As individuals and supply chain professionals, we are inherently connected to the broader economy.These are tough economic times, but for planning purposes, what will this down cycle really look like?

The smart folks at McKinsey recently defined four potential scenarios, ranging from poor but manageable to downright ugly.

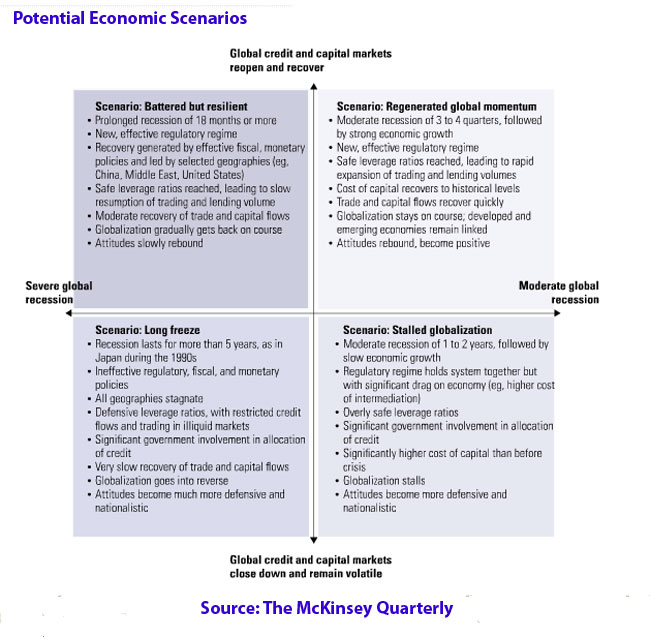

As shown in the chart below, McKinsey looks at two variables: the recovery of the financial and credit markets (faster or slower) and the global recession (shallower or deeper), and comes up with four potential scenarios as a result.

Obviously, a quicker recovery of the credit markets and a less severe recession leads to faster overall recovery (in 3-4 quarters) and strong economic growth coming out of it (top right quadrant).

On the other side, slow recovery in the credit markets and a deep recession could potentially lead to many years of a stagnant global economy.

McKinsey does not make any predictions about which scenario is most likely. Take your pick.

Agree or

disagree? What is your perspective? Let

us know your thoughts at the Feedback button

below. |