Two Decision Drivers

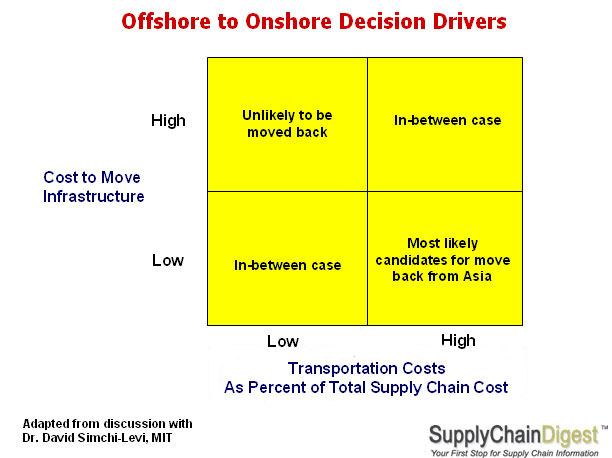

Simchi-Levi says that to facilitate this analysis, it is helpful to consider two variables in a simple 2-by-2 matrix. First, are logistics costs to move products from Asian factories as a percent of total supply chain costs high or low? Second, are the costs or barriers to move infrastructure from Asia high or low?

While each company may define the boundaries differently, such a matrix can be used to visually assess where a company's products fall. For example, products with high logistics costs as a percent of total costs and with low costs or barriers to moving the infrastructure are the prime candidates for moving sourcing back from Asia. Conversely, products with low logistics costs and high costs to move infrastructure likely won’t make sense to reconsider. While each company may define the boundaries differently, such a matrix can be used to visually assess where a company's products fall. For example, products with high logistics costs as a percent of total costs and with low costs or barriers to moving the infrastructure are the prime candidates for moving sourcing back from Asia. Conversely, products with low logistics costs and high costs to move infrastructure likely won’t make sense to reconsider.

Those products in-between the two extremes need to be evaluated in even more detail, though in some cases the inability to move the infrastructure may preclude any sort of move. For example, if the domestic supplier base is gone, it may be impractical to return to domestic sourcing even if the physical factory itself could be easily and cheaply reconstituted in the home country.

“If logistics costs are a relatively low percent of total supply chain costs, then clearly even a substantial rise in those costs is not likely to have a large impact on optimal sourcing decisions,” said Simchi-Levi.

Simchi-Levi says he has already seen makers of products such as furniture and televisions bring production back from Asia to either the US or Mexico. In the case of furniture, the primary factor is high relative logistics costs. With high-end televisions, it is part logistics costs, and part the cost of the long lead-times associated with Asian sourcing.

“With flat panel televisions, for example, the market price can decline by as much as 8-10% per month,” Simchi-Levi said. “So, with 40-50 day cycle time from China, the product could lose 15% of its value. With Mexican sourcing, the cycle time may be only 7 days, and there is little loss in the value of the inventory.”

Simchi-Levi says we are early in this trend, and it is not clear, especially with volatile oil prices, how permanent it will be. However, he said it is important for companies to be aware of the “tipping points” where Asian sourcing no longer is the best choice, and have enough flexibility in the supply chain to react accordingly.

“There is always a tipping point,” said Simchi-Levi. “What is important is to monitor the supply chain to know when it is close to being reached for various products.”

Do you think rising logistics costs can cause a reversal in offshoring? Is a framework like this helpful? Are the costs of moving infrastructure too high in many cases, almost regardless of logistics costs? Let us know your thoughts at the Feedback button below. |