SCDigest

Editorial Staff

| SCDigest Says: |

In just two years, "We could see much higher prices than we saw three months ago, if the investments are not going through," said Fatih Birol, the IEA's chief economist. In just two years, "We could see much higher prices than we saw three months ago, if the investments are not going through," said Fatih Birol, the IEA's chief economist.

Click Here to See Reader Feedback

|

What a difference just a few months make.

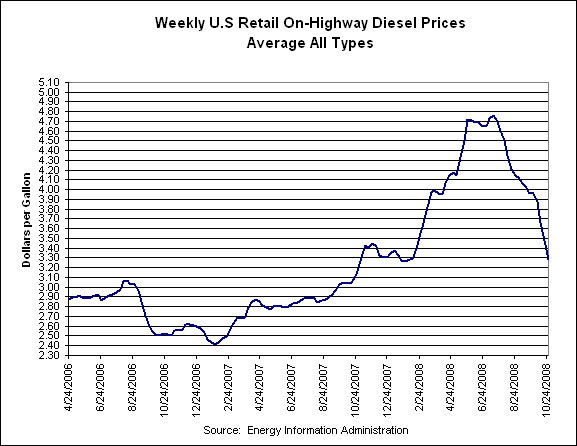

From record high diesel prices in July, topping out at almost $5.00 per gallon in the US, prices have plummeted along with falling oil prices, to levels now not much above $3.00 per gallon (though in percentage terms, diesel prices have not fallen quite as much as regular gas prices yet). (See illustration below.)

The dramatic drop is something of a windfall for shippers, as direct costs for companies that operate their own fleets and rapidly shrinking fuel surcharges from carriers, for now at least, are producing relief for long stressed logistics budgets.

Nonetheless, shippers shouldn’t get too complacent. While prices could fall further, many think we are near the bottom. At these levels, diesel prices are about where they were in late 2007, when there was much concern with rising fuel costs.

The precipitous drop in oil prices also may be sowing the seeds of its own reversal, as development projects that looked to be good investments would now produce negative returns. Meanwhile, while global economic growth and demand for oil has definitely slowed, China’s economic growth is still robust, with recent estimates, while reduced, for approximately 9% year-over-year expansion.

Continued increases in overall global demand combined with shuttered development projects could lead to skyrocketing oil price increases in the short to medium term.

Speaking this week at an oil-industry conference in London, Mohamed Bin Dhaen Al Hamli, the United Arab Emirates' energy minister, said that "Low oil prices are very dangerous for the world economy. We need an adequate and reasonable oil price that will continue to stimulate investment." He added that with prices now in the toilet, "a lot of projects that are in the pipeline are going to be reassessed."

(Transportation Management Article - Continued Below)

|