| |

|

|

| |

|

|

| |

|

|

| |

Transportation Management Focus : Our Weekly Feature Article on Transportation Management Strategies, Bet Practices and Technologies for the Transportation and Logistics Practioner Transportation Management Focus : Our Weekly Feature Article on Transportation Management Strategies, Bet Practices and Technologies for the Transportation and Logistics Practioner |

|

| |

|

|

| |

|

|

|

| |

Expectations for Carrier Rate Hikes Continue to be Modest; Growing Diversion of Rail Movement to Truck? |

|

| |

SCDigest

Editorial Staff

| SCDigest Says: |

In lanes where there is direct competition, the respondents report truckload moves are about 13% more expensive than rail costs; however, at some level of difference, the service advantages of truck movement outweigh the cost delta. In lanes where there is direct competition, the respondents report truckload moves are about 13% more expensive than rail costs; however, at some level of difference, the service advantages of truck movement outweigh the cost delta.

What do you say? Send

us your comments here |

One of our favorite stories at SCDigest is reporting on the quarterly “Shipper’s Report” from Ed Wolfe and the researchers at investment bank Bear Stearns. The Q3 2007 report is out, featuring input from several hundred shippers, and as always the results are worth noting.

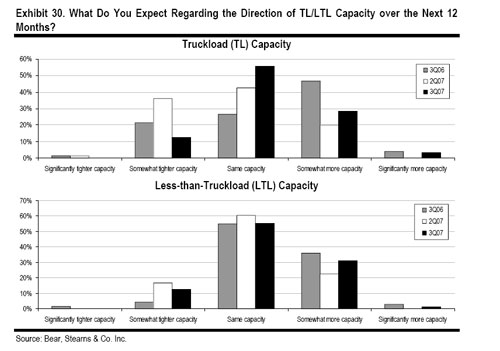

In general, the data shows shipper perceptions that the balance of power in the supply-demand equation continued to tilt towards shippers, which in the end drives lower freight rates. Perceptions of “overcapacity” in the truckload and LTL markets remain at record levels, and expectations for rate increases for 2008 continue to be modest.

The full report is available from the Bear Stearns web site: Bear Stearns Q3 2007 Shippers Report. Highlights are summarized below:

- Total Transportation Spend Growth Modest: Companies are expecting total transportations spend to increase a modest 3.2% for 2007, including fuel surcharges. Given that diesel fuel costs have increased 25% in the year, this implies that either base rates are flat or shipper volumes have decreased.

- Shippers See Overcapacity in Carrier Market: 81% of respondents believed there was overcapacity in the truckload market during the third quarter, versus just 56% in Q3 of 2006. This number is at the highest level in the history of the survey, which began 7 or 8 years ago. Perceptions in the LTL market were almost as strong, with 75% seeing overcapacity among less than truckload carriers.

|

|

| |

|

CATEGORY SPONSOR: SOFTEON |

| |

| |

|

|

|

|

| |

- TL Rates Expected to be Flat: On average, shippers expect truckload rate increases of just .6% in 2008, before fuel surcharges. Compare this with expectations for increases of 4.1% in Q3 of 2005.

- Accelerated Diversion of Rail to Truck: Given the pricing dynamics of each market at this time, it may be no surprise that shippers shifted a lot of freight from rail to truck. Respondents in Q3 said they had shifted on average 9.6% of their freight from rail, up from a 6.2% shift in Q2 and just 3.6% in Q3 2006. Pricing was cited as the number one reason for the modal shift, which is different from many prior periods in which poor rail service was cited as the main factor in diversion, as rail is usually cheaper than truckload.

- The Cost Difference: In lanes where there is direct competition, the respondents report truckload moves are about 13% more expensive than rail costs; however, at some level of difference, the service advantages of truck movement outweigh the cost delta. As rail rates increase and TL rates stay flat, that inflection point may be reached for other shippers.

- Rail Rates Ease: There were some expectations – perhaps driven in the end by overcapacity in the TL market – for rail rate increases to slow. Expectations for rail shippers in Q3 were for a 3.5% hike in rail costs, down from 3.9% expectations in Q2 and 4.2% in Q3 of 2006. However, Bear Stearns said it still expects “sustained momentum in rail rates increases throughout 2007 and 2008, driven by on-going tight rail capacity and expectations for continued long-term rail demand.”

- Concern about LTL Union Negotiations: With the LTL contract with the Teamsters union due to expire in March 2008, 12% of survey respondents said they have already moved some freight away from union to non-union carriers, and another 32% said they plan to do so if it appears a strike is likely.

- Ocean Rates also Flat: Expectations were for flat or slightly dropping ocean container shipper rates for 2008.

Anything in the Bear Stearns report numbers surprise you? Do you expect LT carrier rate increases to be flat for 2008? Let us know your thoughts at the Feedback button below. |

|

| |

|

|

|

|

|

| |

|

|

| |

|

|