(Global Supply Chain and Logistics Article - Continued)

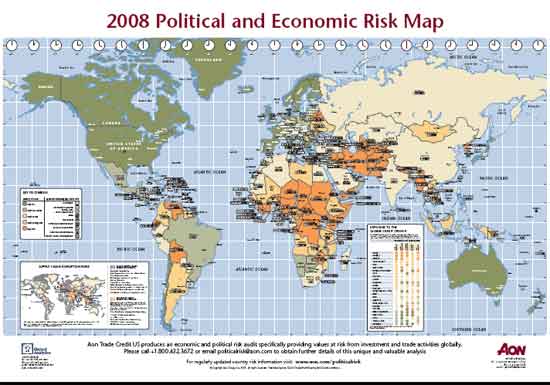

According to Bryan Squibb, managing director of Aon Trade Credit Global, “The global risk management community is increasingly concerned about supply chain risks in Asia.” Factors such as potential political conflict in China, the still looming threat of an avian flu outbreak, and potential actions by Western governments that could limit imports from China as a result of perceived product quality issues in Chinese manufactured goods are among the factors leading to greater concern about Asian supply chain links.

Oil in Unstable Hands

The analysis also noted the rising risks in terms of the world’s oil supply, which creates political, economic and supply chain risks.

“Most of the world's oil reserves are held by government-controlled oil companies,” Aon notes. “As the global demand for oil continues to grow in 2008, most of the demand will continue to be met by state-owned companies in nations with elevated levels of political and economic risk.”

The 25 countries out of the top 50 economies that have elevated risk, according to the study, are as follows:

Economy Size Rank |

Country |

Risk Level |

4 |

China |

Medium |

10 |

Brazil |

Medium-Low |

12 |

India |

Medium |

13 |

South Korea |

Medium-Low |

14 |

Mexico |

Medium |

17 |

Turkey |

Medium |

21 |

Indonesia |

Medium-High |

22 |

Poland |

Medium-Low |

25 |

Saudi Arabia |

Medium-High |

27 |

South Africa |

Medium |

33 |

Thailand |

Medium |

36 |

Venezuela |

High |

37 |

Malaysia |

Medium-Low |

40 |

Colombia |

Medium-High |

42 |

United Arab Emirates |

Medium-Low |

29 |

Iran |

High |

31 |

Argentina |

Medium-High |

43 |

Pakistan |

High |

44 |

Israel |

Medium-Low |

45 |

Romania |

Medium-Low |

46 |

Philippines |

Medium |

47 |

Algeria |

Medium |

48 |

Nigeria |

High |

50 |

Egypt |

Medium |

"I have noted a significant increase in the number of CEOs, CFOs and chief risk officers who are seeking a greater understanding of how their businesses are at risk in an increasingly complex global environment versus their primary risk concerns 10 years ago," Squibb added.

Are supply chain risks really increasing – or just awareness of them? Are high-level analyses like this a useful starting point for assessing risk levels? Let us know your thoughts at the Feedback button below. |