The National Association of Manufacturers has co-sponsored a study to examine the impact on business and consumers were the Bill, as written, to become law. As the report notes, “Greenhouse gas reduction policies need to include consideration of impacts on energy security, economic growth, and U.S. competitiveness.”

The study was conducted for NAM by Science Applications International Corporation (SAIC), a respected consulting firm. The full report is available at the NAM web site: Analysis of The Lieberman-Warner Climate Security Act.

Congress and the U.S. Energy Information Administration (EIA) will model the expected impacts of this legislation. But, as with all such estimates, the assumptions going into the model are really what drive the final results and conclusions. One set of assumptions predicts a lower level of impact on consumers (e.g., energy and other prices) and business, while a different set of assumptions generates predictions of a more substantial impact.

The EIA itself is certainly aware of this issue, writing recently that “Sensitivity analyses suggest that the economic impacts can change significantly under alternative assumptions regarding costs and availability of new technologies. In addition, the cost and availability of offsets outside of the energy sector, both domestically and internationally, is a significant area of uncertainty.”

The NAM report says that “Providing NEMS results using alternative sets of assumptions is the centerpiece - - indeed the purpose - - of this study. Applying alternative input assumptions - - different from those EIA will likely use in its analysis of S.2191 - - in the model used by EIA and relied on by Congress provides insights on implications of a range of possible outcomes that may occur as the economy adjusts to mandatory carbon constraints under provisions of S.2191.”

NAM believes it is far from certain that emissions reduction technologies, new energy sources and market mechanisms (carbon offsets) anticipated for achieving greenhouse gas (GHG) emission reductions will be fully available by the period analyzed (2012-2030).

The study then looks at the impact that would result from these assumptions behind the Bill not being achieved as the sponsors expect.

The NAM report takes a different set of assumptions in the form of various ranges along what it views as likely technology and related developments – a view that is less optimistic than that of the IEA or the Bill sponsors. From those different assumptions, NAM derives Low Cost and High Cost scenarios (based on ranges of expected technology progress) on the impact to various groups (consumers and business) and geographies (national and each state).

Study Findings

The topic is actually quite complicated and, in the end, rests significantly on how the market for so-called Carbon Offsets develops. These, in effect, enable a business to “buy” credits if it can’t or chooses not to meet emissions limits. Those companies that can exceed limits are then able to sell the offsets. If it is more difficult than expected to meet the standards, than the price of the offsets goes up, making it more expensive for businesses to operate. Much of those increased costs to business would be passed on to consumers.

The NAM report predicts the following economic impact from its model, using a more conservative set of assumptions relative to technology and market developments in the environmental sector:

- The CO2 emissions allowance price needed to reduce energy use to meet the S.2191 targets is estimated at $55 to $64/metric ton CO2 in 2020, rising to between $227 to $271/metric ton CO2 in 2030.

- The cost of the allowances raises energy prices for residential consumers by:

- Natural gas: 26% to 36% in 2020, and 108% to 146% in 2030;

- Electricity: 28% to 33% in 2020, and 101% to 129% in 2030.

- These and other increased energy costs slow the economy by $151 billion to $210 billion in 2020, and $631 billion to $669 billion in 2030 (in 2007 dollars). This, in turn, leads to job losses of between 1.2 million to 1.8 million in 2020, and 3 million to 4 million by 2030.

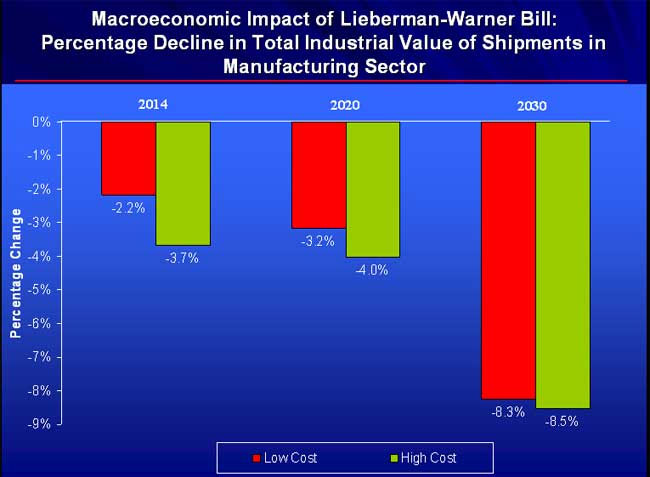

- Manufacturing slows, the value of shipments falls by 3.2 % to 4% in 2020 under the low and high cost cases; by 2030, the value of shipments fall by 8.3 % to 8.5% under the two cases. The higher energy costs, lower economic activity and fewer jobs, in turn, lowers average household income by $739 to $2,927 in 2020, and between $4,022 and $6,752 in 2030 (in 2007 dollars).

- In 2020, job loss is projected to range from 1.2 million (Low Cost case) to 1.8 million (High Cost case) jobs/year, and from 3 million jobs (Low Cost case) to 4 million jobs in 2030.

A chart highlighting the expected impact on the manufacturing sector is shown below.

Of course, many dispute the NAM study’s assumptions. Others, including some important business leaders, believe Green technologies might instead foster whole new industries that will lead to economic and job growth.

Who’s right? Who knows? The one thing that is clear is that this Bill is likely to have a huge impact on business and the economy either way, and companies need to get fully up to speed to understand the merits and how it may impact their futures.

What’s your take on the NAM study? Do you believe a Bill like this would have a serious negative impact on business and consumers? Is the environmental impact worth the cost? Let us know your thoughts at the Feedback button below.

|