The Story: The report (National Rail Freight Infrastructure Capacity and Investment Study) provides an in-depth look at rail traffic, projections and infrastructure requirements for US freight railways. While commissioned by the Association of American Railroads, the report provides a balanced and informed look at the many issues surrounding infrastructure requirements.

While it’s probably not surprising news, the report’s overall message is concisely stated in the executive summary: “The findings point clearly to the need for more investment in rail freight infrastructure and a national strategy that supports rail capacity expansion and investment.”

The key question, of course, is where the money needed for expansion will come from. The report notes that the projected $148 billion in investments needed through 2035 is only to roughly maintain current service levels. If the country desires further utilization of the rails to get more truck traffic off the highways, the investment levels would need to increase still further.

One problem is that the railroads have historically had among the lowest levels of return on invested capital of any industry in the US. As a result, investment in rail infrastructure has naturally been extremely conservative.

That picture has brightened a bit in recent years, as rising rail freight rates have improved rail carrier profitability. In 2007, it is estimated that the rail carriers will collectively invest $1.9 billion for capacity expansion, up from $1.1 billion in 2005.

However, the rail carriers have institutional memory about historical returns on investment, and a variety of market or regulatory forces could easily send the returns on capital investment back to earlier levels – or even lower. Infrastructure investment would slow as a result.

Key findings of the report include:

- The demand for rail cargo movement (tonnage) will approximately double by 2035.

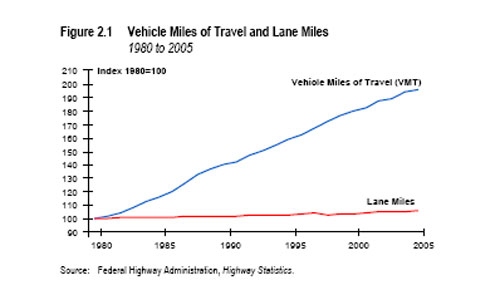

- Recent, import-driven demand for rail carriage has largely soaked up excess capacity in the system over the last few years.

- Any increase in rail passenger traffic, which largely operates over freight rail lines, would increase the level of investment required.

- The gap between the infrastructure investment required and the rail carriers’ ability to fund that investment comes out to about $1.4 billion per year. This gap will have to be bridged through “railroad investment tax incentives, public-private partnerships, or other sources.”

- The $148 billion estimate is for build-out of rail line infrastructure only. It does not include the costs to operate and maintain new lines, new terminal facilities and operating costs to manage the higher traffic, additional rail cars, etc. In our view, this means the actual ability of the carriers to make the projected investments is perhaps overstated.

Rail Productivity Improvements Can Help

The report notes that carriers estimate they might be able to increase freight productivity by .5% per year through 2035. In other words, some of the increased demand will be met by being able to move more freight each year over existing capacity.

This can be achieved by increasing the number of trains, hauling more cars per train, and loading railcars more efficiently to make better use of the 286,000-pound capacity of current railcars. These improvements would allow the railroads to carry the same amount of rail freight in 2035, but carry it with fewer trains.

If a .5% productivity gain per year can be achieved, it would have an important impact on infrastructure requirements, reducing the projected investment needs from $148 billion to $121 billion and, as a result, reducing the gap between the carriers’ ability to fund the investment and the total needs.

But to put the requirements in context, even at the historically aggressive investment by the rail carriers of $1.9 billion in 2007, the report suggests the combined required investment will be about $4.8 billion per year through 2035.

While revenue growth and productivity gains can meet much of the gap, it’s unlikely to cover all of it, the report says.

“Additional work is needed to determine how much more capacity and investment would be needed for the railroads to increase their share of freight tonnage and reduce the rate of growth in truck traffic on highways,” the report also notes. “Finally, the forecasts and improvement estimates in this study do not fully anticipate future changes in markets, technology, regulation, and the business plans of shippers and carriers. Each could significantly reshape freight transportation demand, freight flow patterns, and railroad productivity, and, thus, rail freight infrastructure investment needs.”

What is your perspective on the state and future of rail infrastructure? Does anything in the report surprise you? What is the best approach to meeting these rail capacity needs? Let us know your thoughts at the Feedback button below. |