In fact, many other areas of the world appear to be recovering faster than the US. China, propelled by a giant stimulus program, has said GDP was growing at the 6-7% annual range even in late 2008 and early 2009, as most of the rest of the world economy imploded. Official statistics from the Chinese government now say China’s gross domestic product surged an annualized 14.9% in the second quarter, even as imports were dropping by more than 20%. The Chinese government also says it should reach its GDP target of at least 8% growth for all of 2009.

France and several other European countries also have recovered faster than the US, with French GDP increasing by 1.4% in Q2 – though worries about an unemployment drag on the economy remain there as well.

There are positive signs in the US too. The average of a poll of US economists now forecasts Q3 GDP growth of 2.9% in the US, up sharply from the prediction for 1.6% growth that the same survey found in July.

The International Monetary Fund has also been modestly, but increasingly, bullish on the global economy for 2010, now saying it expects global GDP to rise 3% next year, and upward revision from the 2.5% growth forecast it had until just a few weeks ago.

Some believe that as consumers and businesses see signs of economic stability, a surge of pent-up demand will increase economic growth and corporate top lines faster than many expect.

For example, Martin Welcker, CEO of German industrial company Alfred H. Schuette, recently was quoted as saying: “I believe the recovery will be stronger than many expect, because the underlying demand for goods and services in the world hasn’t gone away. We will need more washing machines, cars and trains worldwide than in the past.”

Many companies have cut inventory levels so sharply that even a modest pick-up in consumer or business demand should accelerate overall GDP growth. In some cases, those business inventory reductions have clearly gone too far, as consumers find empty shelves when looking to buy. Earlier this year, electronics retailing giant Best Buy said it could have sold more product in the second quarter, but was often stymied by lack of merchandise from its suppliers.

One thing that isn’t clear, however, is how well the world economy can fare when the huge fiscal and monetary stimulus supplied in many countries, especially the US and China, begins to wane.

Also of concern, especially in the US, is nascent inflation, driven by huge government spending and similar increases in the money supply. While others fret that deflation is still a serious risk, the dollar has fallen heavily against most world currencies, and that, plus the huge deficits, could ignite inflation and raise interest rates. Those developments could choke off the rally and lead to a “double dip” recession, or at least, slow down the pace of recovery.

The Consumer has Changed

There is much evidence that the consumer, at least in the US but likely across the globe, has changed. Luxury, splurging and debt are out; value, simplicity and savings are in.

The pollsters at Zogby, for example, have seen a substantial shift in consumer mindset – and expect it to last.

"Increasing numbers of people have become less materialistic and more interested in other, simpler forms of personal fulfillment. Some of that has been due to economic fears and realities, and the rest by choice," said John Zogby. "I see this to be a long-term trend that will continue even if and when the economy rebounds.”

He added: “Consumers will look for value and utility in their purchases. There will also be greater business opportunities in travel, leisure, psychological and physical well-being, and tools to keep connected to distant relatives and friends. These trends are well underway, and businesses that have not already adjusted will continue to lose out.”

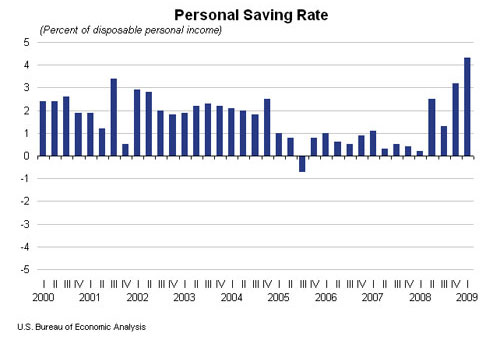

Consistent with those observations, the savings rate in the US has soared, after a decline that has lasted for almost three decades. For most of US history, personal savings rates were in the 5-7% range, but starting in the early 1980s, began a long and steady drop, down to the low single-digits in the 2000s, and even reaching into negative territory a few times in recent years. That means consumers were spending more money than they made, fueled often by easy credit.

Now, however, those savings rates have shot back up, as shown in the graphic below.

So, where are we at? All told, the US and world economy is looking up, but with a likely choppy and tenuous recovery for at least the next two quarters. The key will be reversing the unemployment numbers and data showing job creation – that will give the 90% of employed Americans confidence to give into some of that pent-up demand.

However, that demand will have a different profile than before – one that is more value-conscious than we have seen in years.

We will look at the impact on business and supply chains from all of this in more detail next week.

What’s your take as to where we are economically one year after the great crash? Bullish or bearish? Should now be the time to start planning our supply chains for recovery? How will the changed consumer impact what businesses do? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest |