For as long as I have been in supply chain, companies have been trying to reduce SKU counts - with carrying degrees of success, but most commonly on the less successful side of the ledger.

One of my favorite supply chain quotes comes from Fred Berkheimer, formerly head of logistics at Unilever NA, who told me about a decade ago that "We're killing slow moving SKUs as fast as we can, but marketing keeps adding new ones back even faster," like the proverbial hydra.

I am sure Fred is not the only one with such an experience. Cut one head off, and two grow back.

Gilmore Says: |

Many of the rest in the Long Tail should continue to be built to order, but (importantly) a broad swath should be "candidates for elimination," Simchi-Levi said, as they are eating away at profitability. Many of the rest in the Long Tail should continue to be built to order, but (importantly) a broad swath should be "candidates for elimination," Simchi-Levi said, as they are eating away at profitability.

Click Here to See

Reader Feedback |

More recently, a term called "the Long Tail," has entered the lexicon. It was coined by Chris Anderson of Wired magazine back in 2004, and had then to do with the potential of e-merchants to do very well selling SKUs that have relatively little demand locally but large enough demand overall to be successful on the web. The "tail" part came from charts plotting SKUs (x-axis) against sales volume (y-axis), with the lowest volume SKUs to the right. For web merchants, there might be large numbers of SKUs with very low volumes, making an expanding tail on the right side of the x-axis. "Selling Less of More" was the title of Anderson's later book.

The problem: Anderson as basically saying that supporting this Long Tail could only make sense on the web. But SKU proliferation, driven by increasingly specific customer demands and related "micro-segmentation" strategies, rages across the supply chain. Walmart, in fact, famously pulled thousands of SKUs from its stores in 2009 to increase supply chain efficiencies. It brought them all back and more, some 8500 in total, in 2011 after the move was in part seen as the cause for slumping store sales. And in fact, coincidence of not, Walmart's performance has improved ever since.

With that, some ideas on the Long Tail from two friends and experts, Dr. David Simchi-Levi, a professor at MIT and chairman of consulting firm OPS Rules, and Joe Shamir, CEO of software provider ToolsGroup, who has been focused on this Long Tail challenge for more than a decade.

Simchi-Levi recently addressed this challenge on a Videocast on our Supply Chain Television Channel (See Videocast: Managing Supply Chain Complexity through Long Tail Analysis).

As always, Simchi-Levi covered a lot of ground, but here I will focus on two of the ideas: (1) you need to use supply chain segmentation techniques to reduce complexity and better manager the Long Tail; and (2) the Long Tail has many hidden costs that make them even more of a financial drain than most companies understand.

On the first point, Simchi-Levi used a real example of a steel company with a two-stage manufacturing process: a furnace operation that produces steel slabs of various types, and then a rolling operation that produces finished products from the slabs. The company operated in a sense on a "make to order" model in both production phases - lead time from the furnace to the rolling operation was 8-9 weeks, while rolling in turn took 3-4 weeks to fulfill end customer orders.

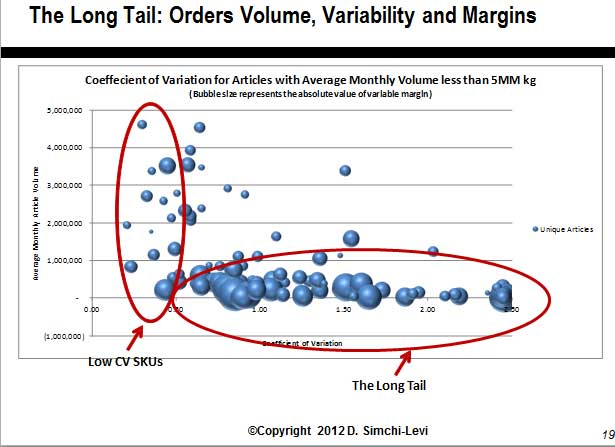

Simchi-Levi has a gift for finding the right way to analyze a given business challenge. Here he simply plotted the demand variability of each of the SKUs produced by the furnace (y-axis) against the sales revenue. As usual, more than the Pareto Principle was in play. Just 9% of the 300-something SKUs accounted for more than 50% of the revenues - and certainly even more of the profit.

So Simchi-Levy recommended a two-level segmentation strategy (I have sometimes seen him use three or four), in which the 19 fast movers with low levels of variability would be built to stock, likely reducing production costs but also enabling the company to improve total competitiveness through faster total lead time.

Many of the rest in the Long Tail should continue to be built to order, but (importantly) a broad swath should be "candidates for elimination," Simchi-Levi said, as they are eating away at profitability.

Some companies don't really measure the profitability of individual products. A growing number of companies use a technique called Gross Margin Return on Inventory (GMROI) that basically calculates the return received from the investment in inventory at a SKU by SKU basis. The results, as I have seen first hand many times, are often eye opening. (More on this soon.)

But even GMROI isn't enough, Simchi-Levi says. The approach is a start, but doesn't nearly capture all the supply chain costs associated with managing the long tail, many of which are "hidden." When you add in total supply chain costs (inventory carrying cost, the costs associated with forecasting and managing these high variability products, engineering effort, etc.), a significant portion of the Long Tail will actually be negative margin products, Simchi-Levi says. Of course, marketing will usually make the argument that the products are needed for other reasons, and maybe they are, but the analysis of the cost must be comprehensive and clear to guide a more informed decision.

The takeaways: (1) dealing with the Long Tail effectively requires supply chain segmentation strategies; and (2) there are better ways to show the true financial impact by detailing the direct and hidden costs of Long Tail SKUs comprehensively.

Joe Shamir agrees with Simchi-Levi that the first place to start is determining whether long tail SKUs can be pruned, but believes in the end that for many companies most of the long tail will remain.

"David is right, companies need for sophisticated tools to better understand and manage the trade-offs" between the cost of carrying slow movers and the impact on sales, customers, and other reasons for keeping many Long Tail SKUs. But in the end, many/most companies will still carry lots of them. And "the only way to manage them effectively," Shamir told me, "is to use optimization."

Shamir adds that the growth in SKU counts has a companion trend, which is that demand is also getting "lumpier," or more inconsistent. He notes for example that for many slow movers, demand in any given period is likely to be zero, especially (and this is important) as the point of demand that is being forecast keeps moving down the supply chain. For instance, in the consumer goods sector that means we are now starting to forecast at the individual store level, not the retailer's upstream DC. Parallel examples are occurring in other sectors.

"So, with lumpy demand, it is really just as much about the frequency of orders as it is the quantity," Shamir says.

He makes a persuasive case that traditional forecast and inventory planning models that dominate the landscape today can't do the job very well in serving the intermittent demand in the Long Tail. Specifically, he says that traditional approaches, which I will characterize as first calculating the forecast with one of the algorithms of the many available, and then using the forecast error to calculate the safety stock that will deliver the desired service level.

But he says, one cannot "serve" the intermitted demand of the tail by producing accurate forecast. "It must be served with adequate inventory," he says. That traditional approach "works OK for fast moving SKUs," but Shamir argues that a fundamentally different approach is needed for slow movers.

That involves modeling demand and inventory stocking requirements using "stochastic" techniques. That may sound like an overly techie term, and I will dive into this subject in more detail soon, but just consider it this way - it's all about probabilities. The forecast and associated inventory requirements needed to meet target service levels shouldn't really be a single number (inaccurate as it usually is), but rather the volatile demand behavior should be modeled statistically, in order to simultaneously provide both the forecast and the information required to calculate the correct inventory to guarantee service.

Shamir says that this probabilistic approach is simply the right way not only to manage uncertainty generally, but especially to address the challenge of modeling both quantity and frequency of demand. He can show you lots of math and real-world examples that support his thesis.

Supply chain segmentation, hidden cost analysis, probabilistic optimization: some weapons to take on the Long Tail.

What are your thoughts on these strategies for managing the Long Tail? Let us know your thoughts at the Feedback button below.

|