“Strategic” Planning Horizons Shrink

How companies think about strategic planning has also been impacted, given the extremely volatile and uncertain environment.

“Over the past 12 months, the respondents to our economic conditions surveys have told us that their companies are cutting costs, reducing capital investments and headcounts, and making plans for weeks or months, not years,” the McKinsey Quarterly recently noted.

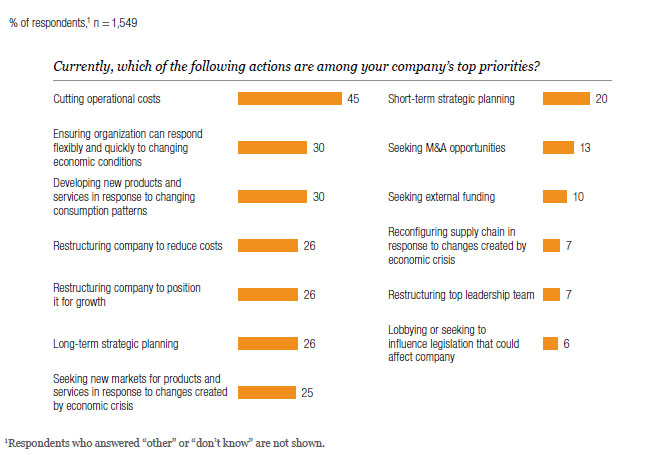

However, after a brutal year of cost cutting for many companies, that imperative may be slowing down, as CEOs become more optimistic about economic prospects, or there just isn’t much more left to cut. The same recent McKinsey research of corporate executives found just 45% of respondents listed additional cost cutting as a top priority over the next 12 months.

Source: McKinsey Quarterly

That doesn’t mean, however, that there will be aggressive investment – at least by many. Capital is still hard to come by – and caution is still the driving force for the majority of companies.

But is caution the smart route? In a recent Wall Street Journal column, money manager and author James Grant argues persuasively that in all US recessions, the sharper the downturn, the stronger has been the recovery.

“Not famously a glass half-full kind of fellow, I am about to propose that the recovery will be a bit of a barn burner,” he writes.

Which begs the question of whether companies should keep playing defense, or begin to play some offense.

At the recent CSCMP conference in Chicago, investment banker Bill Hunter of Jeffries said that “I see two kinds of CEOs – the first kind is still saying ‘I need to hunker down, I have some cash, but I am not doing anything.’ The second type is saying 'we have some cash, things are looking up, let’s prudently use this cash to get more strategic in acquisitions and investments.”

One thing is for sure – 2010 is shaping up to be one of the most difficult years to forecast and plan for in the roughly 25 years of the “supply chain era.” Bet too conservative and you may not only lose top-line revenue potential, but perhaps permanently lose market share. Bet too aggressive and the costs will wreak havoc on the bottom line, leading to more – and perhaps debilitating cost cutting.

What have you seen as the biggest supply chain impacts of the past 12 months? How are you going to handle planning for 2010? Any good approached? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest |