It's not just oil and fuel prices that are going through the roof - prices for almost all commodities are also soaring, including anything to do with agriculture, metals and more.

Companies across many industries, especially the food group, have recently blamed earnings shortfalls on spiking food commodity costs. Kodak cited rising

silver and aluminum

prices as significantly impacting its Q1 profits.

What has many confounded is that this is continuing to occur in the midst of a US and, to a large extent, global economic slow down.

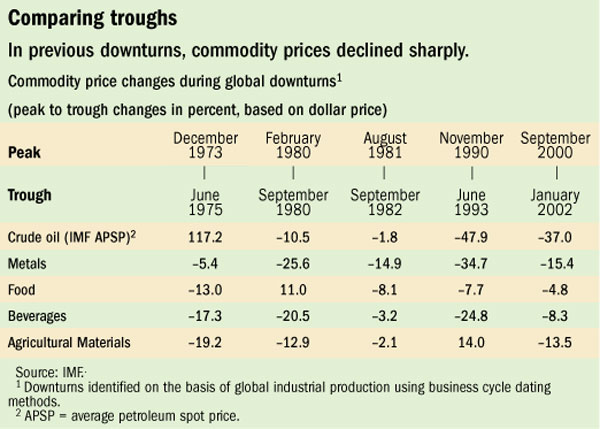

A recent report from the International Monetary Fund (IMF) also finds this highly unusual. The report includes the chart below, which shows that in past economic slumps, commodities prices always have pulled back sharply from their peaks in boom economic times.

Source: International Monetary Fund

The IMF report cites a number of factors for this pricing anomaly, including the falling value of the US dollar, the impact of the great increase in the level of corn production being used for ethanol, investors fleeing to commodities as a safer haven, and the supply side being slow to increase quantities (as usually happens when commodity prices soar, ultimately, better balancing supply and demand).

Agree or

disagree? What is your perspective? Let

us know your thoughts at the Feedback button

below.

|