It is not uncommon to see data or charts relative to manufacturing output by country, but what about numbers relative to where value is being added in the manufacturing process?

The economists at the World Bank actually keep track of those statistics, though there is a lot of variaibility relative to how up to date their numbers are.

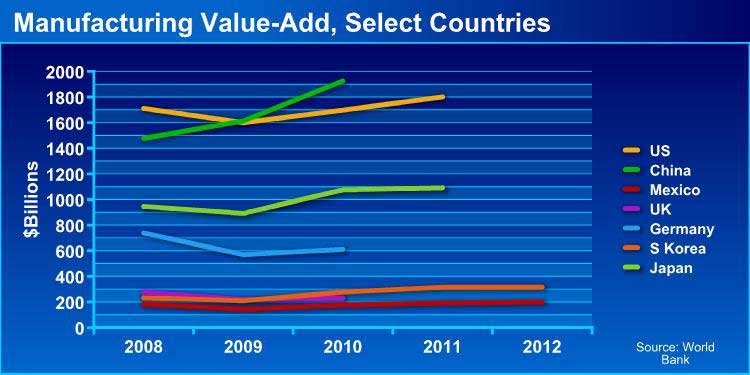

With that proviso, we took a look at the most current data available this week on value-add in manufacturing by select countries (the US, China, Mexico, Japan, Germany, the UK and South Korea).

The World Bank says value-add is "is

the net output of a sector after adding up all outputs and subtracting

intermediate inputs. It is calculated without making deductions for

depreciation of fabricated assets or depletion and degradation of

natural resources."

Put more simply, it is the difference between what manufacturers in a country buy (parts, materials, etc.) and at what price they sell a given item or good. It seems to SCDigest to be at least as important a measure as total output, and maybe even more so, in terms of the health

of a manufacturing sector. In a real sense, it is like the difference between revenue and profit or margin.

Here is our chart:

Some observations:

Though the World Bank is missing 2011 and 2012 data for China and 2012 for the US, China matched the US in 2009 and is clearly now ahead as the number 1 country for value-add. A key factor was that China continued to rise in the deep recession year of 2009, while everyone else sunk sharply or was at best flat.

Still, the US is probably in better shape than many or even most recognize. It has value-add of about 80% more than number three Japan, for example, and nine times the level of Mexico, thought by some to be on a manufacturing tear. It adds much more value than Germany, South Korea, Mexico and the UK combined.

As opposed to everyone but China, the US' value-add trajectory is very positive, whereas even major exporters such as Germany and South Korea are not growing their numbers. With some clear evidence of more "reshoring" in the US, it seems highly likely that trend has continued in 2012 and 2013. Everyone else is basically flat lining.

There may be a lot of sense in buying components cheaply offshore and adding most of the value state side.

Any Feedback on our Supply Chain Graphic of the Week? Let us know your thoughts at the Feedback section below. |