“We may say we have an 85% confidence level of the capacity meeting required volumes in year 3, but maybe just 65% in year 5” for a given design, Barnes said, emphasizing the need to understand the trade-offs in statistical terms. “You could move that confidence level up for year 5, but it may cost you a lot of money to do so,” he added.

Holste notes that most companies are growing somewhere in the single-digits range annually, but that “hyper-growth” companies that are expanding volumes by double digits currently present really tough challenges when it comes to capacity sizing.

“You have to project when that growth is likely to taper off, and also to be thinking about when additional facilities will be required,” Holste said. “Master planning is especially critical for those fast growth companies.”

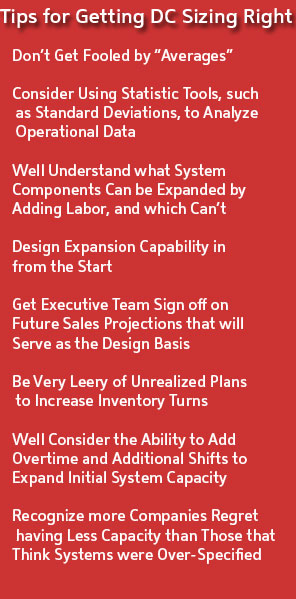

“We’re a big advocate of looking at a full year’s worth of data,” says enVista’s Barnes. “We’ll look at it on a full year basis, then by month, week, day, shift, and sometimes even down to the hour.”

Barnes adds that it is important to look at the data by different sales channels, such as ecommerce/”B2C” versus volumes moving through retailers or other indirect sales channels. Barnes adds that it is important to look at the data by different sales channels, such as ecommerce/”B2C” versus volumes moving through retailers or other indirect sales channels.

While he notes the danger of using averages to understand current volumes, he says it can be a place to start if you then look at “standard deviations” from that mean.

“We will look at how often the volumes are one standard deviation from the average, then two standard deviations, three, etc.,” Barnes told SCDigest. “It really is a very useful way to understand what actually moves through the DC.”

Bias Estimates Upward

Barnes and Holste agree that given all the uncertainties, it is generally better to err on the side of over-building DC or throughout capacity, rather than playing too conservative.

“We will usually lean towards over-sizing a bit, and that makes perfect sense,” said Barnes. “Nobody has ever come back to me and said ‘You’ve grossly oversized my building’” he added. “You are far more likely to see a company that has undersized the DC and now feels constrained.”

Still, Holste says you do have to watch going too far in that direction.

“Capacity and throughput have a cost, and beyond a point, over-specifying can impact ultimate ROI, or your ability to get the funds” he said. “You also don’t want equipment that is underutilized.”

Barnes agreed, noting, for example, that if the DC needs a lot of refrigerated space, adding extra square footage to hedge on the future can become really costly if taken too far.

Flexible Design – and Operating Models- are Key

Forecasts are by definition likely to be wrong, especially the further out you go. So, the best plan is usually to build flexibility into the DC expansion or design.

Holste notes, for example, that most companies should design the new picking system to be easily expanded by adding additional “pick modules” in later years.

“The cost and operational challenges from adding that capacity later on are much lower if you design-in that expansion potential upfront, versus having to shoe-horn it in later,” Holste said.

Barnes notes that it often makes sense to oversize the facility, but leave part of it “empty” awaiting expansion in volumes, delaying the investment in racking and related equipment. In some cases, especially for hyper-growth companies, Barnes says the smart decision may be to over-buy the real estate, but then only build on a portion of that land, leaving room for expansion if the rapid growth continues to materialize. If not, the real estate can be sold off.

But a real and sometimes overlooked variable is a company’s distribution operating model in terms of shifts and overtime and the ability to “throw labor” at surge periods.

For example, if a DC currently works one shift, how will the ability to add overtime hours during peak periods allow a DC to compensate for a system that can’t meet those volumes on a single 8-hour shift? Can weekend operations, or a second, or even a third shift be added over time to expand throughput?

These are key questions, because companies that are more conservative with regards to operating hours have to design their systems to handle more volumes – and, therefore, make a greater investment – versus companies that expect to use overtime and additional shifts to add capacity to a given design.

Barnes also notes that it is important to understand what portions of a full system can be expanded by adding labor and what portions can’t.

For example, “You can usually add labor to increase throughput in pick modules, but if a sorter is maxed out, there is not much you can usually do,” he said. The upshot of that is that you would be more likely to upsize the sorter and be more conservative in spend on pick modules.

Holste agrees, saying “With sortation systems, the raw capacity is not easily expandable. For example, if the “design day” shipping volume, including growth factor, is within 10-20% of the maximum capacity of a particular type of sorter, it would usually be appropriate to select the next higher capacity sorter.”

If you undersize a sorter and need to replace it, the effort is complex, expensive, and highly disruptive to current operations, Holste says.

That same type of thinking often applies to storage, because storage capacity is generally not easily expanded, and can’t be improved by adding labor.

Complicating the analysis of storage requirements are projections about inventory turns – with many companies over-estimating future improvements in turn velocity.

“Inventory turn projects can make you or break you,” Barnes told SCDigest. “Designing a facility based on projections for significant improvements in inventory turns is risky business.”

He says that experience shows that being conservative in the sense of biasing the analysis somewhat towards having more storage capacity usually is the right choice.

“If you analyze the financials over a 5-10 year period, and factor in revenue growth, adding an additional 100,000 square feet doesn’t generally have a big impact on the internal rate of return,” he said. “The additional costs to lease that extra space winds up being a minor part of the overall cost of distribution.”

In the end, Barnes and Holste both agree, the company itself needs to determine its own comfort level with regard to initial investment versus ability to handle future volumes.

“You have to say, “Here is alternative 1, and the costs and ability to meet unexpected volume growth”; here is alternative 2, etc.,” Barnes said. Different companies have different access to capital, different ROIs on a project, and different thinking about financial risk versus operational risk.”

What do you think are the keys to correctly sizing a distribution center in terms of throughput and storage? How much is science, and how much is art? What would you add to the discussion here? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest |