On the other hand, recent research performed by the Retail Systems Alert Group found that retailers which outperform their peers in year-over-year comparable store sales tend to carry a significantly higher percentage of private label merchandise than their competitors. Individual retailers such as Kroger’s and Wegman’s, have in fact been expanding their private label areas strongly. In 2006, one consumable durables manufacturer told SCDigest it was tremendously pressured by the in-house brands of big box home improvement retailers (See Supply Chain Management 2006 -- a Case Study.)

Regardless, everyone seems to agree retailers and other distribution channels remain very interested in private label strategies. The report notes that “In interviews, many retailers claim that private label is one of their top strategic priorities; several suggest that they plan to double their private label share in the next 10 years.”

Perhaps a sign of things to come in the US, private label market share has reach about 30% in Canada and many European markets.

The impact of accelerated growth in private label sales versus continued flat growth can be as high as $55 billion dollars over the next 10 years. With this level of revenue and profit at stake, private label issues will be at the top of the agenda for both retailers and manufacturers.

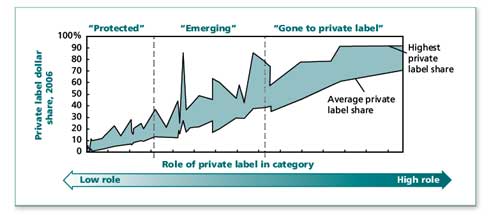

The chart below from the report, for example, is very interesting. It shows that in different product categories, ranging from those with little private labeling (“Protected”) to those which have gone significantly private label, there are significant differences between level of private label market share for an average retailer by different product categories versus the private label market share of the most successful retailers in the category. If average retailers can close the gap between average and leading percentages, branded products would lose billions in sales per year.

The Private Brand Potential – or Threat

Source: Competing in the New World of Brands – The Next Wave of Private Label (McKinsey and GMA/FPA)

Advise for Manufacturers

Naturally, a report from GMS/FPA is concerned with the challenges of CPG manufacturers, not with other types of manufactured goods or certainly the strategies of retailers to maximize private label sales.

With that caveat, it offers some insightful recommendations for CPG companies, while recognizing that the starting point of a company or brand is a key part of the puzzle. For example the number 1 or number 2 brands in a category will need to approach the challenge differently than third or fourth level brands. A given retailer’s own level of aggressiveness with regards to private label is also a key factor.

McKinsey said manufacturers will need the following set of core capabilities regardless of position:

- Develop deep consumer and shopper insights that can lead to overall category growth – a rising tide lifts all boats.

- Increase the pace and quality of technologically- and commercially-driven innovation to differentiate brands and create category value: staying ahead of the private label curve.

- Build stronger in-store marketing and merchandising capabilities to connect with consumers at the point of sale: in-store promotion and consumer experience will play an increasingly critical role in sales success.

- Redefine brand differentiation in context of biggest retailers building stronger cross-category/umbrella brands: Manufacturers may need to add private label offerings to their branded products.

- Actively develop differentiated solutions to meet different retailers’ needs: Customer intimacy and supply chain segmentation to meet the needs and strategies of different retailers, perhaps tailoring products to different chains, will be key.

Supply Chain Implications

There are a number of supply chain implications in the private label issue and the report’s recommendations.

Maintaining a low cost position will certainly be critical, both to mitigate the private label price advantage and also to compete for private label business.

Supply chain innovation will also be important. Manufacturers that can lower total supply chain costs for retailers, reducing inventories while providing exceptional shelf-level in-stock positions, can make their branded products more profitable for the retailer and category manager than private label alternatives.

Supply chain support in delivering innovation will also be key. Manufacturers that can deliver new products with less total cycle time will have a strong competitive advantage.

The report ends on an optimistic note, looking for a “win-win” between retailers and manufacturers on this issue. We’re not as hopeful – this may become an increasing war, with clear winners and losers, and those companies that drive innovation and differentiated sales and supply chain strategies by segment and retailer will stand the best chance of victory.

How big is the threat to consumer goods manufacturers from private label goods? Why do you think private label growth has been flat, despite the retail focus? Is that likely to change? How can supply chain help manufacturers? Let us know your thoughts at the Feedback button below.

|