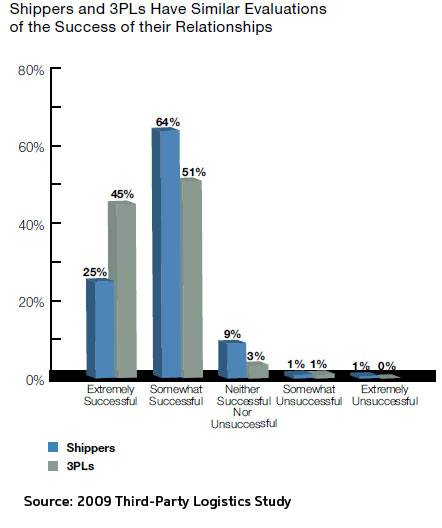

When it comes to views of how well the relationships work, the survey offers a “glass half full/half empty” set of data, depending on your perspective.

As shown in the figure below, 25% of shippers and 45% of 3PLs view their outsourcing relationships as “extremely successful” – a notable gap. That is reverse in the view of “somewhat successful” relationships, as reported by 64% of shipper respondents and 51% of 3PLs. This data has stayed relatively flat for several years, and whether those are good numbers or not depend on your view of the meaning of “somewhat successful.”

Economy Causes an Inflection Point in Thinking about Outsourcing?

Year after year, the study finds the intention of shippers to increase their use of 3PL services and to get more strategic with some of their outsourcing partners, but it generally fails to materialize, for a variety of reasons.

The report says it is possible, however, that the long and hard economic downturn might actually spur some of these changes this time.

For example, many companies would like to further move their supply chain cost structures to reduce the amount of fixed costs and increase the percent of variable costs, which an outsourcing strategy might help them to do. Nearly 60% of shipper respondents said that converting fixed to variable costs tend to increase their use of 3PLs.

“There is a greater sense of urgency around the whole outsourcing thing, leveraging 3PL assets to shed fixed cost and create flexibility,” said Susie Uramoto, VP, Fulfillment Operations at Foster’s Wine Estates Americas.

The reality is that many companies are being driven by necessity or opportunity in this recession to rethink supply chain networks – and combined with the desire for agility and lower fixed costs, this may drive more use of outsourcing.

For example, nearly 60% of shipper respondents feel this is the time in which to re-evaluate their relationships with their 3PLs and possibly drive these relationships deeper. Another 66% of shipper respondents believe they will need to team with 3PLs to reengineer business processes.

Will all this lead to more strategic relationships, and eventually more 3PLs serving as “supply chain orchestrators” for their clients, which the report positions as being more advanced than even the lead logistics provider or “4PL” concept? It is too early to tell yet, but an important strategic question.

Our bet here is that the level of outsourcing will increase in an attempt to reduce fixed costs, but that the relationships will remain largely transactional in nature.

What is your take on these highlights from the 2009 3PL report? Are you surprised that the basic data has little changed for a number of years? Will the level of strategic relationships even increase? Let us know your thought at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest |