SCDigest Editorial Staff

SCDigest Says: |

Many of the carriers expressed concerns that by the end of the quarter, shipper demand was starting to wilt. Werner said, for example, it saw a softening of demand starting in October, especially among smaller companies concerned the nascent economic recovery was losing steam.. Many of the carriers expressed concerns that by the end of the quarter, shipper demand was starting to wilt. Werner said, for example, it saw a softening of demand starting in October, especially among smaller companies concerned the nascent economic recovery was losing steam..

Click Here to See Reader Feedback

|

Financial results for US truckload carriers for the quarter ending in September showed robust profit and revenuegrowth for most, the result largely coming from continued discipline in the industry as freight volumes gradually expand in the lukewarm recovery.

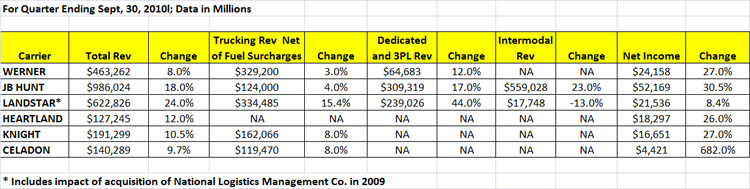

A snapshot of publicly traded carriers showed strong numbers virtually across the board versus the largely dismal quarter for the same period in 2009, when many believe truckload freights actually bottomed - at levels sometimes below the actual cost to operate the vehicles. (See graphic on this page.)

Total revenues for the largest carrier, JB Hunt, were up 18% in the quarter, largely on continued strong performance in its dedicated/3PL services unit (up 17% in revenue) and its intermodal business (up 23%).

Werner saw a similar pattern, with overall revenue growth of 8% despite only a 3% gain in its core trucking business. Growth came from its dedicated transportation unit, which saw growth of 12%. Werner's CEO noted that larger shippers are moving towards dedicated fleets in order to secure capacity.

All told, net profits at the six truckers included in the graphic below were up substantially, including a 682% increase at Celadon Group. Four of the remaining five carriers saw net income grow 25% or more. While net income growth at Landstar was just 8.4% in the quarter, CEO Henry Gerkens said that without some special one-time charges mostly related to the acquisition of National Logistics Management Co., income was up 21% in Q3.

Carriers in general saw solid upticks in such measures as revenue per truck and revenue per freight mile. Revenue per truck was up 14% at Landstar, for example, while Knight Transportation saw 5.0% increase in average revenue per total mile in the third quarter, in conjunction with a 6.7% increase in average length of haul. Given a trucker's high fixed costs, even single digit increases in such metrics can drive double-digit gains to the bottom line.

Capacity Remains Tight

Discipline in holding back capacity increases has been key to the renewed pricing power of carriers, as some shippers are worried about emerging capacity shortages, seen on a rolling regional basis for much of the year.

Source: SCDigest Analysis of Q3 Financial Statements

(Transportation Management Article - Continued Below)

|