Cliff Holste

Materials Handling Editor

| SCDigest Says: |

The company says that it has switched facilities in a number of cases already to nearby warehouses in the same area as the existing one, often receiving reductions in the 40% range in terms of cost per square foot. The company says that it has switched facilities in a number of cases already to nearby warehouses in the same area as the existing one, often receiving reductions in the 40% range in terms of cost per square foot.

Click Here to See Reader Feedback

|

The price for warehouse and distribution center space, like other real estate categories in this market, have taken a big tumble, offering opportunities for many companies to reduce their distribution costs.

It’s hard to get precise figures, and there are some regional differences, but some logistics managers are saying they have seen the price per square foot for warehouse space fall by 40% or more in some markets, the result of lower demand for space and a glut of distribution center space erected during the past few years before the financial crisis hit.

The price declines seem to be strongest in areas served by ocean ports, as the steep drop in import volumes combined with a building boom of import DCs near those areas has put the supply-demand balance strongly in favor of shippers.

Prologis, which in the past has published distribution center price analyses for the US market twice per year, has not produced a new report since mid-2008. Even then, however, it noted that “The nation’s bulk distribution property leasing markets are in the early stages of a cyclical slowdown.”

Bloomberg reports overall commercial real estate prices dropped 15% in 2008, but some believe the warehouse market declined at an even greater rate.

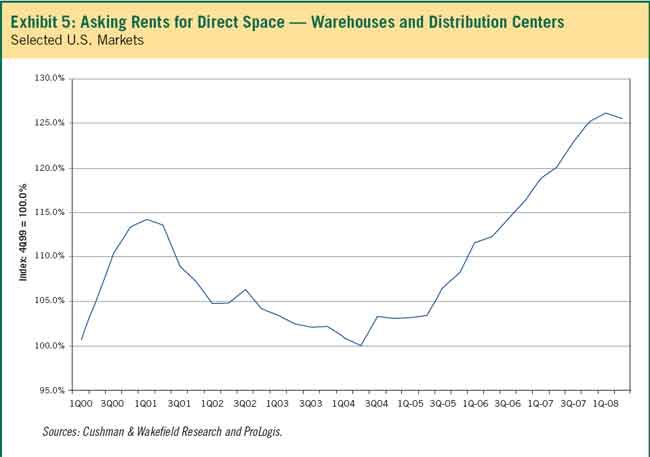

The current strong decline that started in 2008 comes after a three-year run-up in distribution center costs, fueled by a strong economy and huge growth in import volumes, as shown in the graphic below.

Prologis itself is feeling the effects of the DC market slow down. One of the world’s largest owners and managers of distribution center space, the company had been on a building boom over the last several years, but lately the wheels have been coming off. When the financial crisis hit last fall, it had $8 billion in development projects in its pipeline.

Amid a tanking stock price, its CEO resigned in November, and the company announced it would stop all new development for now.

(Distribution Article - Continued Below)

|