SCDigest

Editorial Staff

| SCDigest Says: |

Many financially troubled carriers for now have not been forced into bankruptcy by their lenders, in part, because of the low current sell-off value of the assets that secured the loans (trucks and terminals). Many financially troubled carriers for now have not been forced into bankruptcy by their lenders, in part, because of the low current sell-off value of the assets that secured the loans (trucks and terminals).

Click Here to See Reader Feedback

|

It’s an interesting contest – will truckload and LTL carriers be able to shed capacity more rapidly than shipper demand has fallen?

Although there are actually many hopeful signs for the economy starting to emerge, right now these are some of the worse times ever for carriers. A freight recession that really started for the industry in at least 2007 and maybe even a bit earlier, combined with the overall economic downturn to create incredibly tough times for carriers in virtually all modes. (Though, we note recently rising stock prices for the carriers may be a leading indicator of recovery, as it usually is.)

The American Truck Associations’ monthly truck index dropped 12.2% in March compared with a year ago, falling to the lowest level since March 2002, just one of many data points illustrating the industry’s challenges.

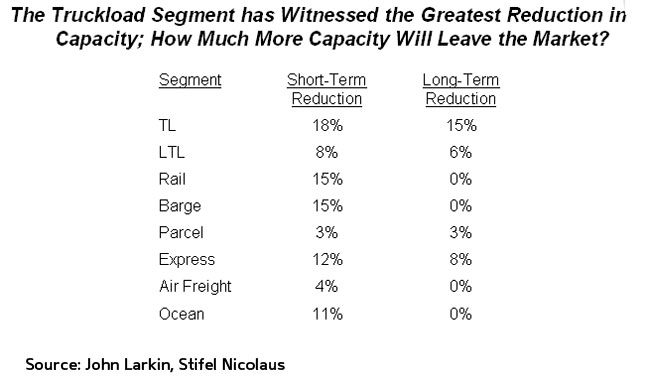

But, while demand for freight carriage has been decimated, there has been a corresponding loss in truck carrier capacity – though not quite as steep as demand has fallen. As a result, the supply-demand situation is still strongly in the shippers’ favor.

In the truckload and LTL sectors, the capacity reduction is coming from two fronts.

First, many carriers and independents are going bankrupt or otherwise leaving the market. Second, surviving carriers are cutting back drastically on their assets.

Jon Langenfeld, a transportation industry analyst at Robert W. Baird, said it looked like only 70-75,000 class 8 trucks would be procured by US carriers this year – versus a normal expected need for 220-230,000 as pure “replacement” units. The difference is lost capacity.

(Transportation Management Article - Continued Below)

|