From SCDigest's On-Target e-Magazine

Nov. 10, 2011

Supply Chain News: Keys to Supplier Relationship Management Success Part 2

The Five Work Streams that Must be Managed; What SRM Leaders are Doing

SDigest Editorial Staff

Two weeks ago, we looked at a recent study from ISM's CAPS Research arm that took a deep dive into Supplier Relationship Management (SRM). (See Keys to Supplier Relationship Management Success.)

The report (Supplier Relationship Management: An Implementation Framework, available with registration at the CAPS Research web site) notes that some companies manage to create a culture of SRM and success, while many if not most other companies are much less consistent, and tend to pursue such improvements in SRM periodically, without sustained and substantial results. In part 2 of our summary, we look in more detail at the five "workstreams" the CAPS Research team (Robert Monczka and Thomas Choi of Arizona State University, Yusoon Kim of Georgia Southern, and Casey McDowell of CPM International) says are critical to SRM success: (1) supply base rationalization, (2) supplier management, (3) relationship management, (4) buyer/supplier development, and (5) supply performance measurement and management.

SCDigest Says: |

|

SRM leaders were very focused on defining how much time and energy needed to be put in which supplier relationships, with many formally recognizing the difference between "important" suppliers and those that were truly critical to the business.

|

|

What Do You Say?

|

|

|

|

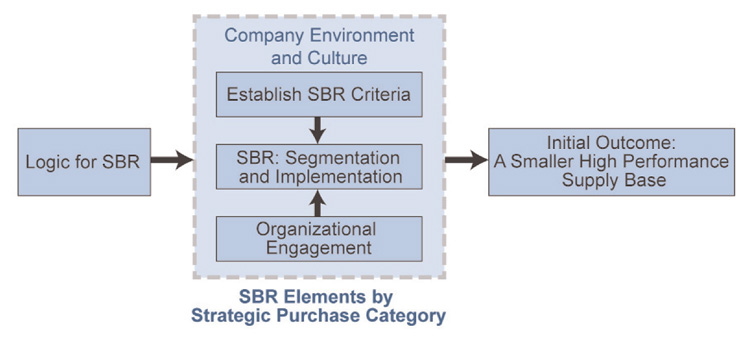

1. Supply base rationalization with family/supplier segmentation: The CAPS research found that supply base rationalization was almost always a component of successful SRM strategies.

However, it found that there is a sort of evolution in how companies approach such rationalization efforts, as companies tend to start out looking at just reducing the number of suppliers overall, say by 30%, to a strategy that gets more granular in terms of supply segments and the purchase categories within those segments.

The benefits of supplier rationalization include the potential to improve supply base performance, lower administrative costs, and the ability to build better relationships with fewer suppliers.

The research found that keys to rationalization succes included what criteria were used to assess the current supply base, and then the steps used to apply the criteria.

The most common supplier attrbutes used were: supplier capabilities; past performance, core competencies, and organizational fit (culture, communications, etc.). (Note: we will assume amount purchased currently from suppliers had to factor in there somewhere).

However, there are often many sub-factors in each category. Under supplier capabilities, for example, were such areas as technology leadership, quality, cost, flexibility, etc. The research found that leading companies weight these different supplier assessment differently depending on the purchasing category - an effort that obviously takes more work, but which apparently leads to better results.

For example, one automative industry firm, the research found, took a measure of how much resources it had to devote to managing the relationships with different suppliers.

Supply Base Rationalization Approach

Source: CAPS Research

2. Supplier management: This related to the process of on-going supplier development, CAPS says. In turn, it found there were two important elements of supplier management:(1) a well-defined strategic sourcing process with commodity and supplier plans; (2) effective supplier performance management and review.

Not surprisingly, SRM leaders were very focused on defining how much time and energy needed to be put in which supplier relationships, with many formally recognizing the difference between "important" suppliers and those that were truly critical to the business.

Most of the firm's studied had proactive programs to steer more business to these critical suppliers.

In terms of performance management, leaders go beyond just the basics in terms of cost, quality, deliery, etc., to look at issues like the "health" of the relationship, progress towards strategic goals, and whether the strategic relationship should continue.

3. Relationship management: The report says that relationship management within a rationalized supply base is founded on three critical elements:

1. Information sharing and transparency

2. Trust building

3. Equitable joint efforts

Though this sort of framework has been widely discussed, the research found that making progress on them is not easy, and many companies have a relative lack of success in these areas with suppliers, resulting from such as factors as short-term thinking or financial performance requirements and difficulty establishing a culture that really believes and operates this way.

The report also notes that the mix of these three elements, and with how much "intensity" a company should pursue improvement in them, will vary based on the criticality of the purchase category and/or individual supplier.

The report notes one firm had success in information sharing when it adopted Six Sigma as a kind of common language between itself and its key suppliers.

In our view, the report is a little short in terms practices in the third area, equitable joint efforts, which involves a level of collaboation and trust difficult for many companies to achieve.

(Sourcing and Procurement Article Continues Below) |