2. Supply Chain Collaboration: While there has often been more talk than action in the area of collaboration, that may at last be starting to change. The report cites several data points that support this view, including a 500% increase in books with “Collaboration” in the title over the past two years.

The report is fairly bullish on Collaborative Planning, Forecasting and Replenishment (CPFR), and cited the example of Motorola, which worked for several years to get CPFR right with its retail customers.

“The result was staggering: retailer inventory decreased by 30% (compared to non-CPFR retailers), transportation costs were cut in half, production capacity improved, retailer relationships were strengthened, and overall sales increased (in addition to promotion effectiveness),” the report notes, emphasizing the need for “win-win” efforts in collaboration.

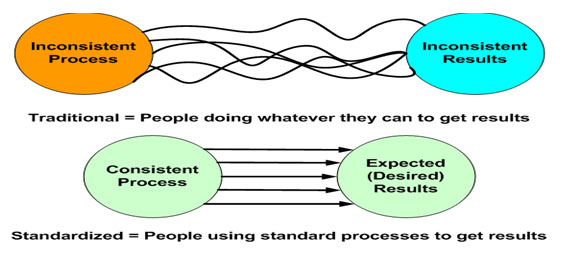

3. Lean/Six Sigma Applied to the Supply Chain: Lean and Six Sigma is rapidly moving from the factory floor to the broader supply chain.

Vitasek and Dittmann are bullish on combining both programs, as many companies are already doing: “Lean eliminates waste and reduces cycle time, while Six Sigma reduces process variability. While both concepts have historically been applied in the manufacturing environment, they are now being used to revolutionize the way that the entire supply chain operates,” they note.

However, as yet Lean/Six Sigma implementations are still in their infancy in most companies once outside the four walls of the manufacturing environment, offering an enormous potential opportunity for major advances in performance.

4. Managing Complexity: Virtually every company is battling the challenges of supply chain complexity – more products, more channels, wider geographies, customized products or logistics services, etc.

Some is unavoidable – but companies must recognize that “Unnecessary complexity is an anchor on the firm and its supply chain performance,” Vitasek and Dittmann say.

They note the potential role of “product lifecycle management” technology tools to help better cope with product complexity, and the importance of process standardization to improve supply chain consistency.

Specifically, the report calls for companies to “Reduce unnecessary product complexity by installing a disciplined process to manage SKUs at both the beginning and end of their life cycle,” a strategy many companies would like to embrace, but few have been able to pull off.

5. Supply Chain Technology: “The goal of end-to-end supply chain visibility has been limited by technology and the capital investment required to monitor inventory in real-time. Now, both of those barriers are falling as companies are pursuing inventory reduction using visibility solutions,” the report states.

A combination of technologies such as RFID, Service Oriented Architectures (SOA), and Software as a Service (SaaS) will be key in the advancement of visibility tools.

6. Network Optimization: This is at the heart of rethinking supply chain strategies, and the tools to help companies do that analysis have improved dramatically.

The report notes the trends toward generally fewer, larger DCs, and how the growth of offshoring has changed supply chain network strategies in the US. Fuel costs can significantly impact network design and on-shore/near-shore/off-shore decisions – but where are those prices likely to go? Network scenario planning can help understand potential impacts and strategies.

“Companies world-wide are turning to network optimization in order to cope with the financial strains that recent economic woes have brought into the limelight. With the promise of better utilization of assets and networks, Optimization is a game changer which holds high promise for 2009,” the report notes.

7. Global Supply Chain Implications: Globalization has become the “the catalyst of our ‘modern’ time,” the report notes, and whether good or bad for individual companies is here to stay.

“On the negative side, there are baffling forces of global change that supply chains are currently facing; and these are creating significant risk. These have turned globalization into a dynamic Game Changer, altering the way companies must manage their supply chain networks,” Vitasek and Dittmann say.

The challenges range from developing a true global supply chain strategy to mitigating the risks associated with what will again be port congestion.

While most every firm is going global one way or another, some think about this much more strategically and proactively versus others.

“Firms who “go with the flow” in this area will find themselves missing the huge opportunity that a well-crafted global supply chain plan can deliver,” the report says.

8. Sustainability: The Sustainability trend has emerged from almost nowhere a few years ago to a tsunami force right now, causing a myriad of actions, large and small, by many companies to get more “Green” in their supply chains. 8. Sustainability: The Sustainability trend has emerged from almost nowhere a few years ago to a tsunami force right now, causing a myriad of actions, large and small, by many companies to get more “Green” in their supply chains.

There are many pressures to do so, from customers, consumers, governments and more. For example, in Minneapolis, every square foot of warehouse space includes a cost of 12 cents per year in stormwater fees. This means a 550,000 square foot warehouse pays close to $65,000 per year in fees alone. This also means that companies may rethink DC facility strategies (up - not out) and collectively try to better manage this issue to reduce the government fees.

Companies, for now though, have plenty of opportunity to go Green and reduce costs at the same time.

9. Risk Management: There has been an incredible interest of late on risk management strategies, driven by such changes as increased globalization and research showing the impact of supply chain disruptions on shareholder value.

The report summarizes the three main types of supply chain risk:

- Supply and Demand: Risks that deal with inbound and outbound flows.

- Operations: Risks that deal with the possibility that an internal issue will affect the company’s ability to produce.

- Security: Risks that have recently played a more important role because of globalization and the ever-increasing requirements for inventory minimization, precision, and availability.

The report notes that “Although risk cannot be eradicated, it can be planned for and even used as a competitive advantage, especially since so few firms have a good risk mitigation process.”

There are an increasing array of process and technology solutions (e.g., supply chain event management) that can help companies reduce their risk profiles.

10: Managing out Costs and Working Capital: There is an increased focus on the supply chain’s role in improving a company’s free cash flow and working capital.

Additionally, supply chain can play an important role in “economic value added," or EVA, a financial and management approach that many companies embrace.

Companies can impact this directly by driving inventory out of their supply chains. Increased use of outsourcing can also play an important role.

The bottom line here is that the intersection of finance and the supply chain continues to increase, and that supply chain managers should be increasingly well versed in these topics.

All told, this is an excellent report, and well argues that understanding and acting upon these “game changers” will have a huge impact on supply chain and corporate success.

What is your reaction to these 10 “Game Changing Trends?” What would you add or change? Do enough companies really look at these sorts of issues strategically and holistically? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest |