Risk management in organizations traditionally resides within the finance function, due to its inherent focus on financial impact on the organization. However, Business Continuity initiatives in most organizations do not assess the supply chain risk separately. In recent years, SCRM has become the focus area for finance executives and, hence, there is a need to establish a common language to monetize the supply chain risk. Value at Risk (VaR) is a popular risk metric widely used by the finance industry to understand the risk exposure of a trading portfolio based on historic volatility. We will briefly touch upon how to apply VaR to measure Supply Chain Risk here.

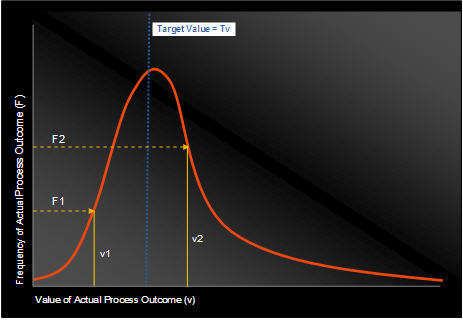

Figure 1: Long tailed distribution for supply chain process

As Figure 1 shows, most of the supply chain process outcomes follow long-tailed distribution. While most of the process outcomes are crowded near the mean, some of the observations are quite far from the target, albeit, with a very low probability. For example, the expected time for overseas supplier delivery is 30 days. However, the actual delivery may happen as early as 15 days and, on rare occasions, as late as 90 days, resulting into long-tailed distribution as shown in the figure.

The distance between the desired outcome and probability of that outcome represents Expected Loss. As shown in Figure 2 below, illustrative risk events are identified for each area – Source, Plan, Make, and Deliver. For each of these events, probability and impact are derived. Calculating the probability for a continuous supply chain process requires the use of distribution and we will not go into that detail here. Once the expected loss is arrived at for each of the potential supply chain risks across all functions, Risk Tolerance is applied. In statistical terms, this is a Confidence Interval. The higher the confidence interval, the lower is the organization’s risk appetite and vice versa. The Confidence Interval represents the expected coverage the organization wants to achieve over all potential risks. Hence, the product of Expected Loss and Confidence Interval represents Value at Risk (VaR).

Fig 2: Illustration – VaR Calculation

VaR allows organizations to look at all potential risks through one metric and helps them prioritize the mitigation. Also, all the risk events across supply chain functions like Plan, Source, Make, Deliver, etc., can be rolled up to arrive at the overall VaR for the entire supply chain. VaR is an effective representation of supply chain risk in monetary value and provides a universal language across all functions. VaR can create a financial lever to help integrate SCRM into the organization’s overall risk management initiative.

We will discuss the Mitigation and Sustain parts of the SCRM in the next post.

|