We received a ton of great formal and informal feedback on our piece last week on A Little Supply Chain Finance 101. "Give us more stuff like this" was a common theme. We will do our best to oblige.

It has been hectic around here as always - we have several new innovations on the way soon about which we are very excited.

| GILMORE SAYS: |

"This means to us that clearly there is a huge supply chain performance and capability gap between companies in a given sector, many of which will in fact be direct competitors."

WHAT DO YOU SAY?

Send us your

feedback here

|

We received a ton of great formal and informal feedback on our piece last week on A Little Supply Chain Finance 101. "Give us more stuff like this" was a common theme. We will do our best to oblige.

It has been hectic around here as always - we have several new innovations on the way soon about which we are very excited.

Given all that, I am going to take it a little easy today and just report on the highlights from a recent study our research arm CSCO Insights recently performed relative to overall supply chain performance.

As you may have seen, our "Cool New Product of the Month" for January was a new supply chain self-assessment tool from JDA Software. I liked it for several reason, especially the automated way that gave respondents some very good insights for relatively little effort. The on-line tool in part took the intelligence of the traditional strategic value assessment process used by i2 Technologies (which JDA acquired last year) and automated it. You obviously can't get the full type of insight you can with an on-site assessment, but this is not at all a bad place to start.

While the assessment is obviously oriented at providing benchmark data and insight for individual companies, we came up with the bright idea that general insight might be gained from analyzing the responses in aggregate, which is what we did across the nearly 100 respondents at the time we did the analysis (there are well over 100 now I believe). The data and commentary are available in the full report (see Insights from the JDA Supply Chain Assessment Tool 2011), but I will pick a few examples to highlight here.

The companies participating represented a wide array of both size and industries, tilting a bit perhaps towards larger companies, but with nearly every industry sector represented with at least a few respondents.

The survey is oriented towards levels of "maturity" across specific processes in demand management, supply management, inventory management, etc. , for most questions giving companies one of five choices in terms of current practice, moving from least mature to most mature or world class. In the report, we analyzed one or two of the responses from each main section, a few of which are published below.

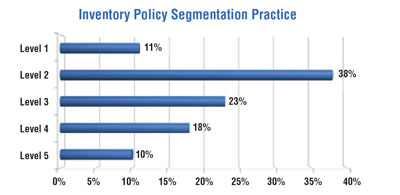

Let's start with a question about the level of process maturity for "Inventory Policy Segmentation." As stated, there were five levels:

Level 1: All parts or items treated the same

Level 2: Simple ABC segmentation-based on one dimension like usage or value

Level 3: Multi-dimension segmentation (many dimensions, more than just usage and value)

Level 4: Multi-dimension across the whole enterprise reviewed/updated at least once a year

Level 5: Multi-dimension within each business unit reviewed/updated at least once a year

As shown in the graphic below, just 11% of respondents said they treated all SKUs the same. But we were not surprised that a large number of companies (38%) at level 2, were using basic ABC type SKU segmentation based just on volume or value.

See Full Size Image Here

Indeed, the fact that 51% of respondents were using multiple attributes and/or reviewing these segmentation frameworks annually at different levels of the company shows just how far many companies have taken the practice of inventory management. This is perhaps the result of the increased emphasis inventory management has received during and after the economic downturn of 2008-09.

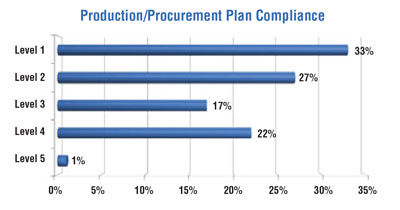

Under the supply management category, we chose a question related to how well final production schedules actually “comply” with published production and procurement plans.

Here, the levels were:

Level 1: More than 20% of the plan is overridden (actual vs. plan variance)

Level 2: Between 10% and 20% of the plan is overridden but overrides are tracked

Level 3: Between 5% and 10% of the plan is overridden but overrides are tracked

Level 4: Less than 5% of the plan is overridden

Level 5: Less than 1% of the plan is overridden

As shown in the chart below, the obvious observation for this question is that just 1% of respondents (one company, actually) had reached the highest level of maturity, in which less than 1% of the plan is overridden - quite a level of production performance.

See Full Size Image Here In fact, different from any other question in the assessment, more companies (33%) chose level 1, in which more than 20% of the plan is overridden on average. The second most common response, at 27%, was at level 2, where 10-20% of the plan is overridden.

As challenging as reaching level 5 may seem, best-in-class companies are in fact able to re-run supply plans daily across their global supply chain and keep to those plans with something like just 1% in overrides.

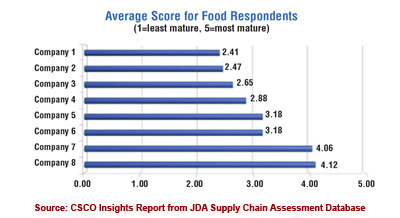

Finally, what I thought was the most important chart was one that showed differing levels of performance within an industry sector. For this exercise, we converted all the answers to a numeric scale, with 1 being the least mature, 5 the most, etc. We then tallied up the scores and divided by the number of questions to get an overall average for the entire assessment.

In the report, we highlighted relative performance among the eight respondents that at the time had come from the food manufacturing industry. This is really what is at the heart of the assessment process. As shown in the chart below, we see that the companies rate from a low average score of just 2.41 all the way to two of the few firms that had average scores over 4.0, with everyone else in between.

See Full Size Image Here

This means to us that clearly there is a huge supply chain performance and capability gap between companies in a given sector, many of which will in fact be direct competitors. That is true not only on a qualitative/maturity level, but also of course in how those differences translate in most cases directly to financial performance in terms of cost, revenue and profit.

A couple of overall observations include:

- The spread between the lowest and highest levels of maturity in each area is very broad

- Just a few companies are well above average in most areas; most have pockets of strength and relative weakness

- Companies tended to be more mature in areas that directly impacted the customer, such as order fulfillment to promise date.

There are many more charts and other overall observations in the full report. Think you will enjoy it.

Any reaction to these benchmark numbers? Let us know your thoughts at the Feedback button below.

|