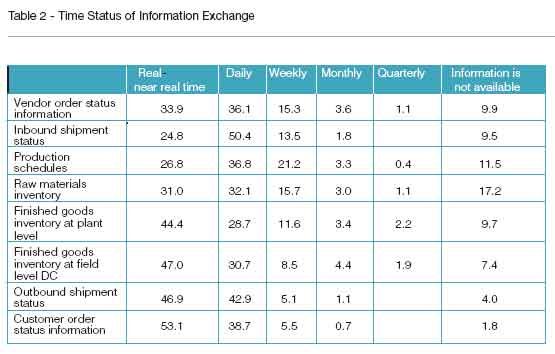

The data showing details of supply chain visibility by specific type of supply chain process step is even more interesting. As shown in the figure below, for example, 24.8% of respondents said they achieve near real-time visibility to inbound shipment status; 47% said the same about inventory in the distribution network.

Transportation Improvements: The survey also asked companies which transportation management strategies they had either already implemented or planned to implement. The top 5 were:

- Improved track and trace with carriers

- Increased shipment visibility

- Improved shipment consolidation

- Core carrier programs

- EDI with carriers and other trading partners

Interestingly, 20% of respondents indicated they were dropping their core carrier programs. About half reported they were shifting more volume to 3PLs.

Playbook Recommendations

The report ends with these four recommendations for becoming a “Master of Logistics:"

- Learn the rules of the game: Winners understand strong systems integration, improved visibility, and internal alignment around goals and strategies have become the entry stakes to a high performance supply chain.

- Focus on talent requirements: Winners put more focus on internal talent development and recruitment.

- Continually develop a few “new plays”: Winners don’t stand pat, as the competition won’t either. Continuous assessment and dialog with trading partners are key to adding new plays to the playbook each year.

- Focus on a few key metrics: Performance measurement seems like it should be easy, but it isn’t. The authors suggest focusing on the few metrics that really matter, noting that “too many measures will lead to paralysis.”

The report smartly observes, however, that winning supply chain strategy and execution follow from the company’s overall approach to the market. Much of the data is therefore segmented by whether a firm said its overall strategy was to be a “cost leader,” a “customer service leader” or a hybrid of both strategies. Low cost-focused companies, not surprisingly, had higher inventory turns than customer-serviced focused companies, for example.

What are your thoughts on this year’s Trends in Logistics and Supply Chain Management report? Do you agree many companies try to manage too many metrics, or are more metrics often better? What do you see happening with supply chain visibility? Let us know your thoughts at the Feedback button below. |