From SCDigest's On-Target E-Magazine

Oct. 26 , 2011

Logistics News: Annual Third Party Logistics Study Review and Comment Part 2

Interest in Gainsharing, Collaboration Way Down, but Could be Statistical Anomaly; Broad Agreement that Global/Local Modal for Emerging Market Outsourcing is Best

SCDigest Editorial Staff

Two weeks ago, SCDigest summarized some key data and insights from the 16th annual third party logistics study. The 2012 report was released as always at the annual CSCMP conference in Philadelphia. The report summarizes survey responses from more than 1600 shippers and almost 700 3PL respondents, and was led as always by Dr. John Langley of Penn State University, supported by various sponsors, such as Capgemini and recruiting firm Heidrick & Struggles . (See Annual 3PL Study Finds Little Change in Outsourcing Levels Year over Year.)

SCDigest Says: |

|

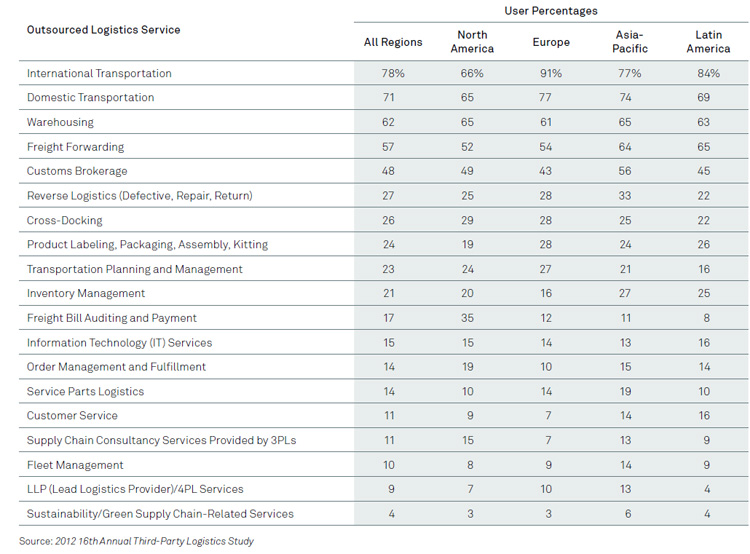

| Also of some note in this chart is that just 7% of respondents in North America report using a lead logistic provider/4PL (an outsourced manager of outsourcers), versus almost double (13%) in Asia. |

|

What Do You Say?

|

|

|

|

This week, part 2 of our review and comment on the 2012 report.

While a high levels of shippers (88%) and 3PLs (94%) said they are satisfied with their overall relationships with each other, those numbers drop off quite a bit when it comes to "openness, communications, and transparency." In those related areas of the relationship, just 69% of shippers are satisfied, and even fewer 3PLs (62%) were positive.

On 3PL side, it seems likely the relatively low number in this area relates to the persistent complaint 3PLs have that shippers will not get "strategic" with them, meaning in part shippers won't share enough of their supply chain plans and strategies, which would enable 3PLs to offer ideas on how they might support those plans.

There is also decent size disconnect relative to perceived flexibility. While a full 98% of 3PLs said their clients expect a high level of flexibility to meet changing needs, a much smaller 68% of shippers believe their 3PLs are sufficiently flexible to meet their needs, down from 72% last year. Our view: shippers, like most customers, just wish they could get their changes almost immediately, and in reality 3PLs take some time to adapt. Whether increasing that 3PL response time in any particular scenario really is possible is the question.

Perhaps surprisingly, the number of shippers reporting that they are involved in gainsharing arrangements with 3PLs declined year over year. This year, 42% of shippers said they were involved in gainsharing arrangements with 3PLs, down from 56% the previous year. Does this represent a true decline in the use of gainsharing, or is it simply a variation in the numbers one often sees in survey data from year to year? Hard to say. The report says the decline might be due to the somewhat improved economic climate, meaning shippers were less interested in reducing outsourcing risk. A multi-year view will be needed to determine if a decline in gainsharing is a real trend.

We also wonder if there was not some statistical "noise" in the data that showed a sharp drop in the number of companies interested in collaborating with others, possibly even competitors, to reduce logistics costs. When this question was asked last year for the first time, 68% of shipper respondents and 80% of 3PLs expressed interest in these strategies. This year these percentages dropped to 44% and 67%, respectively. We find it hard to believe that opinions relative to collaboration really changed that much in a single year, or that only 44% of shippers have an interest in collaboration (who doesn't, in theory?), though perhaps it was the "even with competitors" part that scares some respondents off.

Both these two statistical declines could also be the result of the fact that this year there was a growth in the percent of respondents from smaller companies relative to previous years, and it is possible/likely that smaller companies have less interest in gainsharing and/or collaboration.

The chart below shows what percent of respondents by region use 3PLs for various services. In North America, for example, 66% of shippers use 3PLs for international transportation, as do 65% for both domestic transportation and warehousing/distribution.

(Distribution/Materials Handling Story Continues Below) |