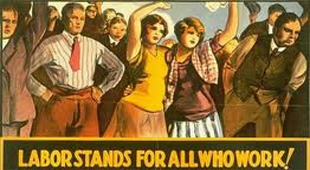

Monday marks the annual Labor Day holiday both here and in Canada. Starting in 2011 I decided to do a column on the state of the labor supply chain in conjunction with this event. It was popular enough that I have continued on each year since.

According to Wikipedia, Labor Day was "first nationally recognized in 1894 to placate unionists following the Pullman Strike [a major event in US labor history in which a number of striking workers were killed and much US rail traffic brought to a halt]. With the decline in union membership, the holiday is generally viewed as a time for barbeques and the end of summer vacations."

Gilmore Says: |

While those two events and overall trends continues to go against labor, that doesn't tell the whole story of the past year by any means. While those two events and overall trends continues to go against labor, that doesn't tell the whole story of the past year by any means.

Click Here to See

Reader Feedback |

That description of the state of US labor is an interesting one, and largely true based on the data. Yet, as weak as the labor movement has seemingly become in the last few years, there are without question some counter trends.

I will also say that the last 12 months have been one of the most meaningful such periods for the labor movement, both positive and negative, in quite some time. Let's look at some basic data, most from the US Bureau of Labor Statistics.

The percent of total US workers that are union members was down 0.2 percent point in 2014, to 11.1%. Unionization in the private sector was down just a tick to 6.6%, after having risen slightly for the first time in memory in 2013, albeit just 0.2 percentage point. But the long-term trend is one of steady decline since the Labor Department started reporting it in 1982, when overall unionization was at 20.1% and 16.8% in the private sector, with those numbers themselves well down from previous decades.

It's clear the last strongholds of unions in the US is in local police and fire and teachers, with about 42% of local government employees in unions, mostly those in those three occupations. After a surprise small jump in the percent of manufacturing workers that are unionized in 2013, to 11%, that number took a rather large drop of 0.5 percentage point in 2014 to just 10.5%, continuing the long terms trend.

Think about that - just one in 10 manufacturing workers are unionized today, versus 17.5% in 1994 and, according to uniopnstats.com, 38% of private sector manufacturing workers in 1973. Wow.

Don't think this downward union trend is only a US phenomenon. Unionization rates in labor-loving Sweden, for example, have fallen from about 90% in the mid-1990s to more like 70% today. Many other countries mirror more closely the US. Union rates in France - generally considered very supportive of labor - almost exactly follow the US patterns, and are actually just below the US in the percent of all workers unionized. Union membership is higher in the UK, at about 25%, but that's down from more like 40% in the mid-1990s.

In July, there were about 8.7 million non-supervisory manufacturing workers in the US. That's up from the bottom of the recession, when we fell to about 8 million shop floor workers, meaning we've added about 700,000 manufacturing jobs since then. But in 2004, just a decade ago, there were just over 10 million factory floor workers - we're down 1.3 million positions from that level.

That obviously puts downward pressure on wages, as the demand for workers is simply much lower than the supply, though the lack of wage growth isn't nearly as bad as I would have guessed, based on all the media reports.

According to the BLS, the average hourly wage for shop floor manufacturing workers was about $19.95 per hour in July. That's up from the $16.58 or so per hour in July 2005, or a rise of 20.3% over 10 years. So wages have risen modestly, but not enough to keep up with inflation, let alone improve a worker's lifestyle.

Meanwhile, there has been steady growth in warehouse jobs, though they represent just a tiny fraction of manufacturing positions. There are now about 770,000 warehouse jobs in the US, up from some 597,000 in 2004, a rise of 29% - but even with that growth they only represent about 8.9% of manufacturing floor positions. That surprises me, actually, though that percentage continues to slowly tick up. (I'll note many jobs at plant warehouses may be counted as manufacturing jobs.)

In terms of wages, average non-supervisory pay for warehouse workers was $15.48 in June, about 22.5% less than average manufacturing pay.

OK, those are some of the key facts. Now let's look at some of the key events and trends relative to labor over the past year.

There was once again one major symbolic union showdown this year, the attempt to organize Boeing factory workers at its relatively new aircraft plant in South Carolina. In 2014, the major event was a negative vote on unionizing a Volkswagen plant in Tennessee, and in 2013 it was a long strike at a Caterpillar plant in Joliet, IL, which ended with the machinests union basically capitulating to the company's offer. Both events at the time were called "labor's last stand" by some. This year, the major event also went against labor, with the union giving up efforts in April to organize the Boeing plant without a vote.

Also in the negative column for labor, in March Wisconsin became the 25th right to work state, joining Michigan and before that Indiana in recent years, all seen as big losses for labor.

While those two events and overall trends continues to go against labor, that doesn't tell the whole story of the past year by any means.

After very contentious negotiations over many months, a deal was finally reached in late February between West coast ports and the Longshoremen that appeared to give the union almost everything it wanted, including maintenance of its no-cost "Cadlillac" healthcare plan that will cost ports and terminals tens of millions annually. A definite labor win here, as usual.

Next up are contract negotiations between US steel makers and their workers, which appear likely to be contentious, with steel makers hurting from big drops in market prices and union leaders digging in against any notion of givebacks. I expect a strike, with the contract having expired earlier this week.

The momentum to increase the minimum wage that started early in 2013 gained additional traction in the last year, with San Francisco, Los Angeles and other cities joining pioneer Seattle in hiking the minimum to $15.00 in their jurisdictions, though the increases will be phased in. New York is raising the minimum wage in many fast food restaurants to $15 as well.

I think we are far from done with this issue, and the experiments in these cities will be interesting to watch. The new wages are already putting some small businesses out of business. But to the extent that the minimum wage starts to rise much over ten bucks, it may put some upward pressure of wages for say warehouse workers, who after all only average a little over $15 per hour nationally, as noted above.

Along the same lines, Walmart earlier this year announced plans to hike its minimum pay first to $9 per hour and then $10 next year, along with also increasing supervisory pay and giving employees more set hours (which I very much support). Saying it was "the right thing to do," Walmart also cited rising labor costs as key factor in its recent Q2 earnings decline. Will we be seeing another wage at Walmart for 2017? I would bet No, but it's hard to say where this minimum wage thing will really go.

But it was the National Labor Relations Board (NLRB) that gave labor its best reasons for optimism in 2015 and beyond.

First, in late December the NLRB approved new rules for so-called "microwave" union elections.

In great summary, these rules would significantly speed up the time from when the union receives enough support to call for an election to when that vote is held - perhaps in as little as just 10 days. Most feel that gives a major advantages to the union, as it can quickly build off its momentum to call for a vote while giving the company little time to conduct a defense.

I do not believe this change has greatly impacted the labor dynamic yet. Will it? Seems like it could, but maybe the concern by employers is overblown.

Meanwhile, just this month the NLRB ruled that large fast food restaurant companies and firms that outsource some of their business services were "joint employers" of workers actually employed by local franchise owners or third pary service companies. Without going into all the details, the ruling likely would make it easier to organize the entire restaurant chain or group of non-direct employees, even though individual outlets or outsourcing companies are separately owned.

This could be a real Pandora's box, and business needs to keep close tabs on the coming legal actions and activities within their own businesses based on the ruling. Could employees in all the 3PLs a company uses organize together under this rule? It's possible.

Similarly, the NLRB has been pushing hard for various contract workers to be classified as actual employees of a company, subjecting employers to a raft of new costs, such as benefits and unemployment insurance, and opening the door to unionization of the contractors. FedEx is suing the NLRB for its decision that contract drivers for FedEx Home Delivery in Connecticut are in fact employees. This is a huge issue that at its most extreme could make most owner-operators in the US trucking industry employees of a carrier and in many cases unioniized, sending carrier costs (and rates) up significantly.

Finally, the Obama administration proposed in June substantial changes to existing rules on overtime pay, raising the threshold on what salaried employees are entitled to overtime from the existing level of under $23,600 to more than double that (under $50,400).

Does this mean many warehouse/factory supervisors and even managers could be required to receive such overtime pay? Not clear. The rules are now open for comment, and could change, and the interpretation of who qualifies for this staus will be key (administrative or professional employees are exempt, but those definitions must be interpreted.)

So, general trends and several developments (recent results of most major unions standoffs, growth in right to work states) are running against labor, but the regulatory climate and the minimum wage issue are decidedly pro-labor. Which direction the former goes will obviously be tied at the hip to the 2016 election, while we'll just have to see whether $15 minimum wages prove smart or foolish.

Any reaction to our summary of the labor supply chain 2015? Let us know your thoughts at the Feedback button (email) or section (web form) below.

|