Since the financial crisis and deep recession began in late 2008, there have been opinions on many sides as to if and when companies should play some "offence" or simply hunker down and/or pursue deep cost cutting to deal with trouble top and bottom lines.

The best path is probably different for each company, but we were still intrigued by the analysis from Ranjay Gulati, Nitin Nohria,

and Franz Wohlgezogen in the March editipn of the Harvard Business Review, based on research across some 4700 companies and their strategies and results coming out of previous recessions.

The three found, for example, that "Only a small number

of companies—approximately 9% of our sample—

flourished after a slowdown, doing better on key financial parameters than they had before it and outperforming

rivals in their industry by at least 10% in

terms of sales and profit growth."

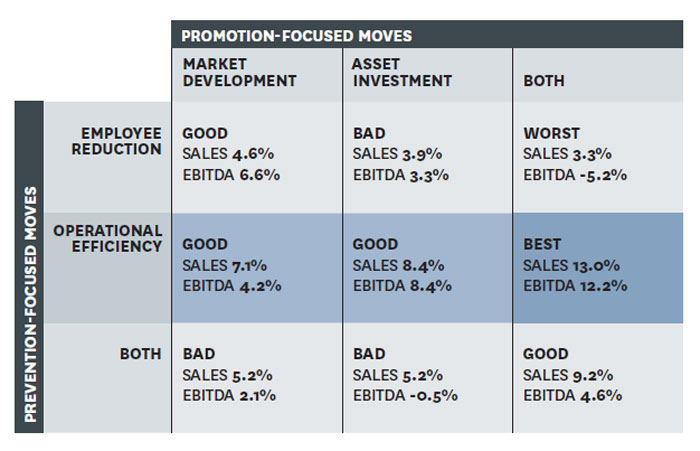

What were the keys to that success? A balanced strategy of both offense and defense, as shown in the table below, taken from the article.

The chart is a little hard to understand, but shows two potential offensive strategies (upping market development activites and acquiring or building assets) and two defensive strategies (large layoffs and "Leaning out" supply chains and other areas of operations. Considering that companies could do either of both of each type of strategy, it results in a total of nine different scenarios.

Best Strategies for Coming Out Strong from Recession

Source: Ranjay Gulati, Nitin Nohria,

and Franz Wohlgezogen, Harvard Business Review

The sales and EBITDA rercentages refer to the three-year compound annual

growth rates after the recession is over (adjusted

for industry averages).

The key takeaways for us:

1. Using mass layoffs and aggressive efficiency moves together are very bad for post recession performance unless both offensive strategies are used at the same time (cost cutting funds the offense?). The best strategy, however, is to focus on just efficiency without large payoffs, combined with both offensice moves.

2. In a period where it appears most companies are eager to shed supply chain and other assets to provide more financial and operational flexibility see Who Will Own the Supply Chain Assets in the End?) this research shows building/buying assets (perhaps on the cheap during a downturn?) can often be a winning strategy.

"companies that respond to a slowdown

by reexamining every aspect of their business

models—from how they have configured supply

chains to how they are organized and structured—

reduce their operating costs on a permanent basis.

When demand returns, costs will stay low, allowing

their profits to grow faster than those of

competitors," the authors say.

They add that "progessive companies "take advantage of depressed prices

to buy property, plants, and equipment. This helps

them both during the recession and afterward, when

they can respond faster than rivals to a rise in demand.

Because their asset costs are lower than their

noninvesting competitors’, their earnings can be

relatively higher."

Agree or

disagree? What is your perspective? Let

us know your thoughts at the Feedback button

below.

|