The ocean shipping industry has been through quite a whipsaw over the past two and a half years, as the severe downturn in cargo volumes that reached depression levels in 2009 was accompanied in many cases by new ships ordered years before continuing to be delivered. Many carriers were said to be operating ships at or below variable costs to run them in 2009.

Rates have improved substantially since those days, from the carrirers view at least, and we seem to be in a period of reasonable supply-demand balance, with trends favoring carriers or shippers, depending on whom you ask.

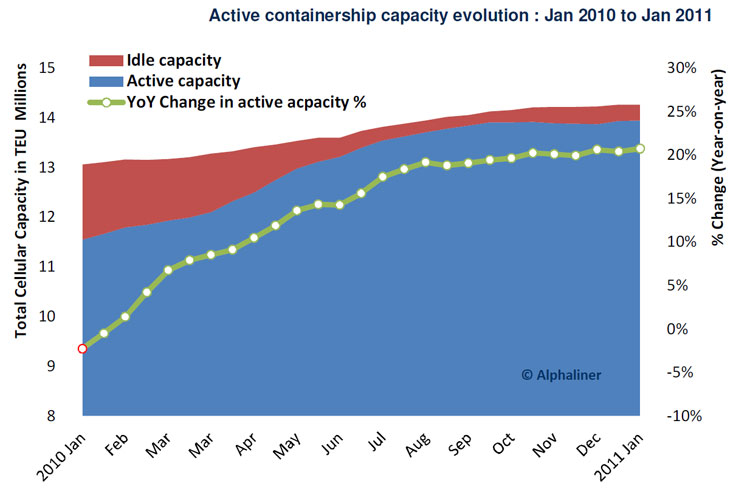

The chart below, from ocean shipping data service and research company Alphaliner, shows the dramatic change in the market just the past year, as idled capacity is dramatically down, while active capacity is corresondingly way up.

Source: Alphaliner

Alphaliner says that idled fleet has dropped

by 78% from 1.51 million TEU in

Jan 2010 to 0.33 million TEU currently.

Even though demand and load factors have fallen in recent months, Alphaliner says there has been relatively low fleet

idling, as carriers were reluctant to

withdraw capacity and

give up market share. That sounds like good news for ocean shippers to us.

Alphaliner says average utilization levels

have dropped to between

80-85% in December on

the main linehaul routes

from the Far East to

Europe and North America

Agree or

disagree? What is your perspective? Let

us know your thoughts at the Feedback button

below.

|