As the US and most of the developed world try to finally pull out of the deep global recession that began more than two years ago, policy makers and corporate CEOs are struggling with the bi-polar nature of global economic growth.

While Germany and Canada have enjoyed a decent recovery, and of late the US is finally showing signs of real improvement despite high levels of unemployment, overall growth in GDP and other economic indicators in so-called developed countries continues to lag well behind that of many developing markets.

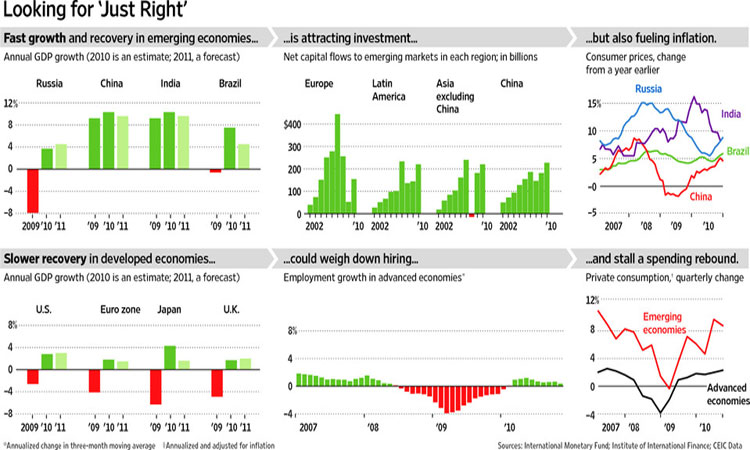

As shown in the graphic below, both GRP and economic investment in those developing economies have grown stongly, while developed economies as a whole continue to struggle along many economic dimensions.

Source: The Wall Street Journal

Perhaps most telling is the difference in household/individual spending between developing and developed markets since the recession started. While both groups saw a deep dive in in 2009, as shown in the graph on the bottom right of the above chart, that measure has improved rapidly in developing countries since then, up some 10% from the bottom in 2009, while in developed markets the increase is a paltry 2% or so, well below normal recovery levels.

"In many emerging markets, it's as if the downturn never happened," the Wall Street Journal says.

Quite a difference from the struggles of the US, most of Europe, and Japan. With a big supply chain impact in the end.

Agree or

disagree? What is your perspective? Let

us know your thoughts at the Feedback button

below.

|