Baseline magazine, in a recent cover story that analyzes Wal-Mart’s RFID strategy and results, notes that Lora Cecere of AMR Research says AMR had once predicted RFID would achieve widespread adoption by 2008.

“Now her firm predicts the industry will probably need another five years of conducting pilots to determine how best to deploy the technology,” the article says.

Wal-Mart, in fact, has announced a series of new pilots as it “refocuses” its RFID program. (See Wal-Mart is Changing Its RFID Tune, Launching a New Set of Pilots.)"

There was a lot of hype when Wal-Mart unveiled its plans," Cecere also told Baseline. "Now that the dust has settled, it's clear that Wal-Mart has not been able to produce on its original value proposition."

"We haven't lost faith in the potential of the technology," says Simon Langford, head of Wal-Mart's RFID initiative. "But we have had to change our strategy to provide more benefits to our suppliers."

Chicken and Egg – Tag Prices

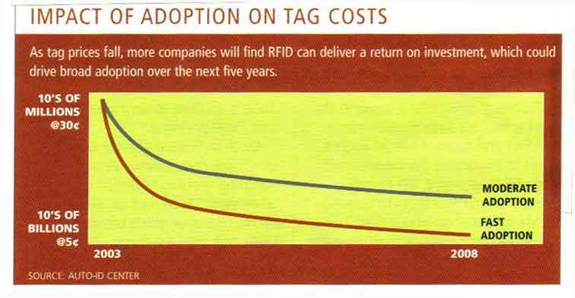

All along, the premise was that rapidly increasing EPC-based tag volumes would drive down tag (and reader) prices, spurring still greater adoption of RFID in a “virtuous cycle.”

As shown in the figure nearby, nearly five years ago the Auto ID Center at MIT generated some estimates related to potential tag price scenarios and how they would impact user adoption.

Clearly, the top curve, representing a more moderate level of EPC adoption and relatively higher tag prices than the more optimistic predictions for the “5 cent tag,” has been the scenario that has played out.

Should Wal-Mart Stop the PR Offensive?

“I don’t understand why Wal-Mart doesn’t keep its RFID plans and timings more to itself,” said SCDigest editor Dan Gilmore. “It has many initiatives going on even just to address inventory levels, such as the ReMix program, which is expanding, and the Inventory DeLoad effort. It doesn’t have to please anyone but itself in the end. If it just did this all in a more private way, it wouldn’t be set up for all the criticism when it doesn’t meet unrealistic schedules.”

The history of every one of these types initiatives, from bar coding to EDI, to more recent programs like Collaborative Planning, Forecasting and Replenishment (CPRF) is that they take 2-3 times longer to develop than everyone initially estimates, Gilmore added.

Best Buy, for example, recognizes the long process that will be required to really leveraging RFID. Again, from the Baseline article, the electronic retailer’s RFID program director, Paul Freeman, says they have been pleased with the results of pilots conducted to date, but that Best Buy plans to conduct more pilots and is still a long way from full-scale implementation.

"In the next 18 months I think we're going to see big gains in cost and quality," Freedman told Baseline. "But no matter what, it's realistically going to take about five years to get real business integration." The integration of RFID data with the retailer’s business applications needed to drive real value will take a number of years, after the insight and opportunities are first developed via the pilots. |