That suggests to us that the US job losses were primarily the result either of increased efficiencies/productivity (blue and white collar), or that a significant portion of offshoring was done to non-company owned operations (such as outsourcing electronic product production to China's Foxconn).

Shift of Employment to Fast Growth Countries

Not surprisingly, the report finds that the most rapid growth in foreign affiliate employment has been in the fastest growing economies of the world. Foreign employment in developing Asia increased 66% over the nine years ending in 2008. Developing Asia’s share of foreign employment increased from 14.7% in 1999 to 21.5% in 2008, a 6.8 percentage point increase.

This is an important change. In the past, most direct foreign investment by US companies was in large, mature countries such as Canada, Europe, Japan, and Australia. That is changing dramatically, as the share of foreign employment in those countries fell 5.7 percentage points, from 60.8% of total offshore employment in 1999 to 55.2% in 2008.

Surprising to us, the Latin American share of foreign employment fell 1.5 percentage points since 1999 from 21.7% of the total to 20.2%.

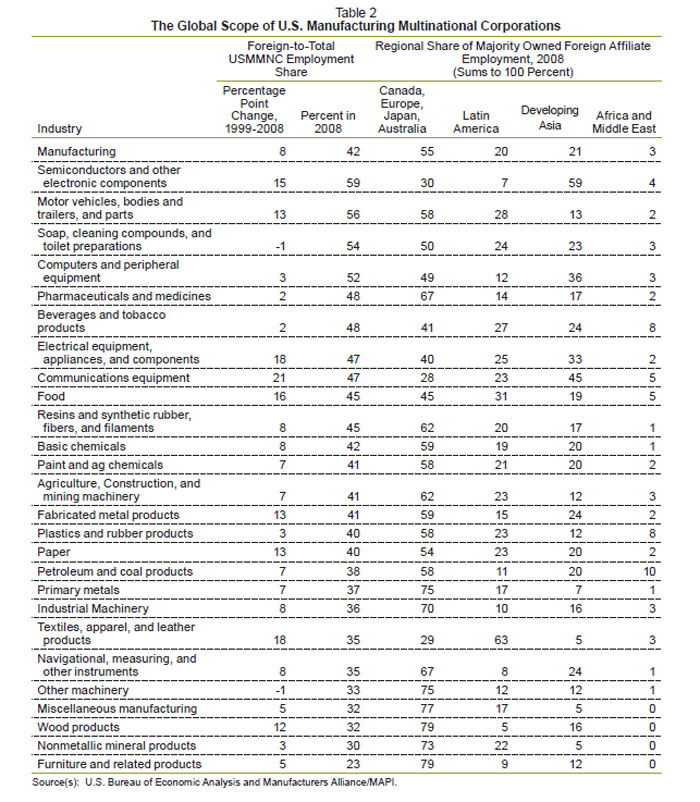

The report notes there are big differences in the percent of foreign workers in MCSs depending on the specific vertical industry they are in, as shown in the graphic below.

As can be seen in the column 2 of the graphic, the semiconductors and other electronic components industry has 59% of its employees in foreign affiliates, the largest proportion among any manufacturing sector. The least foreign-engaged industry, furniture and related products, still had a relatively large 23 percent of its total employment abroad.

What's your reaction to this MAPI data? Does it seem right, or are there factors that are masking the real numbers? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest

|