The controversy over the law passed in Washington last year requiring 100 percent container screening/scanning by 2012 at port of origin took another twist this week, with a report sponsored by the World Customs Organization predicting a number of negative outcomes if the law is not amended, as the WCO and many US shippers and organizations have called for. (See

Will International Protests Scuttle US Plans for 100 Percent Container Scanning?)

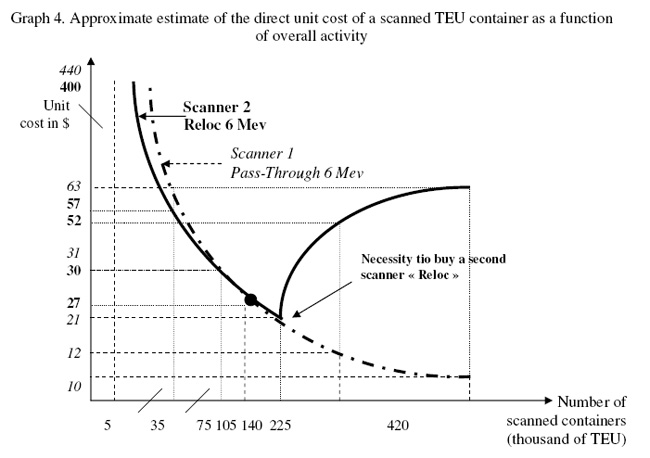

The chart below is taken from that report, developed by France's University of Le Havre and professor Frédéric Carluer. It shows the expected cost per container to perform the scanning, based on use of one of two types of scanning equipment and the level of container volume. Since the equipment is a fixed cost regardless of volume, ports with smaller export volumes to the US would incur much higher per container costs and one assumes charges levied to either shippers or importers.

Frédéric Carluer, University of Le Havre/WCO Report

So, for example, a port moving approximately 75,000 TEUs annually to the US would incur a total cost of about $30 per container in either equipment scenario. Above certain volumes (about 225,000 TEU) the "Reloc 6 Mev" scanner can no longer handle the volumes, resulting in a new cost curve.

The upshot: for most large ports, the cost per container would be relatively modest. For example, 460,000 US-bound containers moved through the port of Rotterdam in Europe in 2006, meaning the incremental cost per container would be less than $10, according to this analysis. The real impact would be on the hundreds of smaller and even some mid-sized ports and exporting countries, where costs could approach $50-100 per container - a sizable hit.

Agree or

disagree? What is your perspective? Let

us know your thoughts at the Feedback button

below.

|