|

Gattorna Says:

|

The

truth is that most organizations

have not reached an acceptable

level of understanding

of their customers’

dominant buying behaviors,

because they haven’t

really been thinking in

these terms...

The

truth is that most organizations

have not reached an acceptable

level of understanding

of their customers’

dominant buying behaviors,

because they haven’t

really been thinking in

these terms...

What

do you say? Send

us your comments here

|

Let’s

cut to the chase and stop dancing

around the issues that pervade

contemporary supply chains.

People, and people alone, are

at the centre of every enterprise

supply chain that exists in

the world today. On the outside,

we call these people ‘customers’

or ‘clients’ (or

indeed ‘credit risks’

at times), and on the inside,

we have Boards, management,

and employees. That’s

a lot of involved people! But

where are the HRM professionals?

Aren’t they supposed to

advise and assist top management

to shape all this ‘people

power’ on the inside of

organizations so that we can

better satisfy customers and

produce a correspondingly improved

bottom line? Of course there

is no ‘bottom line’

if there is no ‘top line’,

a fact that is sometimes lost

on managers with a 1-Dimensional

focus on costs only. It seems

to me as I travel the world

and engage with major corporations,

that the number of HRM professionals

is increasing, but what are

they all doing? I see no evidence

that they have mastered the

complexity that disparate human

behavior brings to organizations,

and by extension, supply chains.

Quite to the contrary, I observe

a reversion to type, where they

pre-occupy themselves with routine

activities that they feel comfortable

with, e.g., personnel administration,

car policies, recruitment, wages

and award payments, health and

safety, superannuation, and

other routine matters.

A

more enlightened view of contemporary

supply chains

Supply

chains permeate every type of

enterprise, whether commercial

or not-for-profit. They are

the ‘pathways’ through

which products and services

move as they gather value (and

cost) en-route to the end user/consumer.

Along the way there are lots

of processes, activities, and

relationships involved, enabled

by technology and infrastructure.

But the latter are only enablers,

not the main game. I think we

have forgotten this reality

as we have progressively become

smitten by advancing technology,

and in turn this has side-tracked

many an organization from the

correct focus - customers. This

reality is particularly true

of enterprises that have been

through the rigors of implementing

an ERP system. But it should

not necessarily be the case.

The

truth is that most organizations

have not reached an acceptable

level of understanding of their

customers’ dominant buying

behaviors, because they haven’t

really been thinking in these

terms, although few if any will

admit it. I see very few enterprises

in my travels which genuinely

understand and have an in-depth

knowledge of their customers.

Even those that do appear to

quarantine that knowledge in

functional silos such as Marketing

or Sales, which leaves the back-of-shop

operators largely in the dark

and second guessing customer

requirements. Hey, if we would

only admit to ourselves that

the real enemy is on the outside

of the organization, not on

the inside, we would be much

better off! The real villains

here are Marketing and Sales

personnel who are not doing

enough to translate their sometimes

intricate knowledge through

to other parts of the enterprise.

But we will leave that particular

argument for another day.

Aligning

the enterprise around customers

There

is only one fail-safe frame-of-reference

when designing and operating

contemporary supply chains;

the customer and the customer

situation. This is the starting

point for all subsequent action.

If you don’t think this

way, you are guessing! Once

you fully understand the behavioral

structure of your marketplace,

it is possible to ‘reverse

engineer’ the configuration

of your supply chains back through

the organization to actual operations

on the ground. And, because

there is always more than one

type of customer dominant buying

behavior evident in any product/service

market category, it follows

that there is likely to be more

than one type of supply chain.

Indeed, I have consistently

found empirical evidence to

suggest 3-4 generic types of

supply chain, and/or variations

of these, in different mixes

depending on the product, service

or country. Briefly, these are

as follows:

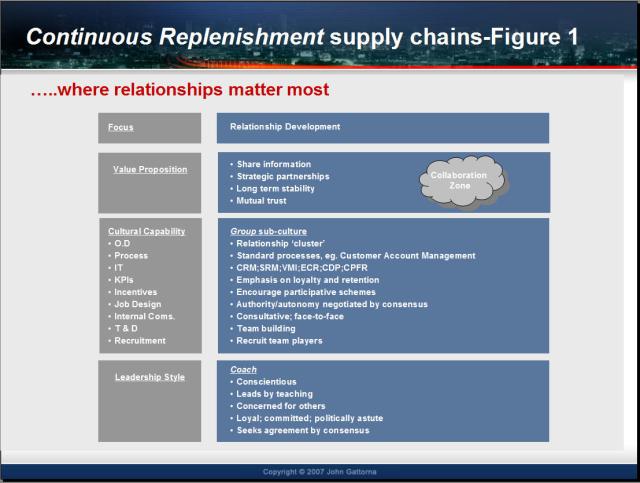

- Continuous

Replenishment supply chain

to service the ‘Collaborative’

segment;

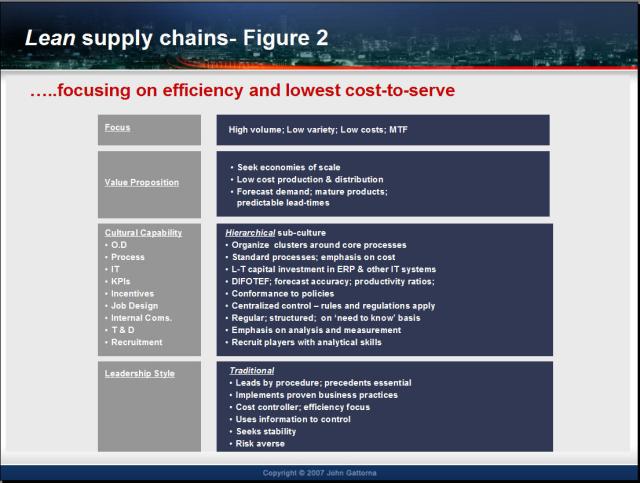

- Lean

supply chain to service

the ‘Efficiency’

segment;

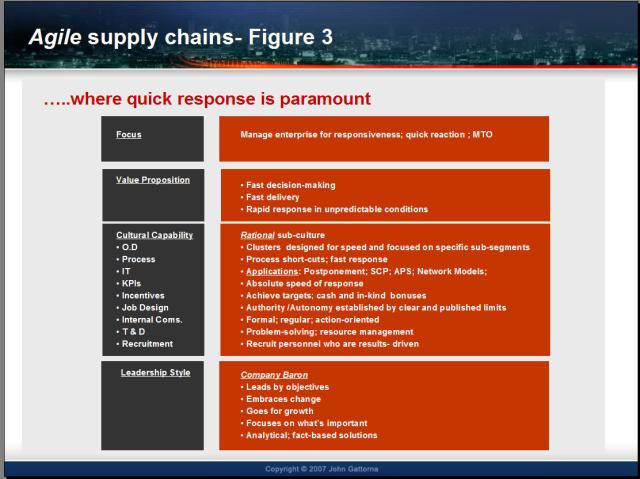

- Agile

supply chain to service the

‘Demanding’ segment;

and

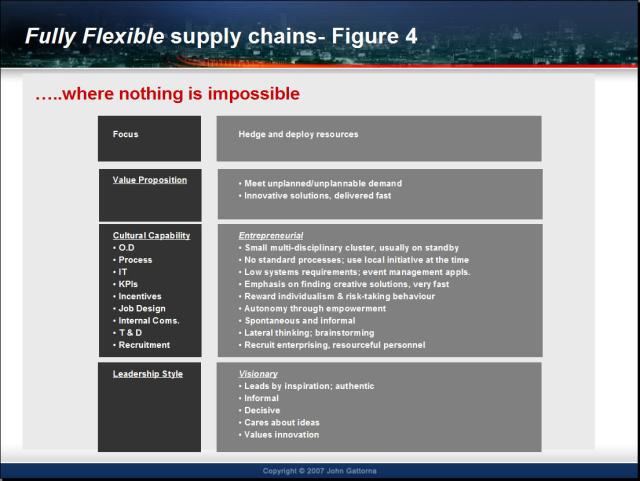

- Fully

Flexible supply chain

to service the ‘Innovative

Solutions Seeking’ segment.

And

as customers move away from

there natural or preferred buying

behavior, there is a good chance

that they will move, either

temporarily or permanently,

to one of the other three buying

states listed above. In some

large organizations it is possible

to discern more that one buying

behavior present. So, any response

must have a dynamic capability;

not this duck-shooting where

you have a single response,

and endeavor to infinitely adapt

this response as customers move

across your sights. That approach

is cost prohibitive because

of the myriad of exceptions

involved, and it is very wearing

on the people inside the business.

Once

you pin down the structure of

your marketplace, it is possible

to develop a corresponding range

of responses that align with

the different customer’

buying behaviors you have identified.

This is simply a packaging

exercise where you mix and

match such attributes as price,

branding, speed and/or consistency

of delivery, relationships,

degree of innovation, and more.

The same basic product or service

can be delivered in many different

ways to suit the same or different

customer. All well and good,

but the problems are only just

starting. The devil is in the

implementation of the supply

chain configurations to deliver

these intended strategies,

rather than their formulation,

and that is where people play

the major roles, front and centre.

They can either make things

happen, or resist simply because

they want to. This is an insidious

form of resistance because it

is difficult to measure in real-time,

and often the effects only become

apparent after significant time

has elapsed. And by then it

may be too late to recover.

The

key to successful execution

is people

The

‘dynamic alignment’

concept requires that four levels

of human endeavor be aligned:

marketplace; response(s)

to customers; internal cultural

capability; and leadership

style, all held together

primarily with leadership, organization

structures, processes and technology.

The biggest problems occur at

the interface between intended

responses (strategies) and internal

cultural capability of the enterprise.

Indeed, 40-60 percent of written

plans are never delivered on

the ground, and the reason for

this is the dislocation that

occurs at the strategy-cultural

capability interface. It is

not due to competitor activity

as many would have us believe.

The root cause of non-performance

is much closer to home, i.e.,

inside the enterprise itself,

a type of ‘Trojan Horse.'

My question, therefore, is as

follows: what have HRM professionals

been doing to understand and

address these issues? Where

is the research to better inform

practice? In short, where have

they been when we needed them

most? Are they not the custodians

of the corporate culture. How

have they advised top management

in the quest to reduce obvious

‘mis-alignments,' particularly

at this crucial interface? The

answers to all these questions

are pretty negative, and worst

of all, there is little or no

respite in sight. Organizations

continue to operate much as

they have for decades, and educational

institutions are teaching the

same old stuff to their students,

the next generation of managers.

It’s a vicious circle

that we must break out of sooner

rather than later. That time

is getting closer for many organizations,

otherwise they won’t survive.

The

four generic supply chain alignment

configurations

Each

of the four (4) generic supply

chain types listed above look

different at each level of the

alignment framework. They have

to be in order to focus on a

particular dominant buying behavior.

Each of these unique configurations

are described in the following

schematics.

For

purposes of this discussion,

we will focus on the forces

at work at the cultural capability

level, because it is here that

the human action inside the

enterprise plays out, mostly

hidden from view. This is also

where the forces of darkness

lurk, leading to gross organizational

ineffectiveness. It is also

right here that we need HRM

professionals to be focusing

their attention, and providing

technical advice and support

to senior management. The following

attributes that shape and create

sub-cultures are the ones we

want them to focus their attention

and energies on.

- Organization

design: other than ‘leadership

style’ itself, this

is the most powerful force

for shaping sub-cultures because

it constrains the way people

work, like a straight jacket.

Unfortunately, it is also

the area that has seen the

least progress over the last

several decades. Organizational

designers have been unable

(or unwilling) to come up

with anything better than

the traditional functional

silos, and a variation of

this, the matrix structure.

Functional silos served us

well in the relatively slow-moving

world of the 1950s, 60s, and

70s, but have become progressively

more mis-aligned with the

way customers want to buy

over the last two decades.

It seems we will never rid

ourselves of this format,

and maybe we won’t have

to. More about that point

shortly.

Matrix

organization structures were

introduced to overcome the

weakness highlighted above

in functional silos, but has

generally not been effective,

and will not get any more

effective from here on. The

problem is the internal conflicts

generated at each intersection

between an Account Manager

and the all-powerful vertical

functions that hold the budgets.

No joy there.

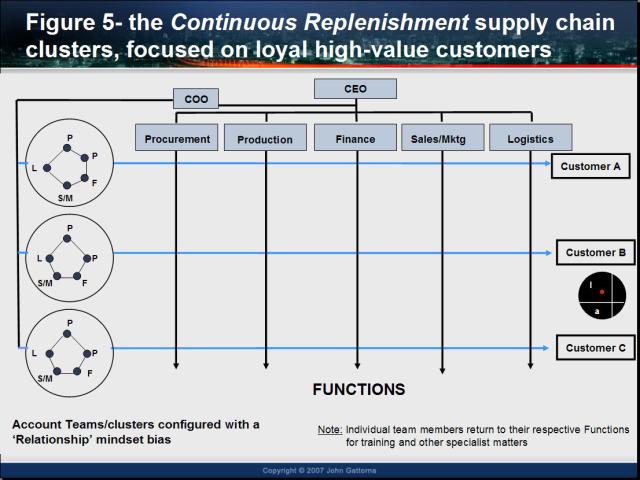

In

my view, there is a way forward

that allows us to engage and

align with customers more

effectively in a fast-moving

operating environment. I called

this organizational format

a ‘cluster.' The idea

is to build groups or clusters

of multi-disciplinary personnel

that faithfully replicate

both the competences required

to service a particular customer

segment, as well as embedding

the required mindset bias.

For example, where we have

a Continuous Replenishment

supply chain aligned with

a Collaborative segment

of customers, it is important

to embed a ‘relationship’

mindset or sub-culture, and

support this with the appropriate

processes and technology as

discussed below.

In

this way we can keep the conventional

functional silos in place,

but with a different raison

d’etre. They become

the repository of specialist

skills and competences, and

the ‘force generator’

from which the new clusters

draw personnel of all disciplines

for short or long-term assignment

to particular clusters. It

would look something like

that depicted in Figure 5

below.

Likewise,

clusters for each of the other

three types of supply chain

can be configured with the appropriate

mix of disciplines and mindsets.

Surely this is an area where

HRM professionals can play a

major role, working with functional

and cluster heads to engineer

the required configurations.

It is here that the second attribute

comes into play.

- Positioning

square ‘pegs’

in square holes: this

is where The fine tuning occurs.

Personnel are closely reviewed

in terms of their technical

skills and mindsets, using

such techniques as the MBTI

for the latter, to ensure

they ‘fit’ any

roles they are appointed to.

We are talking about nuances

here, but they count tremendously

towards organizational effectiveness

at the aggregate level. The

days of wiping out whole layers

of management are gone. Looking

back, that was borne of ignorance.

- Process

re-engineering: there

are no mysteries here, but

the key is to ensure that

the primary processes that

align with each supply chain

or pathway are in place. They

become standard and are invoked

by the cluster as required.

- Information

technology and systems:

these simply mimic and institutionalize

the processes already established.

The problem to date has been

that organizations have been

throwing the full gambit of

systems technology at every

type of customer situation,

without discrimination, looking

in vain for the ‘Silver

Bullet.' There is no such

thing in supply chain management.

What we need is an underpinning

ERP system to provide one

version of the truth, and

then interface this with different

mixes of IT applications as

appropriate. So for example,

the main application servicing

the Collaborative customer

segment might be a CRM system.

It will help us manage the

loyal high-value customers

in the way they expect, where

relationships and trust are

paramount.

- KPIs:

this is an area of management

that seriously impacts on

performance, but is as yet,

badly understood. People will

do what is inspected, not

what is expected. So you have

to use this principle in framing

the KPIs unique to each type

of supply chain. Out with

the so called ‘Balanced

Score Card,' and in with the

‘Biased Score Card,’

which is purposefully designed

to faithfully signal what

you want our people to do.

In the case of servicing customers

in the Collaborative

segment, this might mean focusing

on a few vital KPIs such as:

length of time we have retained

the customer (Customer Retention);

and share of customer’s

spend in a particular category

that we have (Customer Loyalty).

- Incentives:

these are the mirror image

of the KPIs, selected for

particular situations. It’s

a matter of ‘horses

for courses.' What are the

most appropriate incentives

for personnel who are themselves

steeped in relationship building

and maintenance. Is it cash?

Or is it something else in

kind. Again, over to the HRM

professionals to figure this

out. That’s what they

are paid to do!

- Internal

communications; different

sub-cultures have different

communication styles. The

trick is to embed the style

that aligns with the sub-culture

you are trying to shape. In

the case of the organizational

cluster driving the Continuous

Replenishment supply chain,

this is likely to be very

inclusive, with actions only

being taken after a consensus

is reached. To be fair, this

can sometimes be a slow process,

but then again, when you are

servicing this type of relationship-focused

customer, time is on your

side. Nothing changes fast.

Everything is a result of

a lot of thoughtful consideration.

So the cluster is just reflecting

this trait.

- Training

and Development: here

we expect that HRM professionals

will design and conduct a

personal development program

(PDP) for each and every individual

executive. Gone are the days

of spending big on mass training

initiatives. This was wasteful

at best, and a dereliction

of duty at worst.

- Recruitment:

this final parameter represents

a very powerful force for

‘genetically engineering’

selected sub-cultures in an

organization, to reflect the

external market structure.

Thankfully, I have met a number

of recruitment firms recently

that get it, and are actively

engaged in delivering individuals

to enterprises that meet technical,

experiential, and mindset

parameters. Logistics

Recruitment (a Sydney-based

global recruitment network,

with offices in 10 countries

that recently launched the

world’s first global

careers site for supply chain

and logistics professionals

(www.SupplyChainJobz.com))

is one such organization,

and their efforts are to be

applauded. What we need from

the internal HRM professionals

is engagement in this vital

enterprise-building process.

Finally,

there is the over-arching influence

of Leadership styles, that are

perhaps as important in shaping

sub-cultures in organizations

as organization design. Here

again, there are plenty of sophisticated

tools available to HRM professionals

to measure and monitor management

and leadership styles, but you

also have to know what to do

with this data.

HRM

professionals can assist management

by helping and advising in the

formation of the various clusters,

and in particular which individual

executive is appropriate for

the particular leadership role

being considered.

Final

word: some evidence to reflect

on

At

the Smart’07 Conference

in Sydney in June 2007, I addressed

an audience of some 300 people

on the topic of my book, Living

Supply Chains, and what

this meant for designing and

operating contemporary high-performance

supply chains. At the end of

my address, I asked this audience

six (6) questions. The results

are below, and if this audience

is typical and representative,

which I think it is, we

have a long way to go indeed.

Wake up HRM professionals and

get on the job! Your managements

need help.

Q1:

Has your company/enterprise

attempted to design/operate

its supply chain network along

‘alignment’ principles?

Yes: 33%; No 67%

Q2:

Has your company/enterprise

used behavioral segmentation

of customers to inform the

design/operation of it’s

supply chains? Yes

21%; No 79%

Q3:

Has your company consciously

attempted to shape various

sub-cultures to execute the

different types of supply

chains (pathways) that are

running through the business?

Yes: 32%; No 68%

Q4:

Does top management in your

company treat logistics/supply

chain management as a specialist

‘function,' or as an

integral part of the business?

Yes: 69%; No 31%

Q5:

Do you think top management

in your company understands

the role culture plays in

powering corporate supply

chains? Yes 38%; No 62%

Q6:

If no, are they in denial?

Yes 77%; No 23%

Perhaps

you might like to answer the

same questions yourself to get

a reading on how far you are

on or off the pace.

Agree or disgree

with our expert's perspective?

What would you add? Let us know

your thoughts for publication

in the SCDigest newsletter Feedback

section, and on the web site.

Upon request, comments will

be posted with the respondents

name or company withheld. |