| |

SCDigest Editorial Staff

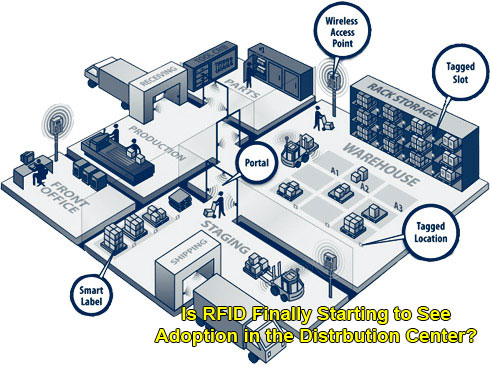

As we’ve noted in the past, an important and, in some sense, glaring hole in the path towards RFID-enablement of the supply chain has been the extreme lack of RFID-enablement of distribution facilities and processes.

| Holste Says: |

The most basic barrier, of course, are questions about whether there is any real ROI at today’s price and performance curve for RFID, especially for companies that already have bar code-based systems in place. The most basic barrier, of course, are questions about whether there is any real ROI at today’s price and performance curve for RFID, especially for companies that already have bar code-based systems in place.

Click Here to See Reader Feedback |

In the US, after International Paper announced in 2002 its RFID-based distribution center in Texarkana, it was hard to find news regarding any other such facility in the US for several years.

Recently, however, we are starting to see announcements of deployment of RFID-enabled DCs in the US and especially Europe, some of which we summarize below.

Why there has been so little RF deployment activity in distribution, outside “slap and ship” applications to meet compliance requirements? There are a number of factors.

The most basic barrier, of course, are questions about whether there is any real ROI at today’s price and performance curve for RFID, especially for companies that already have bar code-based systems in place. Because the impact of any compliance programs that would force companies to tag goods for customers has been minimal, companies considering RFID for DC applications must do so with a stand-alone cost justification – meaning there hasn’t been any “free ride” from pallets and cartons coming into the DC already tagged to meet customer requirements. So far, few companies have apparently been able to find that ROI.

In other cases, companies may simply have never performed a detailed analysis of the potential for ROI in the DC, especially if they have facilities that are working well with bar code systems. SCDigest recently spoke with one distribution manager in the over-the-counter area of a major pharmaceutical company who said, “We simply haven’t had the bandwidth to really perform a detailed analysis on whether RFID would pay us back or not.” Many other companies fall into this category.

Lack of Software Support

Another key barrier has been the lack of RFID support in Warehouse Management Systems. As SCDigest has noted previously, it is not that most advanced WMS packages do not provide at least moderate RFID support today, it is that the versions of the WMS most companies have installed do not offer that RFID support (See What are the Options for RFID-enabling your Warehouse Management System?).

That means companies must go through an expensive upgrade process to get to the most recent version of the WMS that supports RFID. Those companies with older, legacy WMS systems of one kind or another must go back in and make extensive and probably expensive modifications to achieve RFID-enablement.

(Distribution and Materials Handling Article - Continued Below)

|

|

| |

Increasing Number of RFID DCs

Nevertheless, the market has recently seen several announcements of distribution centers using RFID instead of, or in conjunction with, bar codes. That includes: Nevertheless, the market has recently seen several announcements of distribution centers using RFID instead of, or in conjunction with, bar codes. That includes:

Bayer Material Science, a maker of plastics and polymers, said this summer that it is using RFID to track movement in the DC of a portion of its products, those it calls “high-value assets,” primarily in conjunction with an automated storage and retrieval system for unit loads. However, Bayer said it expects to eventually expand the system to “address common processes such as weigh scales and other areas of operations that are inherently prone to human error and latency.”

Drug retailer Walgreen’s recently announced it has had integrated RFID with its shipping, warehouse management and material handling operations at its Anderson, South Carolina distribution center. This is a substantial system deployment that includes 45 dock doors with integrated RFID readers that track more than 170,000 shipping totes and other reusable assets. It is not clear if the DC also handles traditional cartons that do not go into re-usable totes and would therefore not be tagged, at least currently. Regardless, the Anderson DC, which has been running with RFID since last year, is said by the company to be its most advanced distribution facility, which it said it expects to be 20% productive than its previous generation of facilities.

Among the RFID-based capabilities are applications to verify that shipping totes contains the correct items for the order, that all totes required for the order are present, and that totes are loaded onto the truck in the proper order.

Interestingly, 40% of the associates at the Walgreen’s DC have autism or other disabilities. The system was designed in part to make the job easier for those workers, but ultimately RFID-enablement turned out to be the smart decision regardless, says Randy Lewis, Walgreens' senior vice president of distribution and logistics.

DHL also recently announced it would be running an RFID-based DC for European retailer Metro stores, generally considered the global leader in RFID deployment.

Under the program, DHL will tag food pallets at its distribution centers, read them as the pallets are loaded onto delivery trucks, and transmit the shipment data to Metro Cash & Carry stores. The pallets will be read again when they are received at the retail stores, and the tag read data will be compared to the previously-sent order and shipment information to verify delivery accuracy.

Metro had previously announced RFID tagging of pallets for use in shipping verification and store receipts at other DCs in its network.

Finally, Swiss retailer Manor announced recently that it is deploying RFID systems to track cases at two distribution centers and some of its stores and will soon expand RFID processes to all 82 of its retail locations.

The tags are again applied to re-usable shipping containers and used to verify that outbound shipments contain the right cases, automatically record cases when they are received at retail stores, and reconcile shipments with orders. The containers and tags are re-used, making the effective cost of the tags very low.

Many categories of products are shipped in tagged containers, but not all. Manor is not tagging food or apparel items but may include them in the RFID-based process later, according to the company.

What Do Early RFID Deployments in the DC Tell Us?

Some patterns clearly emerge even from this limited data set:

- There is a focus on re-usable containers, so that the effective cost of the tags is very low (Walgreen’s, Manor), and/or pallets, where the tag costs are still moderate versus the value of the item being tracked (Bayer, Metro).

- Retailers are taking the lead, driven largely by the ability to automate and improve store receipts (Walgreen’s, Manor, Metro).

- RFID shows promise in use with material handling automation systems (Bayer, Walgreen’s).

- The focus is also on shipping and loading process, rather than more upstream DC tasks, such as receiving, storage, picking, etc. (Bayer is an exception).

What’s your take on the status of RFID-enablement of the DC? Do you finally see any trend towards increased adoption? Has your company looked at the ROI? Let us know your thoughts at the Feedback button below.

|

|