SCDigest Says: |

One retail respondent described this by saying that this issue is not at all that P&G's supply chain is getting worse, it just that so many others are making progress and cutting into its relative lead. One retail respondent described this by saying that this issue is not at all that P&G's supply chain is getting worse, it just that so many others are making progress and cutting into its relative lead.

Click Here to See Reader Feedback

|

What companies have the top top supply chains in the food and consumer packaged sector?

Well as usual, the analysts at Kantar Retail once again tried to answer that question at the end of 2011, picking up the work in the annual PoweRankings report that was started many years ago by Cannondale Associates, which Kantar acquired a few years ago.

The full report covers a number of company performance measures for both consumer goods manufacturers and retailers, including such areas as brand power, marketing programs, sales teams, overall business fundamentals, and more. Supply chain management is one of those categories included in the survey.

The rankings for this year, as always, were developed through the interesting methodology of asking retailers to rate manufacturers on each of these categories, and manufacturers to rank retailers on a similar set of attributes. Most major CPG companies and retailers participate, with some 400 respondents in total across both groups.

Both manufacturers and retailers are from the consumer packaged goods, food and beverage areas. That means manufacturers in such categories as apparel/soft goods, electronics, hard goods, etc. are not included. Similarly, the participating retailers are drawn exclusively from sectors such as mass merchandise, traditional grocery, warehouse clubs, and drug store chains that focus on consumer packaged goods sales.

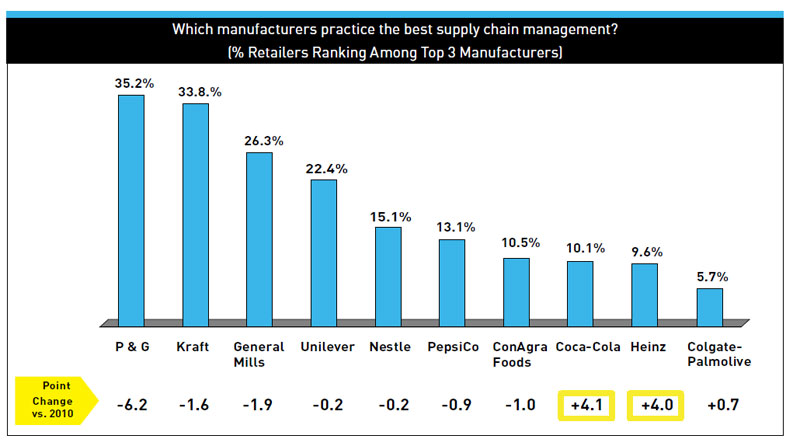

The scores represent the percentage of respondents that place a given manufacturer or retailer as having one of the top three supply chains in the industry.

This week, we will look at the consumer packaged goods results. Next week, we will publish the retail list.

As has been true for many years in a row, Procter & Gambe once again came out on top - but its lead is slipping.

P&G received a score of 35.2%, as shown in the graphic below - but that was down 6.2 percentage points from the 2010 rankings. In turn, P&G's score in 2010 was down 2.4 percentage point over 2009.

That drop this year let number 2 Kraft Foods close the gap this year, even though its own score was down 1.6 percentage points in this year's survey - it just didn't drop as much as P&G did. The same dynamic occurred in 2010. Regardless, Kraft is now just 1.4 percentage points below P&G, the smallest margin Procter & Gamble has had over whatever company was number 2 company is in quite a long time.

Top CPG Supply Chains for 2011

Source: Kantar Retail

(Supply Chain Trends and Issues Article - Continued Below) |