The following column comes through special arrangement with the Lean Enterprise Institute. It is an article written by Lean expert Michael Ballé, consultant and author of several Lean-oriented books.

Every publicly-held company must confront a handful of key questions regarding the timing for maximizing shareholder value: when? Right now? Next week? Over the next three months? Three years?

Every business that incorporates starts with a board of directors. And every founder that has had enough of running the business hires a CEO to do what’s best for the business. But what’s best? Is it to:

• Continuously grow its customer base?

• Come up with wow products that customers love?

• Create a cool work culture to attract top talents in the field?

• Generate a profit every quarter?

• Have your own company jet?

• Sell it top dollar to a giant corporation?

Supply Chain Digest Says... |

|

|

Ensuring certain outcomes are tricky because they are multi-dimension, contextual, and often involve mutually exclusive constraints. When you start with one constraint, it’s hard to fix the second and almost impossible to get the third.

Lean helps discover what’s best for the company - which is what in the long term is best for the stock price. Regardless, leaders must ask: what do we want in the current context, and how best go about it to achieve it? If it’s growing the customer base, how much are we investing in best price and superior customer service? If we’re about wow product, how much are we spending on research? And so on.

Once you’re prioritized one goal, the others follow and need to be balanced against each other. And since these priorities are contextual, they change and need to be challenged and discussed constantly.

And the board or CEO you’ve hired will have their own ideas – some of which will be good, some not so much. No one gets it right all of the time. Like the cowboy in the story from The Magnificent Seven, sometimes we find that we’ve run into the desert and sat on a cactus – because, at the time, it seemed like a good idea.

The only way to learn is to discuss, over and over again, look back at consequences of ideas and actions and discuss some more.

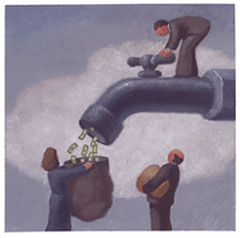

Shareholder value is a cop out. It’s an extension of command-and-control that says: in all cases, I command you to increase and distribute instant profit; and I will control you on this. While increasing revenue is hard, new opportunities to reduce costs on the spot present themselves daily. We’re moving to more work from home – how much surface can we save? How do we take the cost out? The deal is simple:

Command: Instruct CEOs to do what it takes to maximize share price today.

Control: Since this is often silly, incentivize them enough on the spot share price that they’ll do it anyway.

When overall, the share price is not doing well a few months down the line, well, context has changed and there’s always a new way to maximize the share price today – until either we go bust or we get bought out. In which case, find a way to maximize at which price.

“Maximize the share price today!” is a great way to close discussion. Sure, evidence now shows that not only it doesn’t deliver sustained performance, but, worse, it leads the Companies must ask what customers value right now, what technology is available today, and what concrete problems they must tackle.way to all sorts of catastrophic failures of the BP or Boeing type. Asking people what they think is best for the company is so messy! Maybe they’ll put in their own interests first – what if they really want this corporate jet?

How could we frame the discussion about what’s best for the company? In lean thinking terms, there are three starting points:

What do customers value today? In the short term, in the mid term, in the long term, the value of the company is its customer base: the number of people who want its offering, and the average basket they’re willing to spend there. Who are our customers? What do they look for right now? What do they like of what we do? What would they prefer us to do different?

(Article Continues Below)

|

CATEGORY SPONSOR: SOFTEON |

|

|

| |

|

|

What does technology permit today? What can we do with new technologies we couldn’t do in the past? What old technologies customers still like because it solves a specific problem for them? What new technologies should we be exploring and turning into concrete customer applications right now? What does technology permit today? What can we do with new technologies we couldn’t do in the past? What old technologies customers still like because it solves a specific problem for them? What new technologies should we be exploring and turning into concrete customer applications right now?

What concrete problems people think we should solve to align customers and technologies? Each person in the company has their own idea about how we connect what customers like and how we deliver that – and the concrete problems they encounter every day. Listening to employees’ opinions about what real problems we should solve, for customers and for them, and how we should be doing things different is the key to engaging them in discovering better ways of working together.

This discussion space creates a starting point for structured discussions about what is best for the company that frames it in terms of aligning customer value, employee engagement, and long-term sustainability.

These are not discussions we want to close with short-sighted, narrow-minded action plans. These are discussions we want to keep alive and grow as we work, and as we take concrete next step action to solve our immediate problems. Keeping the discussion alive by challenging assumptions and hearing people’s opinions doesn’t make you ineffectual – it makes you smart. The discussion itself draws people in, helps them collaborate and blend their ideas in the most astute ways – in other words: create value.

This, it turns out, is also a discussion about shareholder value – but not just today, sustainably and for the long-term.

Not all shareholders are the same. Many, like Warren Buffet, are in it for the long-term and do not believe that spot optimization every day results in maximum share value overall. Since stock prices over time reflect the market’s long-term forecast of share earnings, discovering what’s best for the company is also discovering how to best support its stock price.

What are your thoughts on Lean and shareholder value? Let us know your thoughts at the Feedback section below.

Your Comments/Feedback

|