| |

|

|

| |

|

|

|

|

|

| |

-Sept.

6, 2007 |

|

| |

|

| |

q |

| |

|

| |

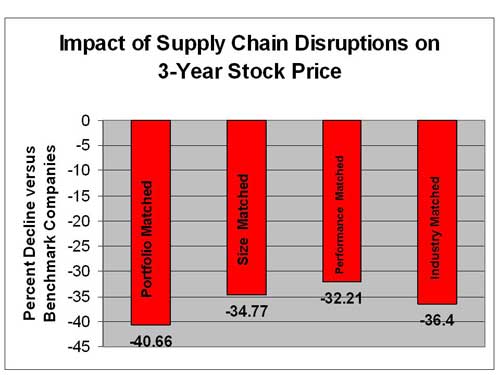

With the never-ending news

about the huge product recall by Mattel

over concerns about lead paint used in millions

of popular toys manufactured for the company

by a Chinese contractor, and rising scrutiny

over the safety of offshored products generally,

it's worth remembering the seminal research

done in 2003 by Kevin Hendricks of The University

of Western Ontario and Vinod R. Singhal

of Georgia Tech showing the clear impact

"supply chain disruptions" have

on company profitability and share price.

As the chart below shows,

companies announcing Supply Chain Disruptions

had stock prices that significantly lagged

their peers over a three-year period (one

year before the announcement, through two-years

afterward). When controlling for factors

such as the size of the company, vertical

industry, etc., Hendricks and Singhal found

companies announcing Supply Chain Disruptions

experienced stock prices that were down

on average between 32-41% from their industry

peers over those three years, representing

tens of millions or even multi-billions

of dollars of market capitalization.

CEOs lose their

jobs over that kind of relative stock market

performance. That fact, and the profitability

and stock price losses from important Supply

Chain glitches, show why aggressive risk

management and supply chain controls are

well worth the cost of this "insurance."

|

|

| |

|

|

|

|

|

| |

|

|

| |

|

|