from the manufacturer’s perspective are that procurement overhead costs are dramatically reduced. It can also lead to lower component/material costs if the vendor is able to gain increased supply chain efficiencies from having more end-to-end control of replenishment and its own production planning and passes those savings on to the buyer.

Cons of VMI include the fact that sometimes, vendors looking at their own self-interest “games” the order flow in a way that the manufacturer would not otherwise have agreed to. The buyer gives up control while maintaining most of the same inventory cost and risk associated with the Buyer Managed Inventory model.

Consignment/Vendor Owned Inventory: This model is something of a hybrid, and the one that, at a high level, is least favorable to suppliers. With “buyer managed” but “vendor owned” programs, the manufacturer controls the order flow, but the transfer of ownership does not occur until very near to the actual use of the component/material in production.

This model is most used in high tech industries, where, for example, a disk drive manufacturer may own the inventory in the manufacturing plant until a drive is removed from a bin at a work cell, the bar code is scanned, and the component placed into the PC. That scan is what transfers ownership from supplier to manufacturer, and triggers a payable transaction to the supplier.

In many cases, the suppliers may maintain a distinct work/inventory area within the manufacturer’s production facility that makes inventory available or delivers components to the manufacturer’s work cells based on demand signals.

Use of this model was a key factor in Dell’s ability to drive negative “cash to cash cycles,” as it was often paid by customers ordering on-line before it paid its component vendors, since the payable was created so late in the supply chain cycle.

Pros of the consignment/vendor owned inventory model from the manufacturer’s perspective are that ownership and working capital cost and risk is transferred from the manufacturer to its supplier.

Cons include the fact that this ultimately raises supplier costs that, in the end, must be reflected in unit costs, and that a more sophisticated IT system is required to manage this ownership complexity.

In the high tech and an increasing number of other manufacturing sectors, some companies are using a combination of all three models, with the decision drivers being:

- Component/material attributes: Product lifecycle speed, inventory risk, number of suppliers in the market, potential advantages of forward buys, etc.

- Supplier attributes: Sophistication of individual suppliers, which side has more relative power, lead times and distance, etc.

- Opportunities for leverage: How much can be gained by allowing suppliers to have more total supply chain control.

Complicating all of this is that Sarbanes-Oxley legislation in the US and related legislation elsewhere around the globe that sometimes requires a more clear legal and physical separation of inventory assets than was required prior to these new laws.

As a result, many companies are looking to third-party logistic providers to play a role, resulting in new inventory models. We’ll look at those models and implications next week.

Are you segmenting your suppliers/components/materials and using different inventory models? How and why? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest

|