|

OK, I better write this column before it becomes so common knowledge to everyone that it has little value.

The topic is the value of inventory – or more specifically, the value of less inventory.

I started to write this column earlier this summer, but began by talking about measures of inventory performance, such as inventory turns. I ran out of time before I got to the main point I was trying to make – but generated a tremendous amount of great reader response nevertheless (See Readers Respond – Measuring Inventory Performance).

It wasn’t that long ago that supply chain professionals and even some financial types did not well understand the role of inventory and free cash flow. Now, it seems like you can hardly read a corporate earnings report without seeing some connection between inventory and cash flow.

Gilmore Says: |

Permanently reducing your level of inventories relative to sales and sales growth can have a dramatic impact on a company’s share price. Permanently reducing your level of inventories relative to sales and sales growth can have a dramatic impact on a company’s share price.

Click Here to See

Reader Feedback

|

Case in point: Goodyear announced last week that its inventory reduction program had generated a $1 billion in working capital reduction through Q3 2009.

Earlier this year, we reported on how Home Depot was striving to improve its inventory turns – meaning “reduce inventories relative to sales” – from 4 to 5. If it can do that, it also means $1 billion in annual cash flow improvement to the home improvement giant. A billion here, a billion there – it adds up.

So, for everyone’s benefit, let’s go through the basics.

It takes cash – capital – to produce or acquire inventory. That cash is tied up in that inventory, not usable by the corporation. It is called “working capital,” and it is not available for other parts of the business. Since many companies turn to financing instruments to support their short-term working capital needs, this has a very real “cost” to the business.

So, for every dollar in inventory reduction, this leads to a dollar reduction in working capital requirements – and, therefore, to a dollar improvement in “free cash flow.” Free cash flow is different than “profits” and “earnings per share,” – and is a critical metric for many financial analysts and investors. More on that in a minute.

The best way I know to illustrate this connection is to use a Walmart example.

In the middle part of this decade, Walmart actually let its inventories grow somewhat out of control – the growth of inventories versus growth in sales reached very high levels versus its historical ratios. It reached a level of as much as 90% inventory growth versus sales growth in 2005.

I think there is a direct connection between that period of poor inventory management and the fact that Walmart’s operating and stock price performance languished during the same period.

What followed? Several initiatives, such as Walmart’s Inventory DeLoad program, designed to get inventory growth back to historical norms.

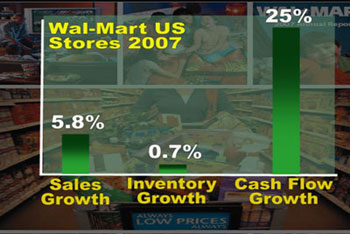

The result? The graphic below says it all:

After Inventory DeLoad and the other programs, in fiscal 2007, Walmart was able to keep inventory growth in its US stores group to just 12% of sales growth (.7% inventory growth versus 5.7% sales growth). After Inventory DeLoad and the other programs, in fiscal 2007, Walmart was able to keep inventory growth in its US stores group to just 12% of sales growth (.7% inventory growth versus 5.7% sales growth).

That, in turn, drove a tremendous growth in free cash flow, which at 25% was not only substantially above sales growth, but about three times profit growth. And not surprisingly, Walmart’s fortunes and stock price were bolstered soon thereafter.

OK, this relationship of inventory to working capital to free cash flow was not well understood even just a few years ago, but certainly has gained much traction in the past few years. Those connections gained even more traction in the recession, when cash and cash flow became “king.”

In fact, a recent panel discussion of Wall Street types at the CSCMP conference in Chicago noted that many companies were looking to the supply chain as a new form of “financing.” As the credit market dried up, or borrowing rates moved to ridiculously high levels, CFOs realized that by squeezing inventories, their companies would generate cash that would supplement their needs for outside capital that was increasingly tough to come by.

But even if you know all this, here is something you may not know: permanently reducing your level of inventories relative to sales and sales growth can have a dramatic impact on a company’s share price.

Gerry Marsh, an independent financial consultant who has worked with many of the world’s leading companies, made that clear to me in a white paper that Gene Tyndall and I wrote a few years back on the value of global supply chain improvements. You can find the chart here that Marsh created that shows, based on his proprietary model, how increases in inventory turns/inventory capital reduction can directly impact share price. In this example, based on a composite apparel company we created for the report (Action Apparel), improving inventory turns from 6 to 7 would actually increase the company’s stock valuation by an incredible 13%.

Why? Because “buy side” Wall Street analysts see that the company can drive more cash flow from each sales dollar – and free cash flow generation is what they care about. In fact, Marsh can powerfully demonstrate how differences in free cash flow generation clearly explain the difference in stock price multiples for companies that on the surface have very similar earnings per share and earnings growth.

The bottom line: inventory management is perhaps the defining element of supply chain management – where supply and demand truly meet. Getting that right not only reduces operating costs, but has a dramatic impact on cash flow and shareholder value.

Those that well understand this have a real leg up on their peers and competition.

What is your reaction to Gilmore’s column on the value of inventory reduction? What would you add? Is this becoming well understood in business today? Let us know your thoughts at the Feedback button below.

|