|

|

|

Featured Sponsor: RedPrairie

|

|

|

DDownload New White Paper To Learn How To

Improve Labor Productivity By 30-35%!

|

|

|

|

|

|

|

|

|

| UPCOMING VIDEOCAST |

Understanding How Technology Improves the S&OP Process

A Step by Step Review of the S&OP Process and how Technology and Decision-Support Tools Improve Decision-Making at Each Phase

Tuesday, August 30, 2011

|

|

| UPCOMING VIDEOCAST SERIES |

Building Next Generation Supply Chains for Discrete Manufacturers

Part 1: Segmenting Supply Chains

for Success

Featuring AMR analyst Matt Davis and Tom Kozenski, Vice President of Product Strategy for RedPrairie

Wednesday, August 31, 2011

|

|

| NEW ON DEMAND VIDEOCAST |

SAP Supply Chain Response Management, The New Benchmark for Supply Chain Leadership

|

|

| NEWS BITES |

This Week's Supply Chain News Bites

|

|

|

|

|

|

|

|

|

|

THIS WEEK ON DISTRIBUTION DIGEST

|

Holste's Blog: Complexity & Justification Are Key Issues For DCs Considering Automation Holste's Blog: Complexity & Justification Are Key Issues For DCs Considering Automation

|

|

Top Story: Factors to Consider when Choosing Between Manufacturers and Systems Integrators for Conveyor System Projects |

|

Top Story: Understanding Conveyor Industry Sales Channels Ecosystem and its Impact on Vendor Selection |

|

Top Story: Building a Performance Culture in Distribution |

| |

|

|

|

By Rich Becks,

General Manager, High Technology, E2open

The Next Big Thing: Multi-Tier

Supply Chain Management |

|

|

By Tom McNamara, Sabry Shaaban

and Sarah Hudson

Smart Buffering in Unreliable

Production Line Performance |

|

|

| Q: |

What seminal supply chain article appeared in 1997 in MIT's Sloan Management Review? |

| A: |

Found at the Bottom of the Page |

|

|

|

|

| There and Back Again? |

Most of you that have real jobs may have been able to somewhat insulate yourselves from the market and economic turmoil of this week by staying busy at what you do, but not me. At our relatively small business I have the luxury, of a sort, of keeping CNBC on in the background as I do what I do. It was on most of this week - it obviously wasn't pretty, but I couldn't turn it off.

Given all that, I just can't get my head around core supply chain topics this week, and am going to offer some perspective on what is going on in the economy and markets, and try to tie it to the supply chain impact at the end.

| GILMORE SAYS: |

"My economic prediction: this current crisis will pass and things will marginally stabilize, and the economy will muddle along, with the idea of higher growth pushed further out."

WHAT DO YOU SAY?

Send us your

feedback here

|

This week and how all the news pulled me towards the overall economy's fortunes and away from supply chain reminded of two similar but very different situations I have been in over the past 12 years or so, First was in 1999, where I was an industry analyst and in Philadelphia along with some 14,000 others for the SAP SAPHIRE conference. On the second main day, a major hurricane (Emily?) had made it that far up the East Coast, and soon was battering Philly with blinding rain and winds. You were sitting there in a presentation trying to pretend even to yourself you were really interest in what was new in the APO module, when all you could really think about was how you could possibly get out of town. Ultimately, I had to drive to Pittsburgh to get a flight home. More similar to this week, in 2008 the CSCMP conference in Denver was the exact same week that Lehman Brothers failed, and the stock market was declining 500 points a day. I remember interviewing CSCMP CEO Rick Blasgen, and I think he had a pager or something that was updating him on the market, and several times as we were setting up and concluding he would look down and say something like "market's down another 180 points" or whatever it was. It was again a little hard to really pay much attention to say the presentation on keys to network optimization success with all that going on.

So are we back to 2008? I don't think so, but it is going to be tough slogging nevertheless.

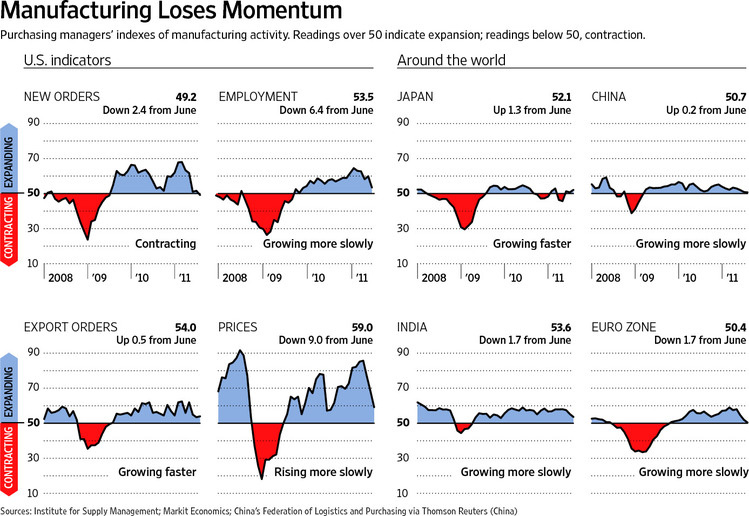

The signs of a weakening economy were already there. Below, you will see the graphic we posted last week, prior to the market debacle that started on Friday, and you can see the weakness showing up in measure after measure in recent months, especially in June. (Remember, with the PMI measures anything over 50 indicates expansion, under 50 contraction, but you also need to look at the direction of either. We are seeing dramatically slowing expansion of late.)

View Full Size Image

On top of that, you have a credit and banking crisis in Europe that may explode at any time. Jim Cramer thinks it can be managed, but with some pain, but really no one knows. I believe there will be some major bad news and a major inflection point somewhere in the next 6 months or so over these issues. The German people will simply say enough of bailing everyone else out. There is much political tension there over the path forward.

China has some major bubbles of its own, with huge government debt at the state/local levels, an economy only moving along nicely until recently due to (1) massive infrastructure spending that is not sustainable and (2) their huge positive trade balances. Inflation is rising there at more than 6%, the debt binge is coming home to roost, and Western governments are tired of footing the bill. Things will change there, maybe for the long term good but not necessarily in the short term.

Riots in the UK and elsewhere, though it appears by hooligans rather than real social unrest. Nevertheless, a well known Democratic pollster said this week Americans are in a "pre-rage" state not seen in decades.

On the good side, oil prices have slid mightily, down to $80 per barrel or so. That will be a sort of natural stimulus for consumers and business that will fight the downward economic pressure.

Many corporations have been highly profitable for 18-24 months, due to cost cutting, and are stuffed with cash. If the law is changed to allow them to bring home cash held offshore at acceptable tax rates (US companies pay taxes in the local countries; the US is one of the few that wants to tax them again for repatriating those profits), that would put even more cash in US business checking accounts. The point just is that many firms will be well funded to ride out a downturn, unlike 2008/09. Credit should not be that hard to get, certainly in comparison to how credit disappeared in 2008.

I just do not see the stock market collapsing to the 6500 type level we saw then. While we are unlikely to fully spring back to where we were soon, the "lost wealth effect" shouldn't be nearly as bad this time. That opinion and $4.00 will get you a small Starbucks.

So, where is the intersection with all this and the supply chain? My thoughts.

- The period of extreme volatility in demand and input commodity prices is going to last well into the future. Companies need to plan networks, response capabilities, hedging strategies, etc. explicitly with the recognition of this volatility, and how it can be best managed. Few companies really do this, actually.

- Relatedly, we are in an era that will likely last in which oil only declines along with slow economic growth or financial panic. Economic good news means higher oil prices, and really good news means prices easily over $100 and higher. The idea of good economic growth and even medium oil prices is largely gone until/unless there is a change in energy technology, policy, etc. In turn though, high oil puts a damper on the global economy. What a scenario.

- We have to expect right now that most decisions in terms of investment, hiring and other supply chain initiatives will be put on hold, awaiting a more definitive view of where we are headed. Vendors close to getting a signature on a contract better move really, really fast.

- I may be wrong, but I think many supply chains have cut staff so far, mostly in 2009, that barring a collapse in volumes (which I do not expect), I am just not sure how many more could be let go and still keep the freight moving.

- Corporate cash positions and much better credit availability should mean the extreme pressure we saw in 2008-09 to slash inventories somewhat indiscriminately will be much lower. That said, with slow top line growth continuing/extending , companies as usual will turn to the supply chain to reduce costs to shore up profit, with increase urgency versus the past year.

- While there are troubles in many emerging economies, including China and Brazil, the belief window of slow growth in Western economies will be extended, leading companies to focus even more fervently on expansion in emerging markets chasing a bull market somewhere.

- I would say there is a 33-50% chance the Euro doesn't make it. That would mean companies would need to recalibrate currency issues country by country there again, and many Euro countries would devalue their currencies to try to rev export business and reduce the impact of their debt levels. But this would take some time to play out. China desperately wants to change away from the dollar as the world's reserve currency, which in the end would result in more loss in the value of the dollar and make imports more expensive, but I don't think given the turmoil this really can happen any time soon.

- There will be a renewed round of tension between retailers and manufacturers in terms of pricing, as CPG companies are pressure by high/rising input costs (driven in large part by weak dollar) and highly competitive cost pressures on the shelf.

My economic prediction: this current crisis will pass and things will marginally stabilize, and the economy will muddle along, with the idea of higher growth pushed further out. If we have a recession, it will be relatively mild, if painful given the already weak condition of the patient (but importantly not many large companies). The global system will be shocked again in the next 6-9 months when the Euro debt mess comes to some sort of head.

What are your predictions into how this will play out in the economy and the supply chain? Agree or disagree with Gilmore's view? What are the other impacts you see on the supply chain? Let us know your thoughts at the Feedback button below.

|

View Web/Printable Version of this Page |

| |

|

|

|

| YOUR FEEDBACK |

Feedback of the Week - On Rethinking China Part 2

I appreciate reading your articles on China. Thoughtful, complete and insightful. And for people familiar with China .... most is "spot-on".

I've been in China off-and-on for the last 8 years. For the last 6 months, I've been on-site in Shanghai, Jinnan, Taishan, Ningbo, Changhouz, and Minhang Technical Development Zone. Over this time, I've gained a tremendous appreciation for the Chinese culture and behaviours. For sure, China is large with diversity of thought. Yet, in most instances, China is of one mind. They, and each of it's citizens, are bend on improvement. Young family seek the means to make money, and accumulate wealth to send their child to the best schools. People work in all hours of day-and-night to simple make a few extra RMB. Businesses look for ways to use their income on the best projects and to develop their employees and young managers. Governments work to enable businesses to prosper via straight-forward and rapidly implemented policies to incentivise local growth consistent with a national 5 year plan.

As you routinely observe, the growth here is phenomenal. In all matters of industry and government. That is not to say China does not have problems. Issues consistent with other countries such as pollution, safety, worker rights, women rights, taxes, economic disparity, social equality, corruption, etc. are all challenges. Yet, China seems better positioned to meet these challenges. Why, because change is pervasive throughout the country and has been for centuries.

In my view the key difference in China is leadership. I'll qualify my following comments. As a general rule, the quality of leadership from local to national levels is exceptional. There may be out-liers, but in general, Chinese leaders take their responsibilities very serious. They look for steady progress to the future rather than "the big bang" theory. They are focused on their particular business, rather than the business of others communities, or nations. They are thorough in their approach to problems and challenges. They are quick to accept responsibility for their actions, rather than deflect consequences to others. In short, the Chinese leaders in business and government is very pragmatic. They are intolerant of poor performance. Perhaps if our political and business leaders were more intolerant, America would have fewer failed business, fewer incompetent legislators and a sustained GPD greater the3 %.

In summary, China will continue to grow, prosper, and likely remain inwardly focused on infrastructure, social well being, technology innovation and education. They will likely spread their form of social responsibility worldwide. Whether in medicine, finance, technology, business practices, governance, and leadership, the Chinese are changing at lightning speed. I have no doubt, the western world will learn more over the next 25 years. As China emerges on the world scene, I see a better place.

Steven D. Abbott

BBK

More on Rethinking China:

This goes to the heart of my main point in your January 2011 “Guru Predictions” piece (First Thoughts, Jan. 21). The U.S. needs to provide a combination of incentives and legislation to repatriate some of the work which has been sent to China and other locals over the past decade. The biggest concern of the U.S. voters is not the war in the Gulf or whether government went too far in the bailouts, but rather the need to get a job, a roof over their heads, and to put food on the table.

I do agree with Mr. Fung’s statements that over time there will be a balancing caused by risings in China, but changes over 5 years are not going to produce U.S. jobs in 2011-12. Nor will they help the current administration get re-elected.

Steve Murray

Principal Consultant and Chief Researcher

Supply Chain Visions

I say that it’s about time OUR pundits start shouting from the mountaintops how the U.S. is moving to reclaim/rescue its status as the world’s #1 economy.

WHAT HAVE YOU DONE TODAY TO PUT THE U.S. ECONOMY BACK ON TRACK?

McLain Oppy

Supply Chain Consultant

The Open Sky Group, LLC

I believe we all recognize that developed countries have ridden the wave of prosperity on the backs of developing nations. As we become one world we will inevitably see a leveling of wages, opportunities, etc. My hope is that we can raise the level for everyone while not drowning ourselves.

Jamie Elder

Nuskin

I think your arguments can be summarized in one phrase – “Sour Loser”. Supply chain is but a tool in the hands of the investor – the corporate giants who in their greed for more money and global market share have been sacrificing US jobs for the sake of corporate gain and all in the name of efficiency and globalization. Wasn’t it obvious when entire factories in the US were being closed and people laid off?

After enjoying low prices for almost 2 decades, I believe it is very unfair and selfish on your part to say that the west paid the money for Chinese growth as you have failed to recognize the humungous efforts put in by the Chinese workers who toiled in miserable conditions to enable consumers in the West to continue to buy goods at extremely cheap prices. Fact of the matter is that the Chinese earned their growth through hard labor and intelligent use of resources just like any other nation.

Yonus A. Siddiqui

Vice President Projects

e2e Supply Chain Management (Pvt.) Ltd.

Karachi, Pakistan.

|

|

|

| SUPPLY CHAIN TRIVIA |

| Q: What seminal supply chain article appeared in 1997 in MIT's Sloan Management Review? |

| A: "The Bullwhip Effect in Supply Chains," by Hau Lee, Lee, V. Padmanabhan, and Seungjin Whang. |

|

Copyrights © SupplyChainDigestTM 2003-2010. All Rights Reserved.

SupplyChainDigest

PO Box 714

Springboro, Ohio 45066

POWERED BY: XDIMENSION |

|

|

|

|