These large firms were focused in 2009 on improving their supply chains by better integrating with trading partners, according to the study. A reasonable assumption is that many of these companies have improved internal supply chain operations enough that they now feel integration with trading betters is the area of focus that will provide the next best source of improvement opportunity.

Building Sustainable Supply Chains

The report says focusing on five areas is essential for building supply chains that can last and prove resilient to changing market and customer conditions:

- Optimization: Manual processes and spreadsheet-based tools are not usually capable of dealing with the complexity of today’s supply chain decision environment and speed with which the right answers are needed.

- Synchronization: Trading partners acting together as a single entity; the study found the willingness and/or capability to share data to drive synchronization is still often lacking.

- Profitability: In this environment, Supply Chains must contribute more than ever to profitability (cut costs) and cash flow (reduce inventories). Need to sustain profitability in good times and bad implies moving to more variable supply chain cost structures.

- Adaptability: Being able to rapidly flex the supply chain up or down to meet demand or avoid cost is more important than ever. Visibility is the foundation, and the data showed close correlation between levels of visibility and financial performance at the respondent companies.

- Velocity: The gap between supply lead time and customers’ order cycles is widening, the report says. Leaders focus on accelerating movement of materials, information and cash in the end-to-end supply chain.

Transportation Technology Adoption

Each year, the report also looks at some data with regard to supply chain technology adoption.

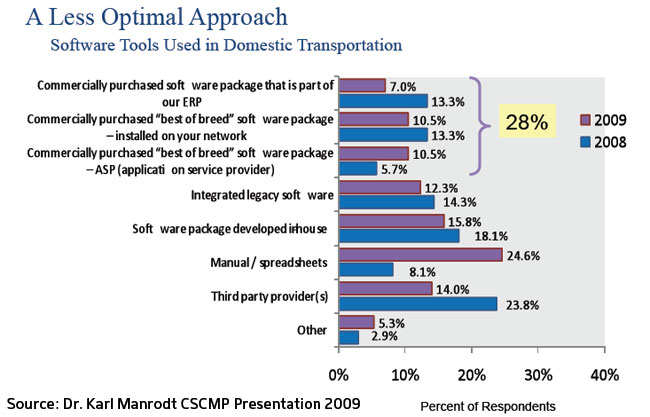

Again this year, the survey asked respondents about their transportation management technology, and this year’s results compared to 2008 data are shown in the figure below.

We would not put a lot of stock in the changes in the numbers from 2008 to 2009, as they more likely reflect differences in the survey population than they do actual market changes (e.g., the percent of companies using third party providers for transportation technology did not drop by almost one-half in just one year).

Still, the numbers do seem to be about right to us, within maybe a range of the 2008 and 2009 numbers. That would say, for example, that maybe 7-13% of companies use the TMS of their ERP provider; 20-30% using either a traditional or “on-demand” TMS, etc.

Regardless, the numbers seem to suggest that many companies still have opportunities to gain efficiencies through investment in transportation technology.

In a change, the first issue of the report was not a comprehensive look at all the data. The authors say additional data and insight will be released over the next few months.

Any reaction to this year’s Trends and Issues in Logistics report? Should large companies be considered the “Masters of Logistics?” Why or why not? What is needed to build “sustainable" supply chains in your view? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest |