SCDigest

Editorial Staff

The News: The

always interesting Bear Stearns quarterly

Shipper's Survey (called the Supply Chain

Indicator) was released earlier this month

for Q1 2007.

|

SC Digest Says: |

Importers

are staying very focused on keeping

ocean container rate increases down

in the face of rising rail costs for

full international to domestic multi-modal

moves.

Importers

are staying very focused on keeping

ocean container rate increases down

in the face of rising rail costs for

full international to domestic multi-modal

moves.

What do you say?

Send

us your comments here |

The Impact: More

evidence that the “Perfect Transportation

Storm” of 2005 is largely gone for

now (but will be back, we expect), with

base rate increases down and capacity up

among most modes. Rail carriage remains

one exception, and then there are those

pesky fuel surcharges….

The Story: We

look forward every quarter to the release

of the Shipper’s Survey results from

investment firm Bear Stearns, under the

guidance of analyst Ed Wolf and several

colleagues. The result of survey input from

hundreds of shippers, the report provides

perhaps the most detailed view of what shippers

are thinking and doing of any report available

in the industry. (For the full report, go

to The

Bear Stearns Supply Chain Indicator Q1 2007).

The report

for Q1 2007, released earlier this month,

shows continued changes in the supply-demand

situation favorable to shippers, as slowing

demand plus rising capacity in the trucking

sector helps keep costs down.

Key findings

include:

- Shippers

see moderation in overall transportation

spending in 2007, with an average estimate

of just a 1-1.5% increase in rates across

all modes after the effect of rising volumes

is factored out. That’s down .5%

from a year ago.

- There

is still a “record setting”

perception of overcapacity in the truckload

market, giving shippers the edge. An amazing

80% of respondents believe there was overcapacity

in the TL market in Q1, the highest level

in the history of the survey. By comparison,

in the last major downturn for the trucking

industry in 2001-02, only 50-60% of respondents

saw overcapacity among truckload carriers.

- From the

capacity situation, shippers have mild

expectations for rate increases by TL

carriers in 2007. On average, shippers

expect just a 1.3% increases in TL rates

for 2007 before fuel surcharges, down

from 3% in the Q1 2006.

- There

are also strong perceptions of overcapacity

in the LTL market, and pricing expectations

for LTL carriers is the lowest since 2002.

Shippers expect 2007 LTL rate increases

of just 1.5%, down from 2.5% a year ago.

- Despite

the changing economics, shippers do not

see any impact yet on small carriers exiting

the market.

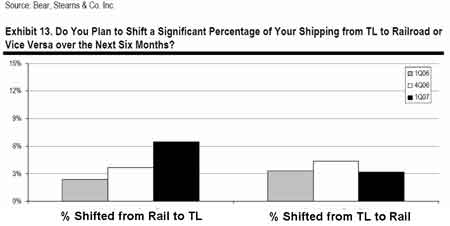

- Expectations

for rail pricing increases, however, remain

strong. Shippers expect 2007 increases

in rail rates to be 4% before fuel surcharges,

up from 3.5% in Q4 2006.

- The current

scenario is causing a greater percentage

of shippers which plan on moving freight

from rail to truck, citing both cost and

service issues. Interestingly, price has

actually replaced service concerns as

the number one reason for moving from

rail to truck. “Shippers expect

to move slightly more freight from rail

to truck and less from truck to rail than

we have seen in several years,”

the report says, noting this is counter

to the overall, longer term trend of increased

rail usage.

- A small

but growing level of shippers is beginning

to divert some freight from unionized

LTL carriers and UPS as we approach the

end of the union contracts for both, which

end March 31 and July 31, 2008, respectively,

over worries about a potential strike

and loss of capacity.

- Shippers

do not think “dimensional pricing”

is cost neutral, despite claims by UPS

and other parcel carriers. Respondents

believe the new rating programs, which

took effect in January, will actually

increase parcel shipping costs by 1.5%

based on cost per pound.

- Rate expectations

are also modest for ocean shipping, though

up slightly from last year. On average,

shippers expect ocean container increases

of 1.2% in 2007, but that’s up from

an expected decrease in rates in Q4 2006.

The report says it believes importers

are staying very focused on keeping ocean

container rate increases down in the face

of rising rail costs for full international

to domestic multi-modal moves. The implication

is that shippers will have more luck negotiating

on ocean container rates than with the

rail carriers.

A

Growing Number of Shippers Plan to Shift

Freight from Rail

to

Truck in the Short Term, though the Longer

Term Trend is the Opposite

What is your

reaction to the Bear Stearns Q1 shipper’s

report? Do you also see great overcapacity

in the TL and LTL markets? How long do you

expect that to last? Are changing dynamics

causing you to think about moving from rail

to truck? Let us know your thoughts at the

Feedback button below. |