MAPI also argues that the US share of global manufacturing output has remained roughly steady at about 20% for three decades, even in the face of China’s growth.

The reality is, however, that MAPI data does show some modest decline in US share of global production since its apex in the late 1990s, coinciding in a sharp rise of China’s share. Nevertheless, China’s gain is much greater in percentage terms than the US decline, meaning that China’s growth has come largely at the expense of countries other than manufacturers in US.

Where the US has fallen off is in the share of exports. In 2000, U.S. manufacturing exports were more than three times larger than those of China, while in 2008, Chinese exports were 28 percent higher than those of the United States.

Challenges Lie Ahead for US Manufacturers

The MAPI report does warn of challenges for US manufacturers ahead, repeating themes it and the National Association of Manufacturers have raised many times in the past, mostly related to “external” costs that the report says put a drag on US manufacturing competiveness.

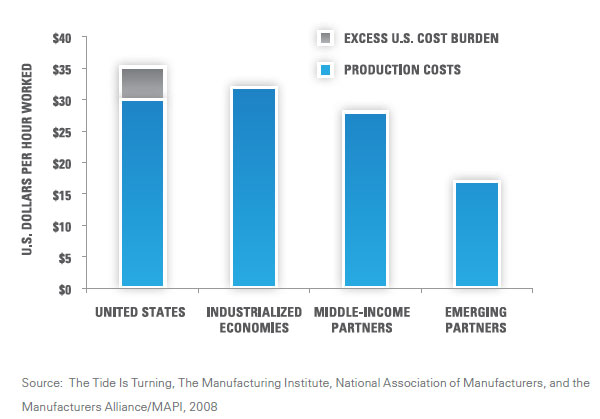

“While it is well known that Mexico and China have lower labor costs, it is generally not recognized that external structural costs put U.S. manufacturers at a competitive disadvantage, even with our industrialized trading partners,” the report says. “Compared to our nine largest trading partners, U.S. manufacturers face higher costs in the areas of taxation, employee benefits, tort claims, and government regulation.”

The report notes, for example, that the United States now has the second highest corporate tax rate among our major trading partners, trailing only slightly behind Japan.

Economic simulations by MAPI indicate that cutting the U.S. statutory corporate tax rate by five percentage points would increase manufacturing output by $156 billion over ten years and create 500,000 manufacturing jobs.

Perhaps surprisingly, the report says that U.S. industry is already faced with the highest pollution abatement costs compared with other countries – even higher than the so-called “green economies” of Western Europe.

It says, for example, that in 2007, U.S. manufacturers spent an estimated 6.2 percent of value added complying with air and water emissions standards (which are among the strictest in the world), compared to 6 percent in France and Germany, 5.5 percent in Canada, and 3.5 percent in the United Kingdom.

The report, among other challenges, notes a worrisome drop in engineering graduates in the US and falling basic math and science skills among the labor pool.

The report says the country must pay more attention to the factors that drive US manufacturing competitiveness.

What is your reaction to the MAPI 2009 report? Does any of the data surprise you? How big a drag do you think tax rates, regulatory and heath costs, and other factors really are on US manufacturing competitiveness? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest

|