View Across Segments

In our view, out-of-stock data is too often focused narrowly at the consumer packaged goods segment of the value chain, with much less attention to other types of consumer goods-to-retail product categories.

This report looks at other sectors, and finds, for example, that more than 1 in every 5 consumers (21.2%) coming into the door of Consumer Electronics retailers leaves without buying at least one product they intended to purchase due to out-of-stocks – an incredible number, and one many consumers can probably relate to based on personal experience.

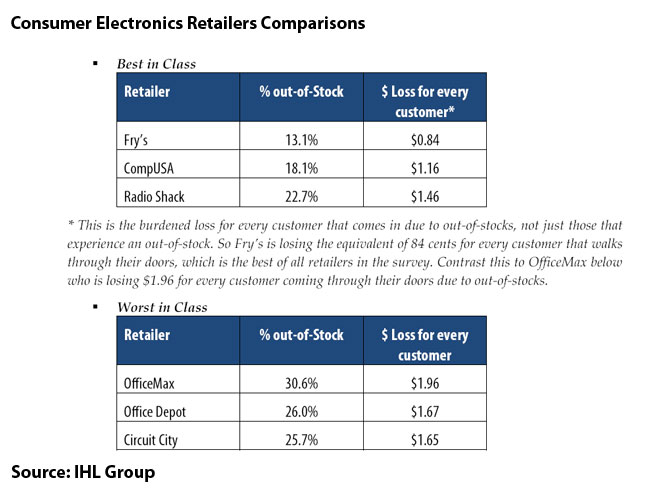

The difference in the numbers between retailers in a sector can be significant. As shown in the graphic below, for example, entertainment retailer Fry’s has an out-of-stock rate of about 13%, while at the other end of the spectrum, Office Max has a OOS rate of over 30% (in fairness, the two retailers carry very different product lines, though the report puts them in the same category).

There were also big differences in the grocery store channel, among chains that obviously carry nearly identical product categories.

Ahold, for example, had an out-of-stock rate of just 7.4%, according to the IHL research, whereas Food Lion and A&P had OOS levels of 22.8%.

In aggregate, the study found that fully 9% of survey respondents said that in the past 12 months they had stopped shopping at a particular retailer due to their out-of-stock situation.

Such research is certainly likely to add support for RFID supporters in the consumer goods-to-retail channel, where the focus is increasingly on in-store execution and shopper experience, rather than supply chain efficiencies.

Other surveys have shown, for example, that a significant percentage of store out-of-stocks at shelf level are really for products for which inventory is available in the back room, but has not been brought to the selling floor – an area where RFID and smarter store applications could make a big difference.

Do you think out-of-stocks should be more broadly defined than just shelf-level inventory? Do you think the OOS problem is really bigger than previous studies have estimated? What are the best answers for manufacturers and retailers? Let us know your thoughts at the Feedback button below. |